BENEFIT SHOWCASE

Welcome!

We know how important benefits are for you and your family. That is why we are committed to offering excellent, well-rounded options that protect your physical, mental, and financial health—and that of those you love. Our programs are designed to provide peace of mind in protecting your lifestyle and planning for the future.

Because choosing your benefits takes careful thought and planning, we created this virtual benefits showcase to help you easily navigate and understand our offerings.

Please take some time to review the information and return to the site whenever you or your family members have questions or want to review our benefits.

This showcase will be available to you on-demand throughout the year, so feel free to bookmark it.

How to Navigate

Use the navigation bar at the top of the page to learn more about each of your 2024 benefits. You can watch videos and view documents from each of Golden Entertainment benefits partners. Click a topic to learn more!

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

2024 Annual Enrollment

Golden Entertainment's benefits Annual Enrollment takes place November 6th – 20th. Changes become effective 1/1/2024. This is your opportunity to make changes to your benefit elections for the 2024 plan year.

During Annual Enrollment, you may:

- Enroll or waive coverage

- Make changes to your benefits

- Add or remove dependents

Your current medical, dental, vision and FSA/HSA elections WILL NOT roll over to 2024. You must re-enroll in these plans for active coverage in 2024. All other coverage will rollover to 2024.

The Benefits Enrollment Guide will be digital this year! This will be user friendly and easy to access for our team members. You will be able to download a copy from the link in the Benefits Portal, or by scanning the QR code posted in your property's Benefits Center. For those who prefer a printed copy, we will be printing a limited amount. You may pick up a copy in the Benefits Center or Human Resources.

The deadline to provide any required dependent documentation is due to the Benefits Department by November 30, 2023.

- Medical Plan - UMR will continue to be our medical provider. The High Deductible Health Plan (HDHP) will now be available at all locations! Participants who enroll in the HDHP, will also be automatically enrolled in an employer-paid Hospital Indemnity Plan through Voya.

- New FSA/HSA Provider - We will be changing our FSA and HSA account provider to Voya! The HSA will now be available at all locations to participants who enroll in the HDHP.

- New Prescription Plan Provider - We are excited to announce that we will be partnering with CerpassRx as our new prescription coverage provider. With CerpassRx, we will have the same access to our preferred pharmacies and the same tier structure for prescription copays. Your prescription ID card will be merged with your medical ID card for your convenience! No more needing multiple cards!

- New Pet Insurance Provider - We will be offering two pet insurance plans through Pet Partners! There will be an Accident & Illness Plan or an Accident Only Plan. These plans will be available via payroll deduction.

Educate Yourself and Review all Options

Before making your benefit elections, you should first educate yourself on all the benefit options Golden Entertainment has to offer. Review the various tabs in this Showcase site and review the Benefits Enrollment Guide to put yourself in the best position to make an informed choice on coverage for yourself and your family.

How to Enroll

Enrolling is easy! You have multiple ways to complete your enrollment.

See your options below:

Online

Visit the benefits portal and click on Register to set up your username, password, and security questions. Returning users click on Login.

Phone

Receive assistance from an enrollment counselor. Spanish and other languages are available. Call Center hours: Monday through Friday, 5am to 5pm (PST).

Mobile Device

Download the FREE MyChoice Mobile APP from the App Store or Google Play.

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

Eligibility

Eligibility

Full-Time Status: All team members hired into a Full-Time status are eligible to participate in Golden Entertainment’s benefit plans the first day of the month following 60-days of employment.

Part-Time Status: All variable hour (PT, Extra) team members will be offered medical coverage only if weekly hours worked during Golden Entertainment’s established 12-month Standard Measurement Period (SMP) averages 30+, as required by the Affordable Care Act (ACA). If you qualify, the Benefits Department will send you a notice of eligibility.

Status Changes: Team members who move from a variable hour (PT, Extra) status to a Full Time status, are eligible for coverage the first of the month following the status change, provided they have satisfied the initial 60 days of employment.

Eligible Dependents

Any dependent not meeting the eligibility requirements listed below is not an eligible dependent.

- Legally Married Spouse (includes same-sex marriages)

- If your spouse is employed and eligible for coverage through their own employer, they are NOT eligible for medical coverage as a dependent on your plan, regardless of whether or not they enroll in their employer’s plan - Child or Stepchild up to age 26

- Child (up to age 26) who is legally adopted, placed for adoption or has legal custody by the team member, and children for whom healthcare coverage is required through a Qualified Medical Child Support Order (QMCSO).

Dependent coverage for all plans will end on the last day of the month they turn age 26.

Dependent Verification

If you are enrolling a spouse or dependent child, you must provide proper documentation.

Spouse: a copy of your marriage certificate

If your spouse is employed and not eligible for their employer’s plan, they must obtain a letter from their employer stating they are not eligible for coverage.

Child: a copy of the child’s birth certificate (hospital or state/county issued) that indicates the names of the parents

Stepchild: a copy of the child’s birth certificate showing the relationship to the team member’s spouse and marriage certificate

Child who is legally adopted or is in the team member’s legal custody: a copy of legal adoption or placement documents or document granting custody from applicable court or government agency. If the document does not include the birthdate, provide a copy of the birth certificate.

A dependent child over the age of 26 may be covered if medically certified as disabled prior to their 26th birthday and is deemed incapable of self-support. Medical documentation required.

Documentation must be submitted by the enrollment deadline. If not received, the enrollment for the dependent(s) will be denied. You may submit documentation:

- Upload directly into the Benefits Portal

- Drop off in Human Resources

Life Events

Once you choose your benefit options, you are not eligible to change your elections until the next annual enrollment, unless you have a Qualifying Life Event. If you initially decline coverage you must wait until the next open enrollment period to enroll.

Qualified Life Events include:

- Marriage, divorce or legal separation

- Birth of a child, or placement of a child with you for adoption or foster care

- Death of a spouse or child

- Change in you or your spouse’s employment status

- Loss of other coverage

- Entitlement to Medicare or Medicaid

- Qualification by the plan administrator of a medical support order

- Financial hardship is not considered a qualifying life event for cancellation or changes to coverage.

You must provide proof of the qualified change within 31 days of the event, or you must wait until the next open enrollment period.

End Of Coverage

Coverage ends on the team member’s last day of employment or the effective date of a status change to a non-eligible position.

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

Medical & Prescription

In this section, you can learn more about the coverage options available for medical and prescription plans.

Medical

Because we have a diverse population across the country, Golden Entertainment offers a combination of HDHP/HSA, PPO, and EPO plans. As you go through the enrollment process, the Plans you are eligible for will populate automatically for you to choose from.

You can click on the Benefits Portal link below where you can login and view a summary of the plans you are eligible for in the Reference Center. You can also view the Plan Comparison Chart in your Benefits Enrollment Guide.

HDHP

With an HDHP (High Deductible Health Plan) plan, you have the choice between plan providers in-network and plan providers out-of-network. This is the only plan that allows you to enroll in an HSA Plan which gives you greater flexibility and discretion over how you use your health care dollars. HDHP’s have higher annual deductibles and out-of-pocket maximums. The annual deductible must be met before the plan pays for services, other than in-network preventive care services. Preventive services are covered at 100%.

PPO

With a PPO medical plan, you have the choice of two benefit tiers: Plan providers (in-network) and non-plan providers (out-of-network). The PPO option offers a larger network of providers and specialists to choose from, including the United Healthcare Choice Plus national network. Unlike an HMO, you do not need to designate a PCP and you do not need to obtain a referral to see a specialist.

EPO

An EPO (Exclusive Provider Organization) health plan requires you to use the doctors and hospitals within its own network, like an HMO. With an EPO you are not required to get a referral to see a specialist which makes the process a lot faster since you don’t need to see your PCP first. There are no out-of-network benefits with this plan but you have a larger network available to find providers.

Prescription Coverage

Prescription Coverage is included when you enroll in medical coverage. Services are provided through CerpassRx. The ID card information for prescription coverage will be printed on the front of your medical ID card so you will NOT receive a separate ID card. We use a preferred network of pharmacies where you will receive more favorable copays. The preferred pharmacies include CVS, Target, Walmart, Smith’s (Kroger), and Sam’s Club.

Participants have the freedom to choose a non-preferred pharmacy also within the CerpassRx network and pay a higher copay. Please refer to the Plan Summary or the Benefits Enrollment Guide for specific copays.

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

Dental & Vision

Dental

Maintaining good oral hygiene is paramount to your overall health and wellness. That is why Golden continues to partner with Delta Dental, one of the nation's largest carriers, to provide our team members with affordable dental coverage.

You can choose between two plans, the Buy-Up or the Basic Plan. The Buy-Up Plan offers you $2,000 for covered services and the Basic offers $1,000. This amount is for each person you have covered. The Buy-Up plan offers orthodontia for dependent children only.

All diagnostic, preventative and periodontal services are not subject your annual plan maximum.

Vision

A vision plan can play an important part in keeping your eyes healthy and your vision clear. See healthy and live happy with help from VSP! With VSP you’ll have the help you need to manage the health of your eyes.

We offer two plans to choose from. The Basic plan or the Buy-up. Both plans offer routine preventative exams and prescription eyewear (contacts or glasses or both). Please view the Plan Summary for more detailed plan information.

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

Life & Disability

Life and AD&D Insurance

We understand you have worked hard to get where you are today. Ensuring your loved ones can maintain financial stability if an unexpected death should occur is something to consider when planning for the future.

Golden pays the full cost of your basic life and AD&D coverage for yourself, your spouse, and eligible dependent children.

Salaried team members receive 1 X your annual salary up to $200,000.

Hourly team members receive a flat $15,000

Dependent Spouse receives $5,000

Dependent children to age 26 receives $2,000

Newly eligible team members (within their initial eligibility period) may elect voluntary coverage for themselves, their spouse, and dependent children up to the following amounts:

Team Member = $500,000 / Guaranteed Issue $200,000

Spouse = 50% of Team Member Coverage / Guaranteed Issue $50,000

Dependent children to age 26 = $10,000

If you choose to enroll or increase your voluntary coverage outside of your initial eligibility period (excluding any special AE rules) you will be required to submit an Evidence of Insurability (EOI) for approval.

Please see the individual plan summaries for more detailed information.

Short- and Long-Term Disability

How would you pay your bills if you were sick or injured? If you become disabled due to illness or injury (outside of work), you may be eligible to receive benefits that replace a portion of your income.

With disability coverage, you can concentrate on getting better, not how you are going to make ends meet.

- The elimination period begins on the first day of disability

- A pre-existing condition means any injury or illness, for which you receive medical treatment, advice or consultation, care for services, or diagnostic tests in the 3 months prior to the day you become insured under this policy. Benefits will not be provided for the first 6 months of policy (STD) or 12 months (LTD) if the claim is due to a pre-existing condition.

- The benefit amount you receive may be reduced by other sources of income such as retirement/government plans, or social security disability.

- Your bi-weekly premiums are calculated in the benefits portal and are based on your current bi-weekly earnings. This allows for all earnings (base/tips) to be included. Because of this, your premiums may vary from check to check.

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

Spending Accounts

What Is a Flexible Spending Account (FSA)?

A Health FSA is an employer-sponsored plan that allows you to set aside pre-tax money from your paycheck to pay for eligible health expenses incurred while you’re participating in the plan.

You can use this account to pay for eligible out-of-pocket health care expenses such as copays, coinsurance, prescriptions, dental and vision costs. These costs can be incurred by you and your eligible dependents including your spouse, children and any other person who is a qualified IRS dependent.

- Your entire 2024 election amount is available for immediate use. This is especially helpful for unexpected expenses. The funds in your FSA don’t rollover, so it’s important to accurately estimate your upcoming expenses.

- The Plan Year is from January 1 to December 31, 2024. The total amount you elect will be divided equally as a pre-tax deduction taken from each paycheck you receive in the year.

- If you are hired mid-year, the deductions will be based on the remaining pay periods left in the plan year after your eligibility date.

- Claims can be incurred up through the Grace Period end date of 3/15/2025. After the grace period any unused money in the FSA will be forfeited, so plan carefully.

- You will receive one benefit debit card whether you have one or multiple spending accounts (Health and Dependent FSA). The funds for these accounts will remain separate and cannot be used for the other.

- Receipts may be required, and you’ll be able to submit them using the online portal or the mobile app. Click the link below on Substantiation for more details.

What Is a Dependent Care Flexible Spending Account?

A Dependent Care FSA is a pre-tax benefit account used to pay for eligible dependent care services. It’s a smart, simple way to save money while taking care of your loved ones so you can continue to work. The Health Care and Dependent Care FSAs are two separate accounts. Money in the Health Care account cannot be used for Dependent Care and vice versa.

- Covers child and adult care expenses, such as preschool, summer day camp, before or after school programs, and child or adult daycare.

- Available for your children and/or elderly or disabled dependents.

- You may contribute from $250 to $5,000 per year

- You may use up to the total amount of contributions you have made at the time your claim is submitted.

The Plan Year is from January 1, 2024, to December 31, 2024 . The total amount you elect will be divided equally as a pre-tax deduction taken from each paycheck you receive in the year. If you are hired mid-year, the deductions will be based on the remaining pay periods left in the plan year after your eligibility date. Claims can be incurred up through the Grace Period end date of 3/15/2025. After the grace period any unused money in the FSA will be forfeited, so plan carefully. Your deductions are taken on a pre-tax basis, which could result in tax savings.

What Is a Health Care Savings Account?

With the election of Golden Entertainment’s High Deductible Health Plan (HDHP), you can enroll in the HSA Plan and the company will match your contributions up to $600. You can use the funds that accumulate in an HSA to pay eligible medical, dental and vision expenses or to cover the expense of meeting the deductible on your plan. Unlike your Health Care FSA, the HSA is not a “use-it-or-lose-it” account. Your balance carries over each year and can be invested once it reaches a certain threshold.

An HSA is right for you if:

- You’re enrolled in the HDHP Plan.

- You have no other health coverage.

- You can’t be claimed as a dependent on someone else’s tax return.

- You aren’t enrolled in Medicare or Tricare.

- You can contribute some money each month to save or pay for health care expenses.

- You want to be ready when you have unexpected healthcare needs.

How much can I contribute to my HSA?

The IRS places an annual limit on the maximum amount that can be contributed to HSA’s. For 2024, the maximum annual contribution (team member + employer combined) is:

- $4,150 Single Coverage

- $8,300 Family Coverage

- Team Members over the age of 55 may contribute an additional $1,000

What Can I Use My HSA on?

Use your HSA for:

You CAN'T use your HSA for:

Medical expenses that your plan may not cover:

- Out-of-pocket expenses until you reach your deductible

- Copayments, coinsurance and prescription drugs

- Dental and vision care expenses not covered by your health plan

- Long term care premiums

- Health insurance monthly premium

- Expenses that aren't related to medical treatment or care as defined by the IRS

What Is a Health Care Savings Account?

A health savings account (HSA) works like an individual retirement account (IRA) that you own. It belongs to you and the money is yours to keep, even if you change jobs or retire. You don’t pay any taxes on the money you put in or take out, if you use it for medical expenses as defined by the IRS.

Each time you have an expense, you decide whether to pay with money from your HSA. Qualified Medical Expenses are determined by the US Treasury, 213(d) expenses, and detailed in the IRS Publication 502.

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

Voluntary Benefits

Voya Hospital Confinement

Hospital Confinement pays a daily benefit if you have a covered stay in a hospital, critical care unit or rehabilitation facility. How can Hospital Confinement help?

How can Hospital Confinement help? Your Hospital Confinement Insurance benefit could be used for:

- Medical expenses, such as deductibles and copays

- Travel, food and lodging expenses for family members

- Childcare

- Everyday expenses like utilities and groceries

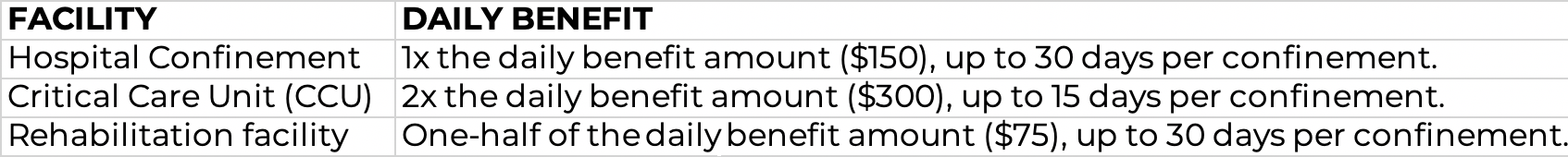

What hospital confinement insurance benefits are available?

The Hospital Confinement Insurance includes:

- An initial admission benefit of $1,650 is payable for the first day you spend in the hospital.

- A daily benefit of $150 beginning on day 2 of confinement up to the maximum number of days listed below.

The daily benefit amount is determined by the type of facility in which you are confined:

Wellness Benefit

The annual benefit is $50 for completing a health screening test. The cost of the Wellness Benefit rider is not included within the Hospital Confinement Indemnity Insurance. Your spouse’s benefit amount is also $50. The benefit for child coverage is 50% with an annual maximum of $100 for children’s benefits.

Voya Critical Illness

Critical Illness Insurance pays a lump-sum benefit if you are diagnosed with a covered illness or condition. For what critical illnesses and conditions are benefits available?

Critical Illness Insurance provides a benefit for the following illnesses and conditions.

- Heart Attack

- Cancer

- Stroke

- Carcinoma in Situ

- Major Organ Transplant

- Coronary Artery Bypass

- Benign Brain Tumor

- Skin Cancer (10%)

- Bone Marrow

- Stem Cell Transplant

- Coma

- Permanent Paralysis

- Loss of Sight

- Loss of Speech

- Loss of Hearing

- Parkinson’s Diseases

- Advanced Dementia (including Alzheimer’s)

- Amotrophic Lateral Sclerosis (ALS)

- Systemic Lupus

- Occupational HIV

- Multiple Sclerosis

- Scleroderma

- Hepatitis B or C

What maximum benefit am I eligible for?

- For you: $5,000 to $30,000 in $5,000 increments

- For your spouse: $5,000 to $15,000 in $5,000 increments

- For your children: choice of $1,000, $2,500, $5,000 or $10,000

Wellness Benefit

The annual benefit is $75 for completing a health screening test. Your spouse’s benefit amount is also $75. The benefit for child coverage is 50% with an annual maximum of $50 for children’s benefits.

Voya Accident Plan

Accident Insurance pays you for specific injuries and events resulting from a covered accident while off-the-job. The amount paid depends on the type of injury and care received.

Below are a few examples of how your Accident Insurance benefits could be used:

- Medical expenses, such as deductibles and copays

- Home healthcare costs

- Lost income due to lost time at work

- Everyday expenses like utilities and groceries

Examples of covered injuries include:

- Burns

- Emergency Dental Work

- Torn Ligaments

- Lacerations

- Ruptured Disks

- Concussion

- Paralysis

- Dislocations

- Fractures

Some covered expenses include:

- Emergency Room

- Ambulance Transportation

- Physical Therapy

- Hospitalization

- Outpatient Surgery Facility

- Doctor Office Visit

- Medical Equipment

- Diagnostic Tests

- Chiropractor

Wellness Benefit

$50 Wellness Benefit - The Wellness Benefit Rider pays a benefit when a covered person has a health screening test.

Sports Accident Benefit - Pays an additional 25% of the Accident Hospital Care, Accident Care, or common injuries up to a maximum benefit of $1,000, if the covered accident is the result of an organized sporting activity.

NEW! Employer Paid Hospital Indemnity

When you enroll in the HDHP medical plan, Golden Entertainment will automatically enroll you in the employer-paid Hospital Indemnity Plan.

How does this plan work?

This plan works much like the voluntary Hospital Indemnity plan but has different coverage amounts:

- An initial admission benefit of $1000 is payable for the first day you spend in the hospital.

- A daily benefit of $200 beginning on day 2 of confinement up to the maximum of 10 days for regular hospital confinement, Critical Care Unit and Rehabilitation Facility.

- This plan does not have a Wellness Benefit included.

- Claims will be automatically processed for you based on your medical claims.

MetLife Legal Plan

Quality legal assistance can be pricey and hard to find. MetLife Legal Plans gives you access to the expert guidance and tools you need to handle the broad range of personal legal needs you might face throughout your life. This could be when you’re buying or selling a home, starting a family, dealing with identity theft, creating a will, or caring for aging parents. You, your spouse, and dependents get legal assistance for some of the most frequently needed personal legal matters – with no waiting periods, no deductibles and no claim forms when using a network attorney for a covered matter.

Discount Home and Auto Insurance

Auto and Home insurance that fits your unique needs!

Take advantage of the special Farmers GroupSelect Savings.

Program Description: Golden team members have access to discounted auto and home insurance. The GroupSelect program provides you with special savings, outstanding customer service and complete coverage to meet your needs and your budget. In addition to auto and home insurance, we offer a variety of policies including:

- RV, Boat, Motorcycle, Personal excess liability and more!

Discounts Available: Automatic payment discounts, multi-car discount, auto repair and home contractor networks, roadside assistance, and 24/7 claim processing.

Switch & Save Today!

Call 1-800-438-6381 and mention your discount code B72

Pet Discount and Prescription Plans

PetPartners offers best-in-class coverage that has no age limits or breed restrictions. They offer coverage for pre-existing conditions*, Rx discounts, 24/7 vet helpline, and much more!

Choose between two different plans, each with a flat rate per pet.

Accident & Illness Coverage or Accident Only Coverage:

- Visit any licensed vet or clinic, pay your vet and submit a claim. You will get reimbursed for eligible expenses.

- You can receive prior coverage credit

- Premiums paid through payroll deductions

ASPCA Pet Health Insurance

With ASPCA Pet Health Insurance, you can choose the care you want when your pet is hurt or sick and have the comfort of knowing they have coverage.

Our coverage includes exam fees, diagnostics, treatments, and alternative therapies for:

- Accidents

- Cancer

- Behavioral Issues

- Illnesses

- Hereditary Conditions

- Dental Disease

Pick your annual limit! You set your annual coverage limit, with choices from $5,000 to unlimited.

Add preventive care! Get reimbursed a set amount for things that protect your pet from getting sick, like vaccines, dental cleanings, and screenings for a little more per month.

Select Accident-Only Coverage If you’re just looking to have some cushion when your pet gets hurt, you can change your coverage to only include care for accidents.

Allstate Identity Theft

Allstate Identity Protection plans are here to protect you and your family. Kids' online identities can grow up faster than they do. Our family plan provides coverage for all ages, so you can help protect their personal data and give them a safe head start. If they are dependent on you financially or live under your roof, they’re covered. Other items they monitor are:

- Check your identity health score

- View and manage alerts in real time

- Receive alerts for cash withdrawals, balance transfers and large purchases

- Get reimbursed for fraud related losses

- Monitor social media accounts

- See if your IP address has been compromised

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

Employee Assistance Program

Your EAP provides emotional well-being and work-life balance resources for you and your family. The SupportLinc program provides confidential, professional guidance to address emotional health and work-life balance concerns. Access support whenever, wherever is most convenient for you.

SupportLinc offers expert guidance to help address and resolve everyday issues.

In-the-moment support

Reach a licensed clinician by phone 24/7/365 for immediate assistance.

Financial expertise

Planning and consultation with a licensed financial counselor.

Convenience resources

Referrals for child and elder care, home repair, housing needs, education, pet care and so much more.

Confidentiality

SupportLinc ensures no one will know you have accessed the program without your written permission except as required by law.

Your web portal

- The one-stop shop for program services, information and more.

- Discover on-demand training to boost well-being and life balance.

- Find search engines, financial calculators and career resources.

- Explore thousands of articles, tip sheets, self-assessments and videos.

Textcoach®

Personalized coaching with a licensed counselor on mobile or desktop.

Animo

Self-guided modules to improve focus, well-being, emotional fitness, and more!

Short-term counseling

Access in-person or video counseling sessions to resolve concerns such as stress, anxiety, depression, relationship issues, work-related pressures, or substance abuse.

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

401(k)

Golden Entertainment, Inc. offers a comprehensive 401(k) Retirement Plan through Empower Retirement.

Plan Eligibility

If you are a full-time team member and at least 21 years of age, you will become eligible to participate the 1st of the month following 6 months of employment. Part-time team members are eligible the 1st of the month following one year of employment.

All members of a collective bargaining contract (Union team members) are excluded unless it states otherwise in the contract.

Automatic Enrollment!

Golden Entertainment’s 401(k) plan makes it easy to save for retirement by offering an automatic enrollment program for new hires and rehires. If you have not made an affirmative election to contribute to your Plan account, you will be automatically enrolled into the Plan starting with the first paycheck of the month following the completion of your eligibility period. The automatic contributions will be at 2%. You will have the ability to opt-out within 90 days prior to your eligibility date. This information will be sent to you in a Welcome letter and Get Started Guide from Empower.

Designate Your Beneficiary

A beneficiary is the person or persons who will receive the money remaining in your plan account if you die. This is not the same beneficiary you select for your life insurance in the Benefits Portal. You must designate a separate beneficiary for your 401(k) account. You can add/update your beneficiary at any time by clicking on the website link below and logging into your account. You can also call Empower to complete it over the phone.

Accessing Your Plan

Enroll, manage your account, update your payroll contributions, review plan information, research your investment options, and more! Click the website link below to login or create your account. You can also call Empower at 877-778-2100.

Contribution Accelerator

Your retirement program is making it simple for you to increase your contribution amount over time – by making it automatic. Contribution Accelerator can shift your retirement savings into high gear in measured, manageable steps.

This is an opt-out program. If you don’t wish to have your contributions increased by 1% each year until you reach the automatic max of 10%, you must opt-out by December 30th.

Vesting Schedule

Vesting on Employer Match contributions is subject to a 5 year vesting schedule:

1 Year 20%

2 Years 40%

3 Years 60%

4 Years 80%

5 Years 100%

401(k) Plan Contributions & Limits

Team members can contribute between 1% and 75% of their eligible compensation on a pre-tax or Roth after-tax basis, up to the annual IRS limit ($23,000 in 2024). If you are age 50 or older, you’re eligible for an additional “catch-up” contribution ($7,500 in 2024). You can change how much you are contributing at any time.

Company Match & Vesting

Golden Entertainment, Inc. offers a discretionary annual company match equal to 25% of your contributions up to the first 4% with a $500 annual cap. You must be employed on December 31st, the last day of the plan year, to be eligible to receive the match. The match dollars will be deposited into your account during the second quarter of the following year.

Vesting refers to the portion of your account you are eligible to keep should you leave the organization. While you are always 100% vested in the value of your own contributions to the Plan, the employer-matching contributions are subject to the above timeline.

Benefit Questions?

Email:

Phone:

Monday through Friday between 9am and 5pm PST

BENEFIT SHOWCASE

Other Resources

Medicare

SGIA is a trusted Medicare partner who works with employers across the country and who has been working with Golden Entertainment’s team members for several years. Their goal is to provide you with knowledge about your options and help you understand how Medicare can supplement or replace a group health plan. They have helped thousands of people nationwide.

They offer personalized guidance and work with you one-on-one to understand your individual needs and concerns. They believe

each individual should have Medicare coverage that fits their specific lifestyle.

- Their services are NO COST to you

- There is no obligation and your private information remains confidential

- They work with all national and regional insurance companies

- They work in all areas of Medicare, including prescription and supplemental plans

- They will provide you with personalized plan options, enrollment assistance, and ongoing support.

They make navigating the world of Medicare easy, so you can have peace of mind knowing you made the best decision for you and your health needs.

Medicaid

Do you know you may qualify for FREE health insurance? Have you tried enrolling in Medicaid? Medicaid offers a comprehensive health plan with no co-pays for most services, no deductible, dental, and Vision coverage. Benestream has Medicaid Enrollment Specialists that can assist you over the phone to see if you qualify. There is no cost to you for their services.

If you think you may qualify, click on the link and complete a short list of questions.

Contact Us: 877-223-1432

Additional Information

Building an Emergency Fund

Building Your Credit Score

How to Budget Your Expenses