Welcome to the Bakkt Virtual Benefits Fair!

This site is available year-round to Bakkt employees and their families. Here, you will be able to view your 2023 benefit programs along with educational videos and links to important information. Just like a health fair, this Virtual Benefits Fair provides access to an Exhibit Hall. There, you will find a wealth of information to help you make benefit decisions for 2023. We encourage you to engage and see all that Bakkt provides to employees and their family members.

One of the best places to start is the Educational Webinars booth. You will find a series of videos that provide information regarding each of the benefit programs. By starting there, you will be prepared to launch into Open Enrollment decision making.

Remember, benefit changes made during open enrollment will become effective on January 1. As a new hire, your benefits will become effective on the first of the month following 30 days of full-time employment. Unless you have a qualified change in status, you cannot make changes to the benefits you elect until the next annual open enrollment.

2023 Virtual Benefits Fair

Main Exhibition Hall

Click on a booth to visit

2023 Virtual Benefits Fair

Your Benefit Program

Benefits are an important part of your total compensation package as a Bakkt employee. Each year, we take great care to evaluate our options to provide benefits and programs that are the most meaningful and affordable for our employees.

Here, you will find the Benefits Guide, Open Enrollment Presentation, and Bakkt Payroll Deductions. If you have questions regarding your benefits, the Important Contacts (phone numbers and websites) are on page 3 of the Benefits Guide.

2023 Virtual Benefits Fair

Educational Webinars

Welcome to the educational webinars booth. This is a great starting point to become familiar with the benefits and programs offered at Bakkt.

Here is the schedule:

- Wednesday, October 26th at 1:00 pm ET: Nationwide – Pet Insurance Overview

- Tuesday, November 1st at 1:00 pm ET: United Healthcare – Medical, Dental and Vision Plan Overview

- Wednesday, November 2nd at 1:00 pm ET: Allstate – Hospital, Critical Illness, Accident and Identity Theft Plan Overview

- Thursday, November 3rd at 11:00 am ET: United Healthcare Resources – Wellness, Weight Loss, Tobacco Cessation + more!

- Tuesday, November 8th at 11:00 am ET: Sun Life – Life, Voluntary Life, LTD, STD, EAP Plan and determining how much life insurance you need

2023 Virtual Benefits Fair

UHC Medical Plans

Bakkt will continue offering eligible employees and their dependents two medical plan options through UnitedHealthcare. Both of these plans provide you with access to quality health coverage, including pharmacy benefits. To view a side-by-side comparison of your medical plans, see page 5 of the benefit guide.

The UHC plans provide a richer level of benefits when you use an in-network provider and have services performed outside of a hospital setting.

To find an in-network provider, please visit: www.myuhc.com. Select “Find a Provider.” Select either the Medical or Behavioral Health Directory, Select “All Unitedhealthcare Plans” and select “Choice Plus.” Enter your address and the type of provider you are looking for.

QUESTIONS?

HSA Plan Call: 866.314.0335 | OAP Plan Call: 866.633.2446

HDHP with HSA

Choosing a Medical Plan

UHC Digital Tools

2023 Virtual Benefits Fair

Dental and Vision

Taking care of your oral health and your eyesight are important parts of maintaining your overall health and well-being. Preventive care or routine visits are covered under the Dental Plan and the Vision Plan. Through UHC, we have access to a broad network of dentists and vision providers. By using network providers, you will have trustworthy providers and discounted pricing.

DENTAL: To find an in-network provider, please visit: www.myuhc.com

Select “find a dentist,” select your state, select “National Options PPO 30 network."

VISION: To find an in-network provider, please visit: www.myuhc.com

Select “find a vision provider,” enter your address or select “advanced search” to search by other criteria.

QUESTIONS?

Dental: Call 877.816.3596 | Visit www.myuhc.com

Vision: Call 800.638.3120 | Visit www.myuhc.com

2023 Virtual Benefits Fair

Employee Assistance Program and Mental Health

Taking care of yourself and protecting your mental health is more important than ever. Personal setbacks, emotional conflicts, or just the demands of daily life can affect your work, health, and family. That is why, at Bakkt, we provide a robust benefit program and resources to support you and your family.

Employee Assistance Program (EAP)

So that you have options and flexibility, we offer two EAP programs.

SunLife EAP – Guidance Resources: This benefit is available to you and your family members at no cost and gives you someone to talk to when life’s challenges threaten to overwhelm you. The program is staffed by experienced, caring clinicians who are available by phone or online 24 hours a day, seven days a week. Services are available for emotional, financial, legal guidance and much more. You can reach a clinician at 877.595.5281. Visit www.guidanceresources.com

UHC EAP: If you are enrolled in the medical plan, you have access to the UHC EAP. This program offers up to three provider visits for $0 by phone and in-person counseling sessions for short-term support and advice to help with: stress, anxiety, depression, personal challenges, substance abuse, legal, and financial support. Start by calling 888.887.4114.

2023 Virtual Benefits Fair

Preventive Care and the UHC Rally Program

We've all heard the phrase "an ounce of prevention is worth a pound of care." If you are enrolled in one of the UHC medical plans, your recommended preventive care is covered at 100% (at in-network providers).

We also have a wellness program called Rally. This programs shows you how to make simple changes to your daily routine, set smart goals and stay on target. You’ll get personalized recommendations on how to move more, eat better and feel happier—and have fun doing it. There are programs with Apple Fitness and Peloton.

Check out Simply Engaged to see how you could earn up to $200 for completing health and wellness activities.

Register on Myuhc.com to access Rally and also download the Rally App!

Rally Assistance: 877-818-5826

2023 Virtual Benefits Fair

Health Savings Accounts and Flexible Spending Accounts

A Health Savings Account (HSA) and a Flexible Spending Account (FSA) are two benefit program features that complement your medical plan and provide options for reimbursing your healthcare expenses.

An HSA is a special tax-advantaged savings account similar to a traditional Individual Retirement Account (IRA) but designated for medical expenses. An HSA allows you to pay for current eligible healthcare expenses and save for future qualified medical and retiree healthcare expenses on a tax-favored basis. You can only choose an HSA if you enroll in the HSA 1500 Plan.

Bakkt contributes to your HSA account. Contributions are made to your HSA each pay period with a maximum annual contribution of $600 for single coverage and $1,200 for two or more (family).

Flexible Spending Accounts There are two types of FSAs - a Health Care FSA and a Dependent Care FSA. You can only choose the Health Care FSA if you enroll in the OAP 500.

A Health Care FSA allows you to contribute money into an account with each paycheck to pay for qualified expenses on a pre-tax basis. You can then use these tax-free funds to pay for qualified out-of-pocket medical costs and other eligible expenses. With an FSA, you save FICA, federal, state, and local taxes by reducing your taxable income, and increasing your take-home pay.

- Note: if you are enrolled in HSA 1500 medical plan, you are eligible for a Limited Purpose FSA. With a Limited Purpose FSA, you can contribute money into an account to pay for qualified dental and vision expenses only.

A Dependent Care FSA (DCFSA) is a pre-tax benefit account used to pay for eligible dependent care services, such as preschool, summer day camp, before- or after-school programs, and child or adult daycare. It's a smart, simple way to save money, while taking care of your loved ones so that you can continue to work.

QUESTIONS? Call 888.873.8205 | Visit www.paylocity.com

2023 Virtual Benefits Fair

Sun Life - Basic and Voluntary Life Insurance

While it is tough to think about - it's critically important to plan for your death. The people you love, and support could face financial challenges without you. Life insurance provides your loved ones with money they need for household expenses, tuition, mortgage payments and more. A regular evaluation of your life insurance needs and your beneficiary elections is a good habit.

The company provides a basic amount of life insurance. Through Sun Life, you have the option to purchase additional life insurance for yourself, your spouse and or your dependent children.

As a newly hired employee, you have the option to purchase coverage on a guaranteed basis – this means, that you do not have to provide “evidence of good health” (Evidence of Insurability). This is only offered during your initial enrollment as a new hire. Refer to page 11 of the Benefits Guide for the details regarding the guaranteed issue coverage levels.

QUESTIONS? Call 800.247.6875 | Visit www.sunlife.com

During the annual open enrollment period, employees and spouses may increase coverage by one increment ($10,000 or $5,000) without health questions if you don’t exceed the Guarantee Issue limit. For those who have previously declined coverage, you may come on to the plan with one increment of coverage with no health questions.

2023 Virtual Benefits Fair

Disability and Leave Management

Did you know that 1-in-4 workers will miss up to three months of work due to a disability during their career? And, the average length of a long-term disability is 34.6 months.

Disability insurance replaces a portion of your income when you can't work. If you were unable to work due to illness or injury, disability insurance can help to pay for essential expenses, including food, utilities, school tuition, mortgage and car payments. Think of disability insurance as "paycheck insurance." Short-term and long-term disability protect your income when you can't work.

Short-Term Disability - upon approval of your disability claim, benefits begin your eighth day of disability and continue up to 25 weeks, as long as you are still unable to work due to a covered disability. Check out the benefit summary for more details regarding the benefits you receive.

Long-Term Disability - upon approval of your long-term-disability claim, benefits begin as soon as 180 days from the date of your disability. Take a look at the benefit summary for the details regarding common causes of disability and the monthly benefit details.

Bakkt’s leave and disability are managed by Sun Life. Sun Life provides assistance with submitting your disability and absence claims as well as your request for workplace accommodation.

If you need assistance regarding a disability or leave request, you may contact Sun Life Monday through Friday, 8:00 am to 8:00 pm ET.

QUESTIONS? Call 888.444.0239

2023 Virtual Benefits Fair

Identity-Theft Protection

Since so much of daily life is now spent online, it’s more important than ever to stay connected. But more sharing online means more of your personal data may be at risk. In fact, 1-in-6 Americans were impacted by an identity crime in 2020.

Identity theft can happen to anyone. That’s why we offer you Allstate Identity Protection. So you can be prepared and help protect your identity and finances from a growing range of threats.

QUESTIONS? Call 800.789.2720

2023 Virtual Benefits Fair

Accident Plan and Critical Illness

Through Allstate, here are two programs to provide financial assistance and security for life's unexpected events: an Accident Plan and Critical Illness Plan.

Accident Plan: Active lifestyles in or out of the home may result in bumps, bruises and sometimes breaks. Getting the right treatment can be vital to recovery, but it can also be expensive. And, if an accident keeps you away from work during recovery, the financial worries can grow quickly. Most major medical insurance plans only pay a portion of the bills. This coverage can help pick up where other insurance leaves off and provide cash to help cover the expenses. With Accident insurance from Allstate Benefits, you can gain the advantage of financial support, thanks to the cash benefits paid directly to you. You also gain the financial empowerment to seek the treatment needed to be on the mend.

Critical Illness: No one is ever really prepared for a life-altering critical-illness diagnosis. The whirlwind of appointments, tests, treatments and medications can add to your stress levels. Critical Illness coverage helps provide financial support if you are diagnosed with a covered critical illness. With the expense of treatment often high, seeking the treatment you need could seem like a financial burden. When a diagnosis occurs, you need to be focused on getting better and taking control of your health, not stressing over financial worries.

QUESTIONS? Call 800.521.3535 | Visit www.allstatebenefits.com

2023 Virtual Benefits Fair

Hospital Indemnity Plan

Life is unpredictable. Without any warning, an illness or injury can lead to hospital confinement and medical procedures and/or visits, which may mean costly out-of-pocket expenses. Allstate Benefits offers a solution to help you protect your income and empower you to seek treatment.

QUESTIONS? Call 800.521.3535 | www.allstatebenefits.com

2023 Virtual Benefits Fair

Home and Auto Discounts

With all the insurance programs offered, let's not forget about custom coverage for your home and automobile with Farmers GroupSelect. Through this program, you have access to insurance savings with a tailored program to meet your needs.

Auto Insurance Features: automated payment options, claim-free driving rewards, roadside assistance, car rentals and so much more.

Home Insurance Features: replacement cost coverage, referral networks, and special group discounts.

Getting a Quote is easy, call today: 800.438.6381 | Visit www.myautohome.farmers.com

2023 Virtual Benefits Fair

Pet Insurance

Are you a dog person or a cat person? With two budget-friendly options, there’s never been a better time to protect your pet. Nationwide's popular My Pet Protection® pet insurance plans now feature more choices and more flexibility. This plan provides cash back on eligible vet bills based on the plan you chose. And, there are no networks or pre-approvals.

QUESTIONS? Call 877.738.7874 | Visit benefits.petinsurance.com/bakkt

2023 Virtual Benefits Fair

Perks at Work

Bakkt Perks at Work gives employees free access to exclusive preferred pricing on electronics, home appliances, groceries and more. This means you don't have to pay full price on the things you buy.

Used by over 70% of Fortune 1000 companies, Perks at Work aims to help stretch your paycheck farther with discounts from all your favorite stores. Plus, enjoy free access to free live recorded classes through Community Online Academy. Classes are offered for kids and adults and focus on wellness, learning and fun! Invite family members and friends to enjoy your perks, too.

2023 Virtual Benefits Fair

Assist America Travel Assistance

With your Sun Life coverage, you receive an emergency travel assistance program and ID-theft protection services provided by Assist America.

This travel emergency assistance program immediately connects you to doctors, hospitals, pharmacies and other services if you experience a medical or non-medical emergency while traveling 100 miles away from your permanent residence or in another country. One simple phone call to Assist America will connect you to:

- A state-of-the-art 24/7 Operations Center

- Experienced, multilingual crisis-management professionals

- Worldwide emergency response capabilities

- Air and ground ambulance service providers

QUESTIONS? Call 800.872.1414 | Visit www.assistamerica.com

2023 Virtual Benefits Fair

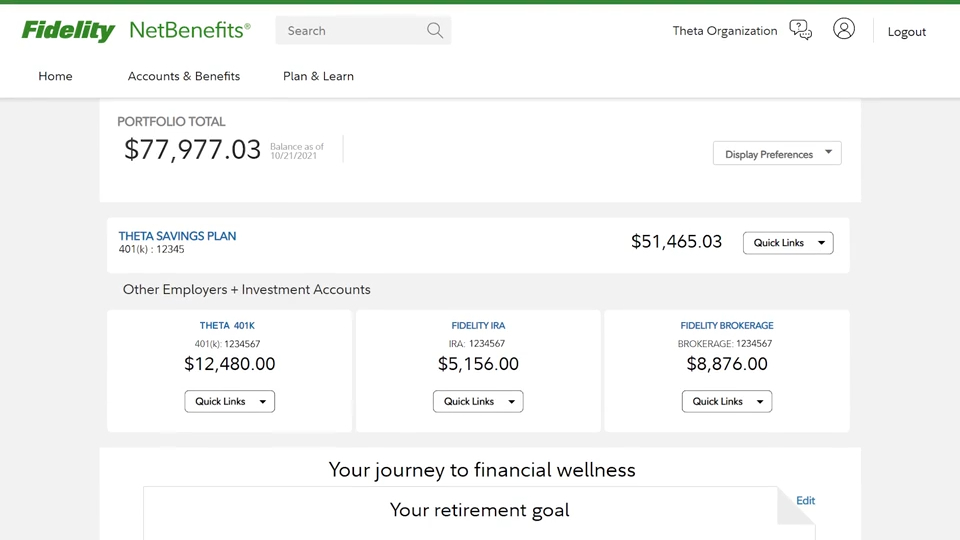

Financial Wellness and Fidelity 401(k) Plan

Medical and emotional wellness is so important in building your state of happiness. But, have you ever considered your "financial wellness"? Financial wellness is a state of being in which you can fully meet your current and future financial obligations, while feeling secure in your financial future and making choices that allow you to enjoy life. All too often, financial wellness takes a back seat to everything else going on in our lives. This booth highlights the 401(k) plan and also a few other tidbits that will getting you thinking about your financial health.

The 401(k) with Fidelity is a workplace savings plan that has tax advantages as an incentive to invest for retirement. The earlier you start saving, the more time your money has to grow. You'll also gain a sense of achievement and maybe even some momentum to take the next step, whether it's getting back on track after an event in your life has slowed your savings, or creating a plan for living out your dreams in retirement.

No matter where you are in life, know that you can take steps toward retirement confidently with the knowledge and tools you'll find from Fidelity.