Welcome to Your GTI Employee Benefits!

Your needs, and those of your family, are unique to you. That’s why Green Thumb is proud to offer a comprehensive and flexible benefits program that you can customize to fit your personal situation. Our program offers you and your family important healthcare coverage and financial security.

How to Navigate This Virtual Benefits Showcase

Take a Look Around!

Use the navigation bar at the top of the page to go through each of the Green Thumb benefit categories. Each tab provides valuable information, interesting videos, and links to forms and other resources.

Get There Fast!

Click on the links below to take you directly to the tab that holds all the information you need for that benefit category!

Come Back Often!

This site will be available to you on demand, all year. Feel Free to bookmark this or add it to your Favorites, so you and your family members can visit whenever you need additional information!

- Benefit Overview

- Eligibility

- Enrollment

- Making Changes

- Termination

- Medical and Prescription

- Programs Included in Your Medical Benefits

- PLANselect

- HSA

- Accident Injury

- Critical Illness Insurance

- EAP

- TalkSpace

- Dental Benefits

- Vision Benefits

- Life and AD&D

- STD and LTD

- FSAs

- Transit and Commuter

- 401k

- Prudential Financial Wellness

- Employee Relief Fund

- Employee Discounts

- OneRep Privacy Services

- ID-Theft Protection

- Business Travel Accident

- Perks Marketplace

- Core Power Yoga

- Partnership Credit Union

You can also always find contact information and benefit details through the following links:

Questions? Email

Bargaining unit employees may be subject to the terms of the applicable collective bargaining agreement.

2024 Benefits Showcase

Benefits Basics

Benefit Overview

Green Thumb offers our employees a full spectrum of benefits, as illustrated below. Keep scrolling for more information on eligibility and enrollment!

2024 Green Thumb Benefit Offerings

- BCBSIL Life and AD&D

- BCBSIL STD and LTD

- P&A FSAs

- P&A Transit and Commuter

- PCS Retirement 401(k) Plan

- Employee Discounts

- BCBSIL ID-Theft Protection

- AIG Business Travel Accident

- Benefit Hub Perks Marketplace

Eligibility

Who Is Eligible?

- An active, full-time employee working 30 or more hours per week

Your dependents are eligible if they are:

- Your legal spouse or domestic partner

- Your and/or your domestic partner’s child(ren)* up to age 26

- Your disabled child(ren) up to any age (if disabled prior to age 19)*

About Domestic Partner Coverage

To enroll your same-sex or opposite-sex domestic partner and his or her dependents for coverage, you will be required to submit a notarized affidavit confirming your domestic partner qualifies as a dependent:

Under federal law, Green Thumb’s contribution toward the cost of healthcare coverage for your domestic partner and his or her dependents is considered taxable income to you.

Domestic partner premiums will be deducted on a post-tax basis. You may wish to consult with a tax adviser for more information.

Enrollment

When Can I Enroll in Benefits?

You can enroll for benefits:

- Within 30 days of first becoming eligible for benefits

- During the annual Open Enrollment period

- During the plan year, if you experience a Qualifying Life Event

When Does Coverage Begin?

Benefits for new hires, unless explained otherwise, will become effective on the first of the month following one month of employment.

How Do I Enroll in Benefits?

You must actively enroll in all benefits that require employee contributions. You will be automatically enrolled in all Company paid benefits.

To enroll (or make changes) to your benefits, you must log in to the Wurk portal or via the HCMTOGO app.

New hires receive enrollment instructions via Wurk/email.

Making Benefit Changes During the Plan Year

The benefit elections you make during your initial enrollment period as a new hire, or during open enrollment, will be in effect for the calendar year. You may make changes to certain benefits only if you have what is called a “Qualified Life Event”, and you submit a life change event in Wurk and upload supporting documentation within 60 days of the event. Proof of life events is subject to approval by Green Thumb.

Please take a minute to watch our video to learn more about Qualified Life Events.

Please review our 2024 Benefits Guide for additional details on qualifying life events and effective dates. Please contact the Benefits Team with any additional questions or concerns.

Termination of Coverage

If you or a covered dependent no longer meet the eligibility requirements or if your employment ceases, your medical, dental, and vision coverage will end on the last day of the month in which you become ineligible.

You may be eligible to elect COBRA for yourself and your eligible dependents for medical, dental, and vision and FSA coverage.

All other coverages will end on the day you become ineligible. Your life coverages are convertible. You are responsible for informing The Benefits Team within 30 days if any of your dependents become ineligible for benefits.

Questions? Email

2024 Benefits Showcase

Physical Health

| Medical and Prescription Drug Benefits

Green Thumb offers two Medical Plans through BCBS of Illinois. Both plans offer:

-

Access to the Blue Cross Blue Shield Network of providers. Go to www.bcbsil.com and click on “find care” to locate participating providers.

-

A comprehensive prescription drug network. Got to www.myprime.com to find a participating pharmacy

-

The BCBS Nurseline, with 24/7/365 medical advice. The flyer below provides additional details.

-

MD Live, offering 24/7/365 telemedicine support. Scroll down on this page for details on this valuable service.

-

Well on Target Fitness, offering access to a national network of discounted fitness locations.

Key Health Insurance Terms Explained

The right plan for you depends on your healthcare needs and provider choices. Your two plan options differ in premium, deductible, coinsurance, out-of-pocket maximum, and copays. This video, while not specific to the Green Thumb plans, provides important general information on each of these key terms.

Programs Included with Your Medical Benefits

BCBS Medical Plan Perks

Watch this video to learn more about all of the perks available to you through your Green Thumb medical plan coverage.

Hinge Health – a no-cost, digital, 12-week, coach-led musculoskeletal program based on proven non-surgical guidelines. If you qualify, Hinge Health will contact you to discuss how you can sign up for this program.

Teledoc – a free diabetes and high blood pressure management tool. If you qualify, Teledoc will contact you to discuss how you can sign up for this program.

Learn to Live – online mental health programing offered at no cost to you. This includes personal coaching by email, phone, or text. You access this by logging into Blue Access via the link provided below.

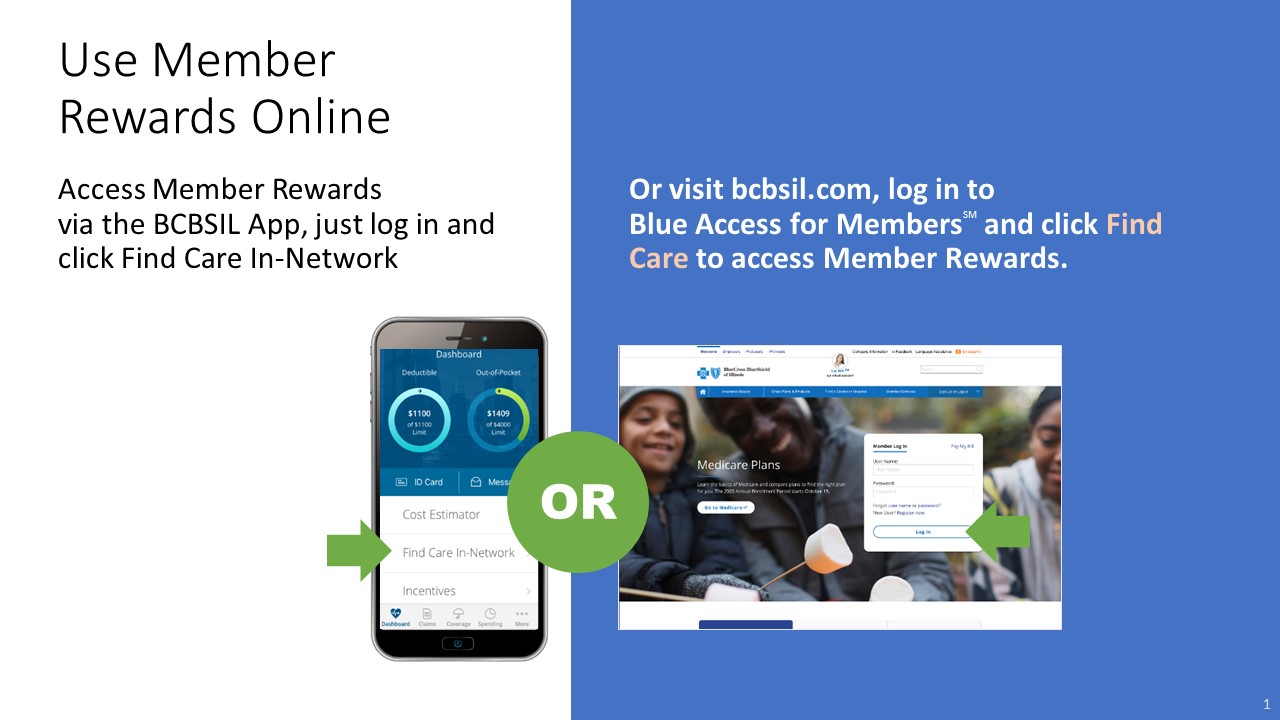

Member Rewards – costs for the same medical care can vary. With Member Rewards, you can shop in-network procedures/services and find reward-eligible locations. If you get the procedure/service at your chosen reward-eligible location, you receive a cash reward. This program is available beginning January 1, 2024.

MedsYourWay – a drug discount card savings program. Simply present your BCBSIL Member ID card at an in-network retail pharmacy and MedsYourWay will automatically search for and finds the lowest cost for eligible medicines if there is a coupon available.

Wondr – a no cost, digital weight loss assistance platform. Wondr can help you change your life! You can learn more, and enroll, at wondrhealth.com/BCBSIL.

You can access information about all of these programs directly through your member portal by clicking the BCBS Website link below.

| Decision-Support Tool

Green Thumb offers two comprehensive medical plans. Now that you have the details–how do you decide which one is right for you and your family?

PLANselect – our medical benefits decision-support tool - can help!

PLANselect is a web-based, video-guided tool developed by physicians and industry experts, providing users like you with a personalized analysis of the Green Thumb health plans.

Click on the link and start your PLANselect modeling now!

Stretch Your Healthcare Dollars

Being sick is enough. You shouldn’t have to worry about healthcare expenses! Our video offers eight tips to help you maximize your healthcare plan. Take a moment to listen.

| Take advantage of Our Telemedicine Option

Both medical plans include virtual visits with MDLIVE visits, which provides 24-7-365 access to board-certified primary care doctors and pediatricians by secure video chat or phone. For an illness or injury that is not an emergency, MDLIVE’S telemedicine program offers a convenient, cost-effective alternative to hospital emergency rooms and urgent care clinics.

MDLIVE is not intended to replace your relationship with your doctor, but rather provides access to healthcare when reaching the doctor is difficult or inconvenient.

Getting started with MD Live is as easy as 1-2-3!

- Download the MDLIVE mobile app, call MDLIVE at 888-676-4204 or go to MDLIVE.com/bcbsil. Enter your first and last name, date of birth and BCBSIL Member ID number.

- Register and complete your account profile, including a brief medical history, for you and your enrolled family members.

- Video chat or talk with a doctor from home, work or when traveling.

Control Your Cost – And Your Care!

You can always rely on MD Live our telemedicine partner, to aid you with emergent care, 24/7/365.

For those times when you want or need in-person medical attention, it’s important that you understand the best place to access your medical care. Learn more, about your options in this video.

| Health Savings Account (HSA)

If you enroll in the Green Thumb HDHPw/HSA, you can open and contribute to a Health Savings Account (HSA) to help cover some of your medical, dental, or vision costs.

Our video offers valuable information on the advantages of opening your HSA.

Funding and Enrolling in an HSA

To enroll in an HSA, you must enroll in our HDHP w/HSA plan. If you enroll in the High Deductible Health Plan, and indicate that you want to contribute to a HSA, Green Thumb will have the HSA opened through P&A Group on your behalf. You will receive instructions following enrollment on how to activate your account and establish a login and password. It is important to note that expenses are not eligible for reimbursement until your HSA has been established.

| Supplemental Health Benefits

Green Thumb offers two supplemental health plans for you to consider. These are intended to supplement your medical plan elections, by paying cash directly to you for qualifying health conditions. These benefits may help you fund costs associated with your medical plan deductible or coinsurance requirements.

Accidental Injury

Accidental Injury pays a cash benefit when you or your covered family members suffer injuries sustained in a covered accident.

Employees enrolled in the High Deductible Health Plan will automatically receive Accidental Injury Coverage for themselves, paid for by Green Thumb. You may add coverage for additional family members at your cost.

Critical Illness Insurance

Critical Illness Insurance pays a lump-sum cash benefit following the diagnosis of a covered critical illness or event. Learn more about Critical Illness in our video.

Both Supplemental Health plans also provide an annual cash benefit of $50 (per calendar year) for eligible health screenings and prevention measures. Since these screenings are often paid at 100% under the medical plan, you could walk away with cash in your pocket for practicing good preventive care.

Please refer to the United Healthcare benefit plan summaries and your 2024 Benefits Guide for details on plan coverage and rates for both plans.

Questions? Email

2024 Benefits Showcase

Emotional Balance

Emotional Balance

We understand how challenging it can be to balance your work and personal life, and we are committed to helping you find that balance. Sometimes, you just need to know that you are not alone. Take a few minutes to hear a few simple suggestions that may help you in your journey.

The Path to Peace of Mind

| Virtual Behavioral Health Therapy

Talkspace provides behavioral health therapy and emotional wellness support to you and your dependents (over 13 years old). Talkspace is messaging-based therapy conducted through their proprietary app. The Talkspace app is completely confidential, HIPAA compliant, secure, and clinically proven.

Individuals can message their dedicated therapist via text as often as they wish, any time of the day or night, 7 days a week. Therapists engage daily, 5 days a week based on your therapist chosen schedule, not simply Monday through Friday.

Talkspace is not appointment-based (excluding the live video). The therapist and individual may engage once per day, or they may exchange multiple messages per day based on the needs of the individual and the schedules of both the individual and therapist.

Talkspace Bookshelf, a clinical insights library is also available to all employees. It is a virtual library that includes vetted information on common diagnoses such as depression, anxiety, substance misuse, and post-traumatic stress disorder.

Green Thumb offers the Talkspace program at no cost to you. Learn more about the program through our Benefits Guide or by accessing the Talkspace website.

| Employee Assistance Program (EAP)

Our ComPsych EAP plan is offered at no cost to you. Counselors are available for support by phone 24 hours a day, seven days a week at 866-899-1363.

To help get you started, the program includes up to three free in-person counseling sessions. Behavioral counselors can help navigate any additional long-term counseling needs.

Learn more about the EAP in our short video. You can register with ComPsych at any time, by clicking on the link below! Your company ID for registration is DISRES.

Questions? Email

2024 Benefits Showcase

Dental & Vision

| Dental Benefits

Green Thumb offers two dental Plans through BCBS of Illinois. Both plans offer:

- Access to the Blue Cross Blue Shield network of dental providers. To search for in-network providers, log onto www.bcbsil.com and click on “Find Care” to locate providers in your area.

- Preventive care is covered at 100%.

| Vision Benefits

Routine eye exams are important for maintaining good vision and can also provide early warning of other health conditions. The EyeMed vision plan provides coverage for exams, glasses and contact lenses, as shown below.

In-network coverage is provided when you use EyeMed providers. To search for providers, log onto eyemedvisioncare.com/bcbsilvis or call 855-362-5539.

You can also download the Eyemed mobile app for on-the-go access to your vision plan information. Vision Mobile App Access

Employees share in the cost of vision benefits, and coverage is available at in-network providers

Questions? Email

2024 Benefits Showcase

Financial Protection

| Life, Accident Death and Dismemberment (AD&D)

Basic Life and AD&D

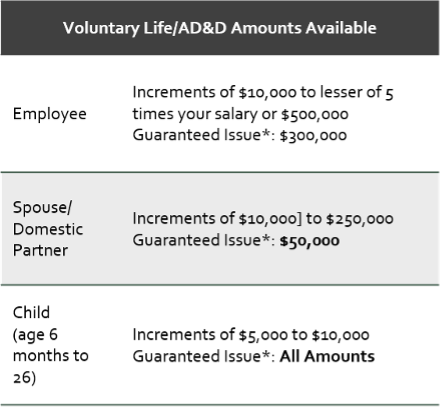

Voluntary Life and Voluntary AD&D

To enroll in Voluntary Spouse/Domestic Partner and/or Child Life, you must have elected at least the same amount of Voluntary Life insurance for yourself.

| Disability Insurance

Could you and your family survive without a paycheck, if you were out of work due to an injury or illness? Disability insurance is essentially “Paycheck” insurance, ensuring you will receive a portion of your income if you are unable to work due to a non-work-related injury or illness. Short-Term Disability (STD) provides a weekly benefit, while Long-Term Disability (LTD) pays a monthly benefits after STD insurance has been exhausted.

Green Thumb offers STD insurance through BCBS of Illinois, at no cost to you. You are automatically enrolled for STD coverage. You are taxed on the value of this coverage, which provides you the advantage of receiving tax-free STD benefits, should you file a claim.

You may elect to enroll in LTD insurance. The cost of that coverage is paid entirely by you, via payroll deduction.

Short-Term Disability (STD) Insurance

STD benefits become payable when you are unable to work due to an injury or illness unrelated to work. If you remain disabled and meet the plan’s disability requirements, you will continue to receive a percentage of your weekly earnings until the benefit duration has ended.

STD benefits are offset by any state-mandated disability plans.

Voluntary Long-Term Disability (LTD) Insurance

LTD insurance offers a monthly benefit to help replace lost income if you experience a disability lasting longer than 90 days. Proof of disability is required.

Disability claims for newly covered employees will be denied if you received medical treatment, medical advice, care or services or took prescribed drugs or medicines in the last 12 months prior to the effective date of this coverage and the disability began in the first 12 months after your effective date of coverage.

| Flexible Spending Accounts

Flexible Spending Accounts (FSA) allow you to set money aside for certain eligible expenses and draw from it throughout the year to pay for those expenses. The money is set aside pre-tax, reducing your taxable income. Three types of FSAs are available:

- Health Care

- Limited Purpose Health Care–HSA plan participants only

- Dependent Care

Money cannot be transferred between the accounts (i.e., you cannot use money from your Health Care FSA to pay for dependent care expenses and vice versa).

An HSA is NOT the same as the Medical Flexible Spending Accounts or FSAs. Click on the video to learn more about the difference!

How Does the FSA Work?

- You select the total amount you want to deposit for the entire plan year, which runs from January 1 to December 31. This must be done during your initial enrollment period.

- The total amount is equally divided by the number of pay periods remaining in that year and deducted from each paycheck. The money is set aside in your FSA account(s).

- As you incur eligible expenses, you can either:

- Use your P&A Group FSA debit card (not applicable to Dependent Care) for qualified purchases, or

- Submit a simple claim form and are reimbursed for such expenses from the account.

Tips

- To register and log into your FSA account(s), go to www.padmin.com, or download the P&A app.

- Our video provides important tips on how to maximize your Health or Limited Purpose FSA – Take the time to listen

| Transit and Commuter Benefit

Offered to all full-time employees

Commuter Benefits allow you to set aside tax-free money to pay for eligible expenses you incur as part of your commute to and from work. Full time employees are eligible for commuter benefits.

You may elect to have a maximum of $630 per month, $315 per account, from your gross income on a pretax basis for the cost of

- Parking: The most common eligible expenses are charges for parking at or near your place of work or at a location from which you commute to work, such as a train station.

- Mass Transit: the most common eligible expenses are charges for train and bus tickets.

Your tax savings will vary depending on your elected deduction amount and tax bracket.

Process, Tips, and More

- Be sure to download P&A Group’s Mobile App and sign in with touch ITD technology!

- Go to the App Store (on Apple devices) or the Google Play Store (on Android devices) and search “P&A Group” to get the app.

- Log into your P&A Group Account from your smartphone and follow the steps under My Benefits.

- QuikClaim - Instantly upload claims and receipts directly form your smartphone with P&A Group’s QuikClaim mobile submission.

| 401(k)

Whether just around the corner or far down the road, it’s never too early to start planning for retirement. Your 401(k) plan is a good place to start.

Green Thumb’s 401(k) Retirement Savings Plan allows employees to save for retirement through convenient payroll deductions. Employees who are at least 18 years of age are eligible to participate in the Plan.

The Plan is administered by PCS Retirement. You can defer up to an annual maximum of the lesser of 80% of your eligible compensation or the annual IRS deferral limit of $23,000 for regular contributions and $7,500 for catch-up contributions (for those age 50 and over). This can be done on a pre-tax basis through payroll deductions, or you may choose to make after-tax (Roth) contributions.

Watch our short video (less than 5 minutes!) and learn more about how the Green Thumb 401k retirement plan helps you!

1. To Set up Your Account and Enroll

- Visit https://www.pcsretirement.com/

login and click 'register for web access' - Confirm your personal information and set up your security questions

- Designate your beneficiaries

- Make your contribution elections

- Set up your investments

- Review and submit! You will receive a confirmation email

- Need help? Call 888-621-5491

2. You Choose When to Pay Taxes!

Making contributions to the 401(k) plan offers tax benefits. The type of contributions you make — pre-tax, Roth (after-tax) or a combination of the two — will determine when you pay taxes on your contributions. You can:

- Pay taxes later. If you make pre-tax contributions to the 401(k) Plan, you will lower your taxes today. The money you contribute, and any earnings will not be subject to income taxes until you withdraw it, likely in retirement.

- Pay taxes now. If you make Roth contributions to the 401(k) Plan, you will pay income taxes on the contributions today.

You can withdraw your contributions and any earnings tax-free once you have had the account for at least five years and have reached age 59½.

3. Need Some Advice?

For questions, investment advice, retirement planning or to request a complimentary 1 on 1 meeting with a financial advisor, please contact:

Questions? Email

2024 Benefits Showcase

Additional Benefits

| Financial Wellness

What is Financial Wellness? It’s the peace of mind you feel when you’ve balanced saving and spending … living well today and planning for tomorrow. How do you achieve it? Visit the Prudential Financial Wellness website to learn how:

| Employee Relief Fund

The Green Thumb Relief Fund was created to help Charitable Class members (individuals who are eligible to apply for a grant) who are in need of immediate financial assistance following an unforeseen disaster or personal extenuating circumstance. The Fund relies solely on support from Green Thumb Industries and aims to support team members during times of crisis and/or extreme hardship.

Green Thumb Employee Discounts

As a Green Thumb employee, you are immediately eligible for our employee discount of 40% on all Green Thumb products and 20% off all non-Green Thumb products sold by Green Thumb.

For more information, go to risecannabis.com and learn more about what is available in our dispensaries!

| Privacy Services

| Identity Theft Protection

Identity theft is when thieves steal your personal information in order to take over or open new accounts, file fake tax returns, rent or buy properties or commit other crimes in your name.

Green Thumb offers ID Theft Protection with BCBS of Illinois, through Experian. All employees enrolled in the BCBS of Illinois medical plans may elect this benefit. This coverage can help you avoid identity theft and, in the worst-case scenario, get your life back after a breach of your secure personal information. Check the BCBS member portal below, for more information.

| Business Travel Accident

Business Travel Accident (BTA) insurance provides financial security for benefit-eligible employees traveling 100 miles or more from home for business. This coverage provides an Accidental Death benefit of $250,000 for employees. BTA also provides Accidental Death benefits of $50,000 for your spouse and $25,000 for each dependent child who is traveling with you. Coverage starts when you leave for your business trip, continues while you are on the business trip, and ends when you return. This program pays benefits that are a direct result of an accident.

Our BTA insurance also includes Travel Resource Services, which offers around-the-clock emergency and information services that can help you access emergency assistance when you are traveling 100 or more miles away from home. Click on the Business Travel Accident Information to learn more.

BTA is administered by AIG and the cost is paid in full by Green Thumb.

To activate your services, you can call toll free within the US: 800-872-1414 or outside the US: +1-609-986-1234.

| Green Thumb Perks Marketplace

The Green Thumb Perks Marketplace, offered through Benefit Hub, offers you the opportunity to save big, on every day items.

You can enjoy discounts on services, rewards, and perks on thousands of brands you love in multiple categories, such as travel, entertainment, restaurants, auto rental, tickets, beauty and spa, apparel, and health and wellness.

It’s so easy to access and start saving!

- Go to Greenthumbperks.benefithub.com

- Enter referral code: M4RAVO

- Complete your registration

- Start Saving!

| Core Power Yoga

As a GTI employee, you are eligible to receive 20% off your unlimited All Access Membership or a 10-class package!

Company Partner All Access Membership:

- Unlimited classes at any studio nationwide*

- Unlimited access to Live and On-Demand ($49/month value)

- Priority in-studio booking (14 days early)

- 15% off in-studio retail purchases

- No long-term contract—freeze or cancel anytime

*Some exclusions may apply. View Safe Studio Standards here.

Viewing this on your phone? Using the QR code, submit your complete interest form including your company name and location. Upon receiving interest, a sales specialist will be in touch with the next steps. Market pricing varies by location.

If you are ready to flow with CorePower, please submit an interest form here to get started.

For those employees in states without a CorePower Yoga studio, you can use discount code ATHOME19 at checkout to purchase the At Home membership for $19.99/month (reg. $49).

| Credit Union

Anyone who works for Green Thumb can join Partnership Credit Union. Once a member, always a member! If you move, change jobs, or retire, you can keep your accounts with Partnership.

Partnership Financial Credit Union offers:

- Several Checking accounts to choose from

- Savings accounts

- Loans – mortgage, vehicle, student, & home equity

- CDs & IRSs

Go to mypfcu.org or call 847-697-3281 for more information.

| Hertz Gold Plus Rewards

Enjoy preferred rates globally and experience the best of Hertz every time when you enroll in Hertz Gold Plus Rewards® for free. Click the button below or scan the QR code to learn more!

Questions? Email

2024 Benefits Showcase

Premiums, Contacts, Resources

Premiums

Medical, Dental, Vision Plan Contributions

Contributions made from each paycheck, as well as contributions to your HSA and FSA, will automatically be deducted from your gross pay before Federal Income taxes and Social Security taxes are calculated. Since these contributions are deducted before your pay is taxed, your taxes will be based on a lower gross pay and you will end up paying lower taxes.

Voluntary Life, AD&D Rates

Voluntary Life/AD&D costs are withheld from your paycheck after taxes, and the benefits paid are not taxable.

Voluntary Life Rates (MONTHLY)

Voluntary AD&D Rates (MONTHLY)

Contact Information

Benefit

Provider

Phone

Website / Email

App

Group/Policy #

Claims Forms

Questions? Email

2024 Benefits Showcase

Part-Time Employees

Part-time Employees

Read below to learn about the benefits Green Thumb offers our Part-time employees!

| 401(k)

Whether just around the corner or far down the road, it’s never too early to start planning for retirement. Your 401(k) plan is a good place to start.

Green Thumb’s 401(k) Retirement Savings Plan allows employees to save for retirement through convenient payroll deductions. Employees who are at least 18 years of age are eligible to participate in the Plan.

The Plan is administered by PCS Retirment. You can defer up to an annual maximum of the lesser of 80% of your eligible compensation or the annual IRS deferral limit of $23,000 for regular contributions and $7,500 for catch-up contributions (for those age 50 and over). This can be done on a pre-tax basis through payroll deductions, or you may choose to make after-tax (Roth) contributions.

Watch our short video (less than five minutes!) and learn more about how the Green Thumb 401k retirement plan helps you!

1. To Set up Your Account and Enroll

- Visit https://www.pcsretirement.com/

login and click 'register for web access' - Confirm your personal information and set up your security questions

- Designate your beneficiaries

- Make your contribution elections

- Set up your investments

- Review and submit! You will receive a confirmation email

- Need help? Call 888-621-5491

2. You Choose When to Pay Taxes!

Making contributions to the 401(k) plan offers tax benefits. The type of contributions you make — pre-tax, Roth (after-tax) or a combination of the two — will determine when you pay taxes on your contributions. You can:

- Pay taxes later. If you make pre-tax contributions to the 401(k) Plan, you will lower your taxes today. The money you contribute, and any earnings will not be subject to income taxes until you withdraw it, likely in retirement.

- Pay taxes now. If you make Roth contributions to the 401(k) Plan, you will pay income taxes on the contributions today.

You can withdraw your contributions and any earnings tax-free once you have had the account for at least five years and have reached age 59½.

3. Need Some Advice?

For questions, investment advice, retirement planning or to request a complimentary 1 on 1 meeting with a financial advisor, please contact:

| Employee Assistance Program (EAP)

Our ComPsych EAP plan is offered at no cost to you. Counselors are available for support by phone 24 hours a day, seven days a week at 866-899-1363.

To help get you started, the program includes up to three free in-person counseling sessions. Behavioral counselors can help navigate any additional long-term counseling needs.

Learn more about the EAP in our short video. You can register with ComPsych at any time, by clicking on the link below!

Green Thumb Employee Discounts

As a Green Thumb employee, you are immediately eligible for our employee discount of 40% on all Green Thumb products and 20% off all non-Green Thumb products sold by Green Thumb.

For more information, go to risecannabis.com and learn more about what is available in our dispensaries!

| Green Thumb Perks Marketplace

The Green Thumb Perks Marketplace, offered through Benefit Hub, offers you the opportunity to save big, on every day items.

You can enjoy discounts on services, rewards, and perks on thousands of brands you love in multiple categories, such as travel, entertainment, restaurants, auto rental, tickets, beauty and spa, apparel, and health and wellness.

| Core Power Yoga

As a GTI employee, you are eligible to receive 20% off your unlimited All Access Membership or a 10-class package!

Company Partner All Access Membership:

- Unlimited classes at any studio nationwide*

- Unlimited access to Live and On-Demand ($49/month value)

- Priority in-studio booking (14 days early)

- 15% off in-studio retail purchases

- No long-term contract—freeze or cancel anytime

*Some exclusions may apply. View Safe Studio Standards here.

Viewing this on your phone? Using the QR code, submit your complete interest form including your company name and location. Upon receiving interest, a sales specialist will be in touch with the next steps. Market pricing varies by location.

If you are ready to flow with CorePower, please submit an interest form here to get started.

For those employees in states without a CorePower Yoga studio, you can use discount code ATHOME19 at checkout to purchase the At Home membership for $19.99/month (reg. $49).

| Credit Union

Anyone who works for Green Thumb can join Partnership Credit Union. Once a member, always a member! If you move, change jobs, or retire, you can keep your accounts with Partnership.

Partnership Financial Credit Union offers:

- Several Checking accounts to choose from

- Savings accounts

- Loans – mortgage, vehicle, student, and home equity

- CDs & IRSs

Go to mypfcu.org or call 847-697-3281 for more information.

| Hertz Gold Plus Rewards

Enjoy preferred rates globally and experience the best of Hertz every time when you enroll in Hertz Gold Plus Rewards® for free.