Welcome to the Rubrik Benefits Microsite!

We know how important health and wellbeing benefits are for you and your family. That’s why we’re committed to offering well-rounded options to protect your physical, mental, and financial health—and that of those you love. Our programs are designed to provide peace of mind in protecting your lifestyle and planning for the future.

This site will be available on demand all year, so visit whenever you or your family members need additional information. Use the navigation bar at the top of the page to learn more.

As a team member working 20 or more hours per week in the United States, you’re eligible to enroll for benefits as of your hire date. You have 30 days from your date of hire to submit your enrollment in Workday.

- In addition to yourself, you can enroll your spouse, domestic partner, and/or children up to the age of 26 for coverage.

- Please do not submit New Hire benefit enrollment without having added your SSN to your Workday profile!

After your new hire enrollment ends, you will not have an opportunity to change coverage until our next open enrollment period unless you have a qualifying life event like getting married, having a baby, or your spouse changing jobs.

-

You must submit the change request in Workday within 30 days of the life event and may need to provide documentation supporting the change.

-

To initiate the change in Workday, please go to Benefits > Change Benefits and select the appropriate Benefit Event Type.

-

Otherwise, Open Enrollment occurs annually around November for a January 1 effective date.

UMR, a UnitedHealthcare Administration Company

UMR is UnitedHealthcare’s third-party administrator solution, providing you with the personal support you need through resources to help you maintain or improve your health, and tools to help you make the best health care decisions for you and your dependents.

Under UMR, there are two plan options to choose from—a High Deductible Health Plan (HDHP) with HSA and a traditional PPO. Both plans utilize the same PPO network, so regardless of your plan, you’ll have access to the same network of providers. If you are enrolling in UMR for the first time, be sure to update all your providers and pharmacies with your new medical ID and carrier information in the new year.

Although UMR is the administrator of our plan, you will still be accessing care through the UnitedHealthcare network of providers and pharmacy services through Optum. Once your enrollment is effective, be sure to register on UMR's member website, member.umr.com, in the new year to access claim information, copies of your explanation of benefits, or search for providers.

UMR: High Deductible Health Plan with HSA Bank Health Savings Account

We get it, a high deductible health plan might feel daunting. Did you know you can continue to see the same doctors under the same PPO network and you’ll be billed later for office visits? The High Deductible Health Plan (HDHP) lets you take advantage of much lower payroll premiums and receive tax-free Rubrik funding into a Health Savings Account. You can use the HSA contributions from Rubrik to pay deductible expenses, save for the future, or invest the funds into retirement. Add your own funds to the HSA as well to help your balance grow even faster. With the HDHP plan, you are still able to maintain your health and wellness without worrying about out-of-pocket visit costs – routine preventive care, such as annual physicals, specific contraceptive care and age-based, routine screening tests are covered at 100% with no copay or deductible cost to you, just like the PPO. Other services and prescriptions are subject to the plan deductible, meaning you pay 100% of the cost until your deductible is met for the calendar year. Those deductible expenses are billed after your visit and you can use Rubrik’s funding into your HSA to pay those charges!

Additionally, UMR has cost calculators and price transparency tools to help you estimate costs prior to receiving care. And don’t forget, as long as you stay in-network, you should never have to pay more than your annual out-of-pocket maximum.

The HDHP plan has its advantages:

- Lower payroll premiums (pay less each paycheck to have coverage),

- Rubrik contributes to a tax-free Health Savings Account (HSA)

- Optional personal pre-tax contributions to the HSA

-

HSA funds can be invested for tax-free growth

- HSA funds can be used via debit card or by reimbursing yourself – all tax-free when used for qualified healthcare expenses

- No need to upload receipts or wait for reimbursement review, receive your funds immediately via wire transfer

- HSA funds can be used for any healthcare related expense any time after the account is opened

- Save even more pre-tax contributions for retirement! Funds used after retirement can be withdrawn as taxable income with no penalties, just like your 401k

Watch your HSA savings grow

Rubrik will fund your HSA each pay period ($33.33 for employees only or $66.66 for all other tiers), totalling $800 for single coverage of $1,600 for family coverage for a full calendar year. Switching from the PPO to the HDHP? Consider using the savings in monthly premiums to fund your new HSA! You can contribute additional funds into your HSA through pre-tax payroll deductions, up to an annual contribution limit (listed below). Since HSA is your personal account, the funds rollover every year and are yours until you spend them, even if you change plans in the future or leave Rubrik. The savings will continue to grow tax-free and remain tax-free as long as the funds are used for healthcare expenses. Additionally, you can choose to invest your HSA funds into mutual funds or within HSA Bank’s brokerage link, which may help your savings grow even faster.

Using Your HSA

Many pay for their medical deductible and coinsurance expenses with regular payment methods and save as much as possible into the HSA for future expenses, even into retirement! The HDHP with HSA is a great option for both savers and spenders - set aside tax-free savings for the future, or use your HSA funds as needed to offset deductible expenses that pop-up unexpectedly. Access your funds easily with a debit card or connecting to your personal bank account to reimburse yourself. While we recommend savings receipts in your HSA Bank portal, there’s no requirement and no waiting for receipts to be validated.

If you are newly enrolling in the HDHP, Rubrik will open your HSA Bank account on your behalf. Be on the lookout for mail from HSA Bank with your account details and your HSA Bank debit card which will arrive 2-3 weeks after your account has been established.

2023 HSA Annual Contribution Limits (includes yours and Rubrik’s contributions):

- Employee Only Coverage: $3,850 (up to $800 from Rubrik and optional $3,050 from you)

- Family Coverage (you + any dependents): $7,750 (up to $1,600 from Rubrik and optional $6,150 from you)

- Catch-Up Contribution (age 55+): additional $1,000

2023 Annual Deductible Amounts:

- $1,500 for employee only

- $3,000 for you + any dependents

UMR: PPO

Rubrik’s PPO plan gives you access to UnitedHealthcare’s broad network of providers and facilities. PPO's are a traditional type of healthcare plan that offers set copays for office visits and prescription medications and low deductibles for other medical services. Preventive care is covered at 100% with no copay or deductible. If you must seek care with a non-network provider, the PPO plan gives you the most flexibility to do so, but with limited coverage reimbursement and increased out-of-pocket costs.

Unlike the HDHP, you will not be automatically enrolled into a pre-tax savings account. However, you have the option to elect a Flexible Savings Account (FSA) to use tax-free funds for expenses incurred with this plan. Click the “FSA” tab to learn more!

Kaiser: HMO (California only)

For those located in California, we offer a third medical plan option through Kaiser, a Health Maintenance Organization (HMO) plan. The Kaiser plan has set co-pays for each type of service, allowing for the ease and convenience of having most of your medical services available under one roof, otherwise known as a "one-stop-shop". As an HMO plan, you must choose and maintain a Primary Care Provider (PCP). All specialist care requires referrals from your PCP, and there is no coverage for non-Kaiser services.

Introducing Modern Health

We strive to provide comprehensive coverage and we believe mental health is a basic healthcare need that should be easy and simple to access. We've heard from many of you that better mental health coverage should be a priority, so we're pleased to announce a new global mental health benefit through Modern Health.

This program is a robust mental health program with best in class providers in all locations Rubrikans live and work. Modern Health provides a tiered service model that offers several options for care to meet the various needs of you and your family members during difficult moments in everyday life or in times of crisis.

Beginning December 1, 2022, this program is available at no cost to enroll and no cost for you and your family to receive care. Access Modern Health via the App Store or Google Play.

Note that this program replaces Ginger. Ginger Emotional Help app will no longer be available through Rubrik as of December 1, 2022.

Carrot Fertility

Carrot is an inclusive family-forming and fertility benefit helping you and your partner pursue any path to parenthood. Unlike many plans that require a medical diagnosis of infertility, benefits through Carrot ensure access to quality care regardless of a diagnosis. This includes education, fertility treatment, fertility planning, IVF/IUI, genetic testing, adoption, surrogacy, and fertility preservation. Eligible expenses can be reimbursed at 100% up to $25,000 per lifetime per employee/household. You will access the program and connect to the Carrot care team by registering with your Rubrik email to confirm eligibility. Your enrollment is kept anonymous and you can change your contact information at any time once your account has been created.

New for 2023! Doulas are now covered under Carrot as an eligible expense for reimbursement!

Dental

We offer comprehensive Dental coverage for you and your family! Choose from a low-cost base plan to cover your annual check-ups or buy-up for more comprehensive coverage with higher allowances and lower coinsurance. See plan details for more information.

MetLife Dental will not issue a dental plan ID card. Your dental provider can verify your and your dependents' eligibility with your social security number. For your reference, our group policy numbers can be found on our Benefit Mobile Wallet Card (bookmark this page!).

Vision

We offer a choice of two vision plans through VSP. These plans provide affordable, quality vision care nationwide. The base plan offers low-cost coverage and a fully covered, no copay, annual well vision eye exam. For an additional per-paycheck premium costs, choose the buy-up plan for annual glasses or contacts with a higher level of reimbursement. Visit an in-network vision provider for the highest level of coverage and immediate savings; if you visit an out-of-network provider, expect lower coverage and you will need to submit a claim to VSP for reimbursement. You can find a list of participating VSP Signature providers at vsp.com.

VSP will not issue a vision plan ID card. Your vision provider can verify your and your dependents' eligibility with your social security number. For your reference, our group policy numbers can be found on our Benefit Mobile Wallet Card (bookmark this page!).

Pre-tax Flexible Spending Accounts

The Flexible Spending Account, or FSA is another type of pre-tax savings account. You make a set, annual contribution, which is then deducted pre-tax in equal amounts each pay period. The funds are available to use tax-free on eligible expenses. We offer several types of FSAs: a Healthcare FSA, Limited Purpose FSA, or Daycare FSA. These accounts are available whether or not you or your dependents are enrolled in Rubrik's medical plans.

Manage your FSA funds with Navia, Rubrik's FSA administrator! Access your funds using the Navia FSA debit card or pay out-of-pocket and submit your expenses for reimbursement via Navia's portal.

Regardless of how you use the funds, be sure to have a valid receipt or statement that includes the date of service, service provider details, type or description of service, name of recipient, amount billed, and amount paid. Visit Navia's website to search for eligible claims.

While a healthcare flexible spending account (FSA) and a health savings account (HSA) both allow you to set up tax-advantaged savings to pay for qualified medical expenses, there are some significant differences between the two. Watch "HSA vs FSA" video to learn more about how they differ!

Healthcare FSA

A Healthcare Flexible Spending Account (HCFSA) is a pre-tax savings account that you can use on eligible out-of-pocket health expenses for both you and your dependents. Make an annual enrollment up to the IRS maximum of $3,050. Once you elect, you will not be able to change your election unless you have a qualified life event such as marriage or birth/adoption. Although you will be contributing each pay period, your full annual election will be available upfront. Elect carefully as the plan is subject to use-it-or-lose-it-rules! Learn more below. You may NOT enroll in this plan if you enrolled in the Rubrik High Deductible Health Plan (HDHP), as a Healthcare FSA makes you ineligible to contribute to an HSA.

Limited Purpose FSA

If you enroll in an HDHP plan (whether or not with Rubrik), and establish an HSA, you may elect to enroll in a Limited Purpose Healthcare FSA (LPFSA). The Limited Purpose FSA is limited to dental, vision, and post-deductible medical expenses only. The annual contribution maximum is $3,050.

Dependent Care or Day Care FSA

The Dependent Care FSA (Day Care FSA) is available to you regardless of medical plan enrollment. You can set aside pre-tax funds to use for child care for children age 12 and younger or adult day care for incapacitated tax-dependents living in your home. Eligible expenses include day care, preschool, after-school programs, summer day camp, and elder day care. This account works like a savings account, meaning you cannot be reimbursed for more than what is in your account at any given time. Navia makes it easy to use your funds with the Day Care FSA Debit Card, or you can submit claims for reimbursement. The annual maximum contribution is $5,000 per household and is considered "use it or lose it." This account is only available if your spouse is also employed, looking for work, or a full-time student.

Wellness Programs at Rubrik

Rubrik cares about your physical and mental wellbeing. We are proud to offer you a variety of wellness benefits that fit your everyday needs both at work and at home. Scroll down to learn more about our various wellness offerings.

Introducing Modern Health

We strive to provide comprehensive coverage and we believe mental health is a basic healthcare need that should be easy and simple to access. We've heard from many of you that better mental health coverage should be a priority, so we're pleased to announce a new global mental health benefit through Modern Health.

This program is a robust mental health program with best in class providers in all locations Rubrikans live and work. Modern Health provides a tiered service model that offers several options for care to meet the various needs of you and your family members during difficult moments in everyday life or in times of crisis.

Beginning December 1, 2022, this program is available at no cost to enroll and no cost for you and your family to receive care. Access Modern Health via the App Store or Google Play.

Note that this program replaces Ginger. Ginger Emotional Help app will no longer be available through Rubrik as of December 1, 2022.

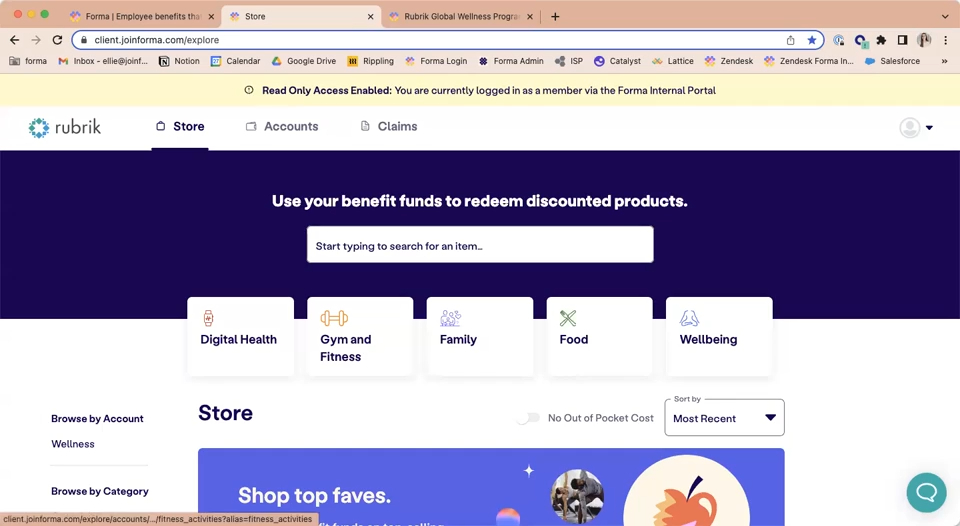

Wellness Reimbursement via Forma

Rubrik uses Forma as our Wellness Reimbursement plan administrator. Rubrik provides you with a budget of $50/month, totaling $600 a year, toward a variety of expenses to help make life easy, healthy, and well. Accrued balances roll over month to month but not year to year, so be sure to submit your claims for reimbursement before the year is over! Eligible expenses include fitness memberships, exercise, and sports equipment, fitness trackers or watches, wellness apps, massages or massage tools, nutrition apps or coaching, home office peripherals, ergonomic equipment, and family support services.

Put your wellness dollars to good use by accessing the Forma Online Store for discounted items and memberships or by submitting eligible expenses on the Forma app for reimbursement. Appropriate documentation is required. Taxable reimbursements are issued through payroll each month. You can access Forma via the Okta homepage!

Carrot Family Planning

Carrot is an inclusive family-forming and fertility benefit helping you and your partner pursue any path to parenthood. Unlike many plans that require a medical diagnosis of infertility, benefits through Carrot ensure access to quality care regardless of a diagnosis. This includes education, fertility treatment, fertility planning, IVF/IUI, genetic testing, adoption, surrogacy, and fertility preservation. Eligible expenses can be reimbursed at 100% up to $25,000 per lifetime per employee or household. You will access the program and connect to the Carrot care team by registering with your Rubrik email to confirm eligibility. Your enrollment is kept anonymous and you can change your contact information at any time once your account has been created.

New for 2023! Doulas are now covered under Carrot as an eligible expense for reimbursement!

401(k) - Fidelity

Preparing for retirement is a top priority of smart financial planning. Rubrik offers a 401(k) Plan through Fidelity to help you save for retirement via payroll contributions. Fidelity offers a variety of investment options to grow your earnings.

At Rubrik, you have the option to contribute via traditional pre-tax deductions or post-tax with Roth or After-Tax 401(k). Here are the differences:

- Pre-tax distributions (aka withdrawals at retirement age) are taxable

- Roth funds are taxed at contribution, but tax free at distribution.

- After-tax contributions allow you to contribute above the standard IRS maximum. Funds are taxed both at contribution and distribution. Converted after tax to Roth upon contributing so that growth is tax free at retirement.

Ways to invest your 401(k)

All 401(k) funds, regardless of contribution type, will be invested the same. Not sure how to invest and which funds to put your savings into? Leave it to the pros and choose a Target Date Fund. Your 401(k) funds will be diversified based on how far or close you are to retirement age – the more time you have, the more aggressive your savings will be invested and it will move to a more conservative array as you age closer to retirement.

You also have the option to choose a Self-Directed Brokerage Account where you can choose to invest in individual stocks. You can speak to a Fidelity Planning Advisor or sign up from Rubrik's voluntary financial wellness program, BrightPlan, for professional assistance in managing and investing your savings wisely!

2023 401(k) Contribution Maximums

- Pre-tax and Roth: $22,500 combined

- After tax: $43,500

- Catch-up contribution (age 50 and older): $7,500

Bright Plan Financial Wellness and Advisory Service

BrightPlan is a financial wellness solution to provide you with comprehensive financial planning support during all market conditions and stages of life.

With BrightPlan you have access to:

- A sophisticated financial plan to achieve your most important financial goals

- Advice on existing investments, such as 401(k)

- Access to speak with a fiduciary Financial Advisor

- An automated Smart Budget and spending analysis

- Financial education tailored to Rubrik benefits

You can get started with this benefit by clicking the registration link here or downloading the BrightPlan app and enrolling.

BrightPlan is available to you at the discounted rate of $10/month. This benefit can be canceled at any time for any reason.

ARAG Legal Insurance

You can't predict the future, but you can plan for it. You can plan for your legal needs that are part of life's good times – like adding your newborn to your will, buying that new house or creating an estate plan to ensure your wishes are honored.

You can also protect yourself from future legal needs that are part of life's struggles – like when kids make mistakes or you get caught speeding.

How legal insurance benefits you:

- Network attorney fees are 100% paid in full for most covered matters.

- Save hundreds, possibly thousands, when dealing with common legal matters.

- Access a network of local, knowledgeable attorneys who can advise and represent you.

- Use DIY Docs®, an online tool that helps you create a variety of legally valid documents, including state-specific templates.

Rubrik is thrilled to offer two plan options, the Ultimate Advisor for $15.35/month, which provides comprehensive legal coverage, and Ultimate Advisor Plus for $21.60/month, which offers even more legal protection and additional services like financial education and counseling, tax services and services for parents/grandparents. Additionally, custody and alimony matters are also covered.

Make the most of this valuable legal protection and affordable access to network attorneys.

FIGO Pet Insurance

Being a pet parent comes with a lot of joy, and some unavoidable realities. But pet insurance—an enhancement to your pet's wellness, your peace of mind, and your bank account—shouldn't add any unexpected twists or turns.

Founded by pet parents unable to find a pet insurance option that fit diverse lifestyles, Figo was born. Figo's innovative experience is designed around real people and real scenarios, taking insurance out of its overly complex and unrelatable world and into the homes of everyday pet parents.

With less barriers, and added benefits that go beyond insurance check out Figo today. Sign up through the link below and save up to 10% off your custom quote!

Leave of Absence (LOA)

Disability insurance, provided through Lincoln, replaces a portion of your income when you are unable to work due to a qualified illness or injury.

Short-Term Disability (STD)

Pregnancy, a scheduled surgery, or an unplanned illness or injury could keep you off the job and without income for an extended period of time. STD can protect part of your paycheck should you become disabled. STD is provided at no cost to you. You are automatically covered and no enrollment is needed.

Long-Term Disability (LTD)

LTD ensures you have a portion of your income replaced if you can’t work for an extended period of time due to an illness or injury. LTD payments will last for as long as you are disabled or until you reach your Social Security Normal Retirement Age, whichever comes first. Certain exclusions and pre-existing condition limitations may apply. LTD is provided at no cost to you—you're automatically covered and no enrollment is needed.

Requesting LOA

If you need time off with a leave of absence, Rubrik provides generous leave policies including paid leave, so that combined with STD/LTD, you continue to receive 100% of your base pay so you can focus on what matters most -- you and your family's well-being. Watch the video above to learn more about Rubrik’s LOA policies and processes. When you need to take extended time off for an eligible leave, contact your manager and the Benefits Team as soon as possible to start the process for filing your LOA.

Basic Life and AD&D

It’s important to give some serious thought to what expenses and income needs your dependents would have if something happened to you. To make sure you have financial protection, Rubrik offers employer-paid Group Life and Accidental Death and Dismemberment (AD&D) insurance. For Basic Life and AD&D coverage choose from 2x your annual earnings, or select a flat $50K to avoid imputed income tax (see Benefit Guide for more information).

Voluntary Life and AD&D

You may purchase additional Optional Life and AD&D insurance for you, your spouse/domestic partner, and your children through Lincoln. As a new hire, you can select up to $350,000 for yourself, $50,000 for your spouse/domestic partner, and $10,000 for your children with no Evidence of Insurability (EOI). If you elect over these amounts, you will need to submit EOI within 30 days of your date of hire via a health questionnaire directly to Lincoln for the coverage(s) to be approved.

Edenred Commuter Program

If you're considering or currently commuting to a Rubrik office via public transit, this is for you!

The commuter program, administered by Edenred, allows you to use pre-tax payroll deductions (up to IRS pre-tax limits) for transit and parking items including:

- Bus/Train tickets & Vanpool Fees ($300/month)

- Parking expenses ($300/month)

Access Edenred via Okta and start saving on your commute! Use Edenred to place commute orders to a Pre-Tax Commuter MasterCard, Clipper Card or other transit or parking authority. Place your order by the 10th of the month for fulfillment the 1st of the following month (e.g. orders placed by June 10th will be loaded onto transit or commuter cards by July 1st).