BILH BENEFITS CENTRAL

If You Cover Dependents, Watch Your Mailbox!

BILH employees with dependents (spouse and/or children) enrolled in their benefit plans are required to confirm the eligibility of these dependents between February 23 and March 13. BILH has enlisted Winston Benefits to complete this Dependent Verification.

Watch your mailbox for instructions. If you do not successfully complete the Dependent Verification process by March 13, your dependents will be removed from benefit coverage on April 30, 2026.

Welcome to BILH Benefits Central!

We are committed to supporting the health and wellbeing of our employees and their loved ones. You can use this site to learn more about your Beth Israel Lahey Health (BILH) benefits and navigate the many resources available to you as you choose your 2026 benefits.

Click each tab above to learn more about what's available to benefits-eligible employees in 2026!

To find specific details such as rates, visit Workday. You can also contact the BILH HR Service Center by creating a case in Workday or calling 617-667-5000.

Learn More About the 2026 Benefits

- View a short video

- Visit Harvard Pilgrim's website

- Access 2026 Benefits Guide

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000

For those covered by a collective bargaining agreement, the terms of the applicable collective bargaining agreement

shall apply absent agreement by BILH and your union. | Terms and Conditions

BILH BENEFITS CENTRAL

MEDICAL PLANS

For 2026, BILH offers four medical plan options administered by Harvard Pilgrim Health Care (HPHC). There are three Health Maintenance Organization (HMO) options and one Preferred Provider Organization (PPO) option:

- BILH Network Premier HMO

- Flex HMO

- Flex Plus HMO

- Access PPO

For the HMOs, providers and hospitals are assigned to Tier 1, 2, or 3 based on a variety of factors including quality and cost; you pay less when you see providers in lower tiers.

Want to Learn More About the

2026 Benefits?

- View a short video

- Visit Harvard Pilgrim's website

* For those employees covered by a collective bargaining agreement, the terms of the applicable collective bargaining agreement apply. You can find medical plan information, including rates, by navigating to the Help page on Workday.

Send a secure message through your Harvard Pilgrim online member account at harvardpilgrim.org/bilh or call 866-623-0194.

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000

BILH BENEFITS CENTRAL

PRESCRIPTION DRUG COVERAGE

Prescription Drug Coverage

If you enroll in one of the medical plans, you will receive prescription drug coverage from InScript. The pharmacy benefit is the same for all the HMO plan options, with different copays for the PPO.

The InScript network includes the BILH Pharmacy as well as CVS, Walgreens, Target, Walmart, Stop & Shop, and more. For a list of participating pharmacies, visit www.inscriptrx.org/patients. You must fill 90-day supplies of medications at a BILH Pharmacy.

Save Money When You Use a BILH Pharmacy with HMOs!

If you enroll in one of the HMO options, you will pay less if you use home delivery or a retail BILH, Lahey, or BIDMC pharmacy. Using a BILH Pharmacy supports the system and saves you money; it’s a win-win for us all.

Transfer your current prescriptions by filling out the BILH Pharmacy Direct form, and be sure to ask your doctor to send new prescriptions to a BILH Pharmacy!

For contact information and hours of operations, click here.

Contact: InScript at 855-542-1819

Contact: BILH Pharmacy at PharmacyEnrollment@BILH.org or call 781-352-6710

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000

BILH BENEFITS CENTRAL

DENTAL & VISION PLANS

Dental Coverage

BILH offers two dental plans: a low option and a high option, both provided by Delta Dental. The low option offers lower premiums and a lower annual deductible, but it does not cover major restorative services or orthodontia. The high option covers these services and also allows you to roll over some unused claims dollars from one year to the next. Both plans include the "Right Start 4 Kids Program" that covers 100% of the cost for diagnostic, preventive, basic, and major restorative (in High Option) care for children up to age 13.

Review the details of each and choose the best plan for your needs.

Contact: Delta Dental at 800-368-4708

Vision Coverage

Two vision plan options are available from EyeMed. Both plans cover eye exams, frames, lenses, and contact lenses, as well as offer a variety of discounts on services and materials. No matter which vision plan you choose, you will have access to a custom provider network that includes Lahey Optical Shops and BIDMC providers.

Contact: EyeMed at member.eyemedvisioncare.com or call 866-723-0514

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000

BILH BENEFITS CENTRAL

FLEXIBLE SPENDING ACCOUNTS

Flexible Spending Accounts are administered by Sentinel. You have two FSA options as a smart and convenient way to stretch your benefit dollars and receive real tax savings: a Health Care FSA and a Dependent Care FSA. Both allow you to contribute pre-tax dollars through payroll deductions. You are then reimbursed tax-free through the account for eligible expenses. You can use the Sentinel Benefits Card to pay for eligible expenses.

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000

BILH BENEFITS CENTRAL

LIFE INSURANCE | AD&D | DISABILITY INSURANCE

Life and Accidental Death & Dismemberment (AD&D) Insurance

BILH provides basic life insurance to eligible employees. For added protection, you may purchase supplemental life insurance for yourself and your dependents. You can also purchase Voluntary Accidental Death & Dismemberment (AD&D) insurance coverage specifically for accidental death or injury.

Empathy Bereavement Support

BILH employees who have basic life insurance have access to Empathy, which provides bereavement support including funeral support and estate planning. Click here to learn more.

Contact: Voya at https://presents.voya.com/EBRC/BILH2 or call 800-955-7736

Disability Insurance

Disability insurance is a source of financial protection if you are unable to work due to illness or injury. Short-Term Disability coverage protects your income for up to 26 weeks.

You can elect coverage without answering medical questions (Evidence of Insurability). Pre-existing condition restrictions may apply. Learn more by visiting Unum's website.

Contact: Unum at https://flimp.live/BethIsraelLaheyHealth or call 866-679-3054

Massachusetts Paid Family and Medical Leave

The Massachusetts Paid Family & Medical Leave Act (MAPFML) provides paid, job-protected family and medical leave benefits to eligible workers in Massachusetts. MAPFML applies to the following:

- Your own serious health condition

- Bonding with a new child (newborn, recent adoption, or foster care placement)

- Complications resulting from the military deployment of a family member

- To care for a family member with a serious health condition

MAPFML is administered by the Massachusetts Department of Family and Medical Leave. Learn more at www.mass.gov/DFML or by calling 833-344-7365.

Note: Joslin Diabetes Center employees should contact Unum at 866-330-3266 and reference MAPFML policy #938646 to file for a MAPFML benefits.

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000

BILH BENEFITS CENTRAL

ADDITIONAL BENEFITS

Accident Insurance, Critical Illness & Hospital Indemnity

BILH offers three voluntary plans, administered by Voya, to complement your medical coverage:

-

Accident Insurance: If you experience an accidental injury, Accident Insurance provides you a payout to use any way you wish to cover deductibles, out-of-pocket expenses, or everyday living expenses that aren’t covered by your medical insurance.

-

Critical Illness Insurance: When a serious, life-threatening illness happens to you or a loved one, this coverage provides you with a lump-sum payment upon diagnosis that you can use to help pay for expenses generally not covered by medical and disability income coverage.

-

Hospital Indemnity Insurance: If you are admitted or confined to a hospital due to a covered accident, illness, or pregnancy, Hospital Indemnity Insurance benefits can help pay for out-of-pocket costs such as health care insurance deductibles, copays, or living expenses.

Legal Insurance

With legal insurance through ARAG, you’ll have access to a network of attorneys that cover 100% of the cost of most covered matters – whether they are serious issues or everyday situations – such as will and trust preparation, family law, tax issues, debt matters, real estate transactions, and much more.

Commuter Program

The Commuter Program allows you to put away pre-tax dollars for situations in which you must pay to park or take public transportation during your commute to and from work.

This program – which does not replace local subsidized parking or commuter programs – is available to organizations within the BILH system. You can choose from a Parking FSA or a Transit FSA.

Note: If you participate in a subsidized parking or transit plan through a BILH organization, you are not eligible to enroll in the Sentinel Commuter program.

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000

BILH BENEFITS CENTRAL

WELLBEING

BILH is committed to ensuring you have a wide range of tools and resources to guide you and your family on your path to well-being. There are a variety of resources available at no cost to you.

BILH Living Well: Resources to Help You Focus on YOU

BILH and Harvard Pilgrim are making it easy for you to put your well-being first. Get moving and reduce stress with this customized well-being program. Accumulate points for completing fun challenges and webinars, then get rewarded! Plus, learn about $150 wellness reimbursement, discounts, and other extras to help you stay healthy. For those enrolled in a BILH medical plan, you have a wide range of resources available through Harvard Pilgrim. (If you are not enrolled, you have access to resources noted below through KGA.)

Wellbeing Resource for BILH Staff

Support for Those Who Provide Care Outside of Work

BILH is pleased to offer an important resource to our staff who are caring for loved ones. By answering some questions, you can understand how much you are impacted by issues typically faced by caregivers and find links to free resources available to you from BILH and beyond. Learn more about this important resource by clicking the links below.

Virtual Peer Support Option Available for All

BILH partners with the Betsy Lehman Center for Patient Safety to offer the Virtual Peer Support Program. With their expertise, the entire BILH community can access free, confidential peer support. To request peer support, complete this form or email Peer.Support@BetsyLehmanCenterMA.gov. You will be matched with a Peer Supporter within 1-2 business days.

Employee Assistance Program (EAP)

The EAP, offered through KGA, provides free, confidential consultations, counseling, and referrals at no cost to you and your adult household members. Contact the EAP for convenient, expert and confidential support.

Contact: KGA at info@kgreer.com or call 855-760-BILH (2454)

Care.com

BILH offers this important program to help you care for those you love, including yourself. Benefits include:

-

Care Membership: Find great support with unlimited access to the leading online network of caregivers to find short- and long-term care for children, adults, pets, home, tutors, and more.

-

Backup Care: Book vetted and subsidized caregivers for kids and adults for times when your regular care is not available. Up to 15 days per year.

-

Pet Backup Care: You can exchange one of your backup care days for a credit that you can use for pet care on Rover.

-

LifeMart: Exclusive savings on major purchases and everyday essentials from brands you know and love, all in one convenient location.

Support for New Parents!

Have a new addition to your family? Click here to find out more about the support you can receive as a BILH employee through Care.com.

Contact: 855-781-1303, ext. 4

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000

BILH BENEFITS CENTRAL

RETIREMENT & FINANCIAL PROGRAM

Retirement Benefits

Saving for a more secure financial future is important, and retirement benefits to help you save are a valuable component of our comprehensive Total Rewards program.

You can find information about your organization’s retirement benefits on your local intranet, by contacting the BILH HR Service Center, or by accessing your retirement provider.

Learn About NetBenefits

Fidelity administers the BILH Retirement Savings Plan for eligible staff. This video provides an overview of Fidelity's NetBenefits site. The video walks through the website, where you can check your account balance, complete transactions, get financial help, and more. You can also find information about NetBenefits in this document.

Save More In 2026! Increased IRS Contribution Limits

In 2026, individuals may contribute up to $24,500 (the IRS limit), to retirement savings plans. The IRS allows individuals who will turn age 60-63 in 2026 to make catch-up contributions of up to $11,250. Those who will be age 50-59 or age 64 in 2026 are allowed to make catch-up contributions of up to $8,000.

Fidelity:

Questions: 800-343-0860 or www.NetBenefits.com/atwork

One-on-one scheduling: 800-642-7131 or www.Fidelity.com/reserve

Pension Benefits (for eligible employees only):

BILH Pension Services: 855-213-9789 or https://eepoint.wtwco.us/ess/bilh

2024 Retirement Plan Summary Annual Reports:

BenefitHub Discount Portal

BenefitHub is a centralized website with access to benefits and discounts specifically for BILH employees. When you log into BenefitHub, you’ll receive access to discounted rates on auto and home insurance, pet insurance, identity theft protection, hotels, concerts, game and movie tickets, apparel, and much more. You can access and enroll in these programs any time throughout the year.

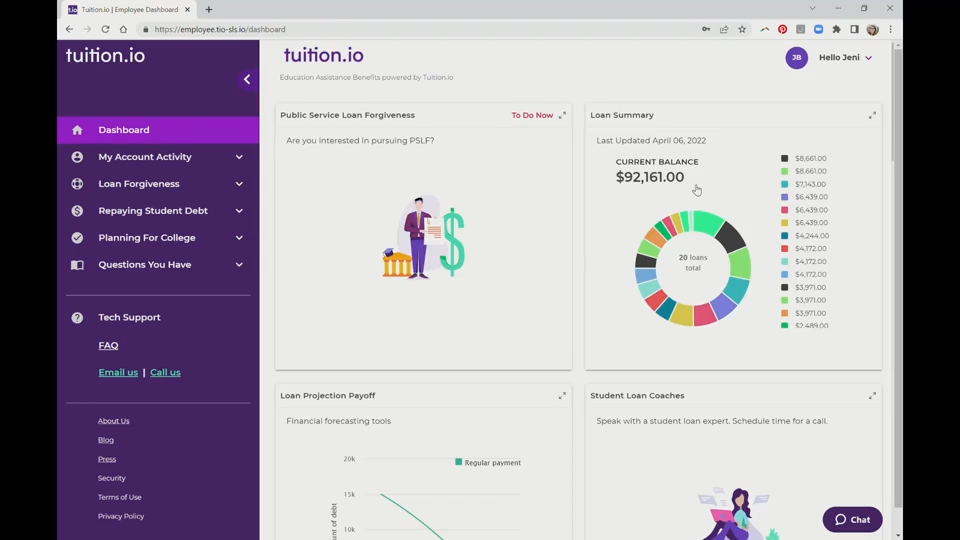

Tuition.io Student Loan Management

BILH offers access to Tuition.io at no cost to you*, to help you manage student loan debt. Visit the Tuition.io site to get started and explore the resources available. When prompted enter your work email address and you’ll receive a link to complete your registration.

Bank of America Banking and Investing Program

BILH provides access to a program that offers financial benefits through Bank of America. If you are a Bank of America customer and enroll in the Preferred Rewards program, you will have access to several financial benefits.

Not a Bank of America customer? You still have access to financial well-being programs. Click here to learn more.

Support for Your Financial Priorities

BILH wants to help support you as you pursue your financial goals, so we partner with Bank of America to offer ongoing financial well-being education, support and tools. You can learn about saving and budgeting, credit, homeownership, investing or debt, or many other financial focuses. Access a variety of personal financial education tools here.

Watch for upcoming webinars to help with understanding Social Security, retiring on your terms, putting your money to work, and many other financial focuses.

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000

BILH BENEFITS CENTRAL

ENROLLING & COMPLIANCE

Enrolling for Benefits

Benefits-eligible BILH employees will enroll for benefits in Workday.

Note: Joslin and Exeter staff will enroll for benefits using a separate process (not through Workday).

Compliance

In this section you can find legal and compliance documents for your Beth Israel Lahey Health benefit plans.

To access 2024 Summary Annual Reports for the retirement plans, click here.

Questions about your benefits?

Reach out to the BILH HR Service Center by creating a case or calling 617-667-5000