|

Traditional Plan

HMO and PPO Network

|

HDHP

HMO and PPO Network

|

|

| Annual Deductible (Individual/Family) | $2,000 / $4,000 | $3,400 / $6,000 |

| Coinsurance | 80% / 20% | 80% / 20% |

| Office Visits | 20% of Wellmark's cost (deductible waived) | Deductible and Coinsurance |

| Preventive Services | Paid 100% | Paid 100% |

| Out-of-pocket Max per Year (Individual/Family) | $4,000 / $8,000 | $4,000 / $8,000 |

Benefit Showcase

Welcome

Benefits are more valuable than ever and are a significant part of your total compensation package. The resources and videos here are designed to provide you the information you need so you can identify which offerings are the best for you and your family.

The benefits guide was designed to answer some of the basic questions you may have about your benefits. Please take the time to review this guide to make sure you understand the benefits that are available to you and your family.

Benefit Enrollment

We know how important benefits are for you and your family. That is why ImpactLife is committed to offering excellent, well-rounded options that protect your physical, mental, and financial health. Our programs are designed to provide you peace of mind and protect you and your loved ones.

Choosing your benefits takes careful thought and planning. Use this benefits showcase to learn about the benefits available to you and your family.

Benefit changes made during open enrollment will become effective January 1.

This site will be available to you on demand all year. Take some time to review this information and return to this site whenever you or your family members have questions or want to review your benefits.

Benefit Overviews

Eligibility

If you work at least 30 hours per week you are eligible for all benefits. Employees working 20 hours or more are eligbile for life insurance. Most of your benefits are effective on the first of the month following your date of hire. Life and disability benefits are effectice the first of the month following 90 days of employment. You may also enroll your eligible dependents for coverage. Eligible dependents could be:

- Your legal spouse

- Children under the age of 26, regardless of student, dependency, or marital status

- Children who are past the age of 26 and are fully dependent on you for support due to a mental or physical disability and who are indicated as such on your federal tax return

Changing Benefits After Enrollment

During the year, you cannot make changes to your benefits unless you have a Qualified Life Event.

If you do not make changes to your benefits within 30 days of the Qualified Life Event, you will have to wait until the next annual Open Enrollment period to make changes (unless you experience another Qualified Life Event).

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

Benefit Showcase

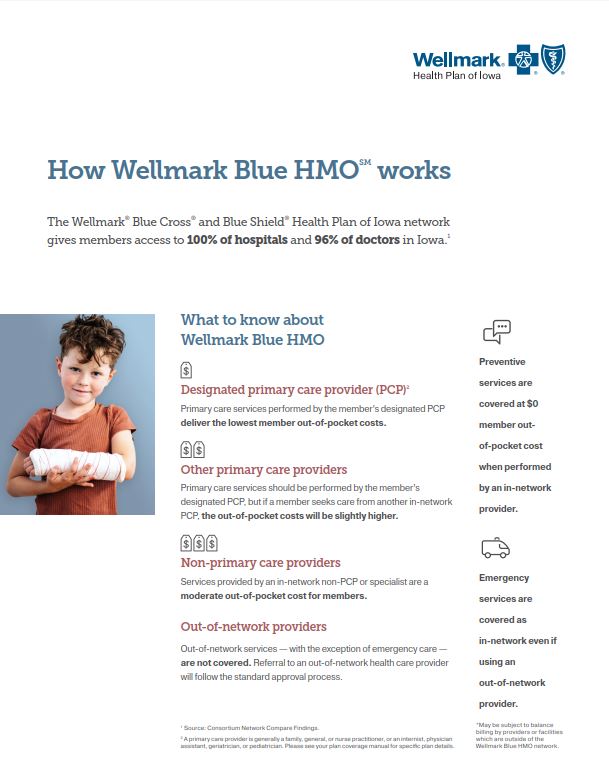

Medical Plans

ImpactLife is committed to offering a variety of benefits that provide generous coverage for both employees and their covered dependents. We are offering two medical plans, administered though Wellmark, to fit your budget and needs.

* Employees living in Iowa or Missouri will have the HMO network. The HMO plans give you access to a narrow network - which provides better discounts when you visit an in-network provider. They do not have out-of-network coverage.

Traditional Plan and High Deductible Health Plan (HDHP)

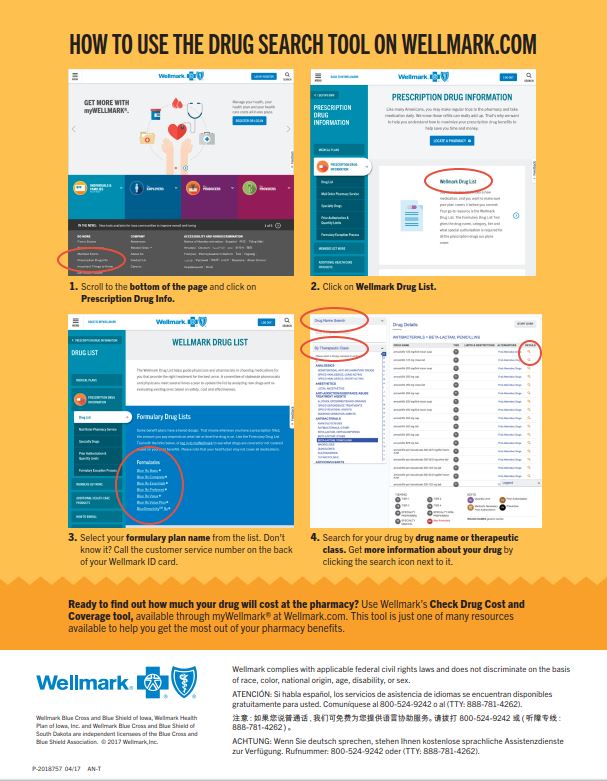

Create an Account at wellmark.com

24/7 access to your health plan.

Wellmark.com helps you easily access and manage your health plan.

- Find network doctors, hospitals and facilities

- Check your coverage

- Check your claim status

- Get a list of covered prescription drugs

- Request or print an ID Card

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

For Internal Use Only

Benefit Showcase

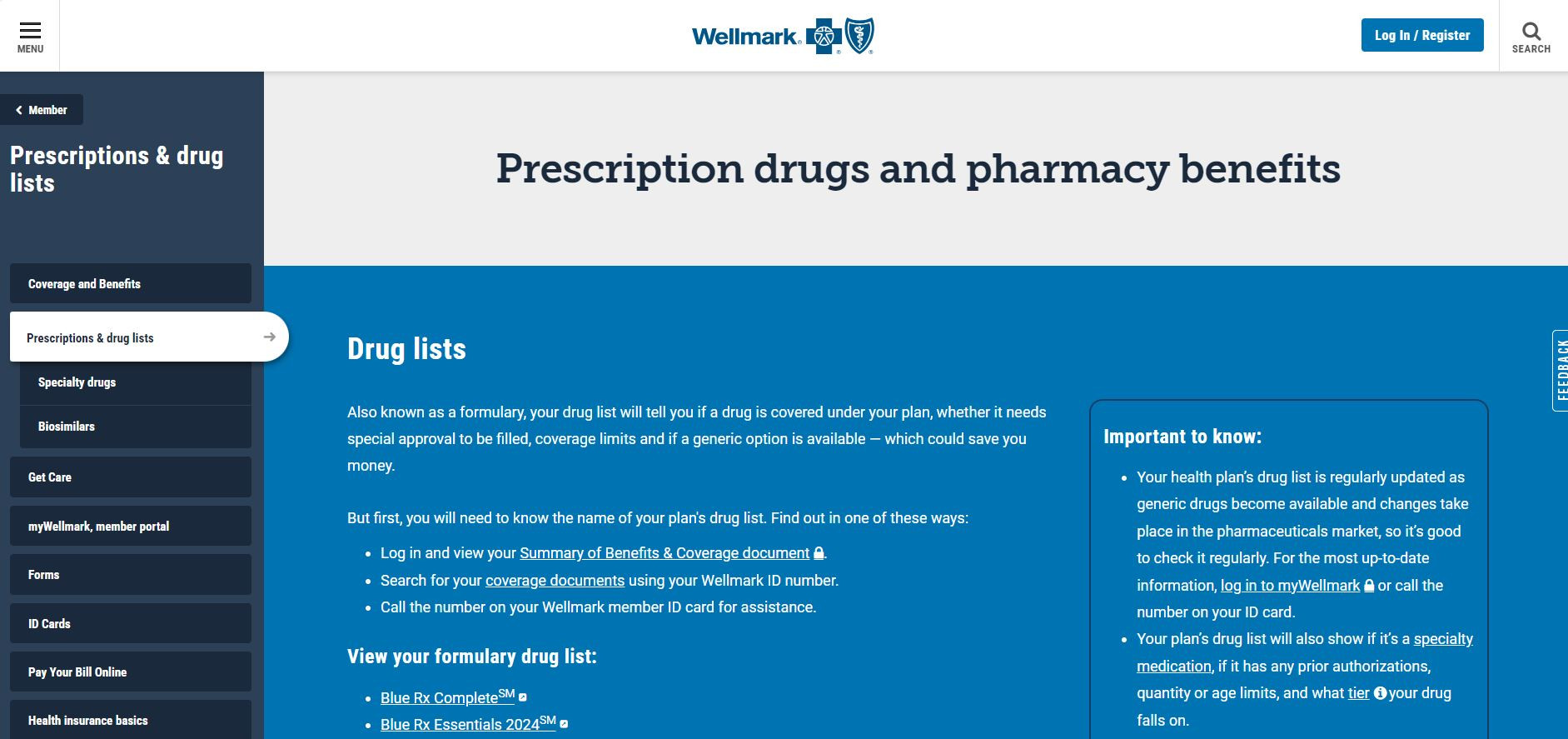

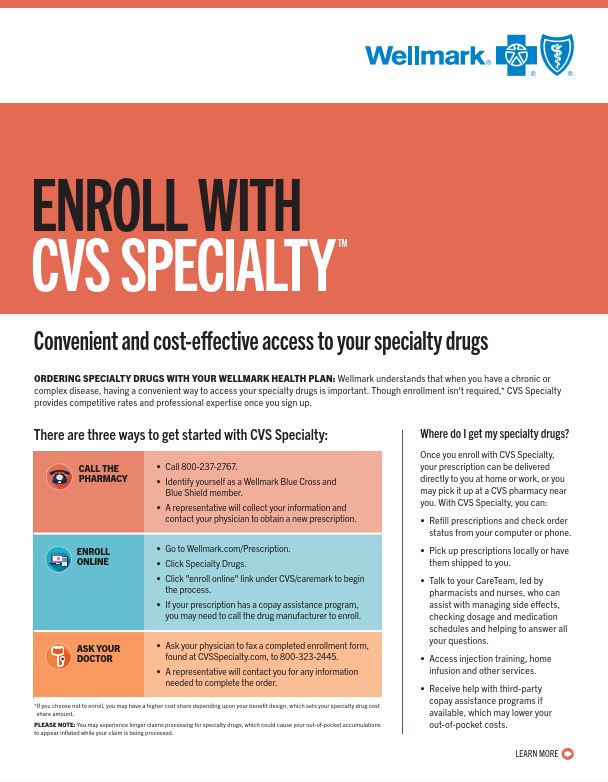

Prescription Coverage

Your prescription drugs will be managed by CVS (through Wellmark) using the Blue Rx Value Plus formulary drug list. If you choose to enroll, we encourage you to create an account at myWellmark.com for more information about your prescription plan and the drugs it covers.

Mail Order Prescriptions - The convenient, cost-efficient way to get your prescriptions!

Savings and Convenience

- CVS Caremark Mail Service Pharmacy delivers up to a 90-day supply of long-term medicines.

- Prescriptions are delivered to the address of your choice, within the U.S., with free standard shipping.

- You can order from the comfort of your home — through your mobile device, online or over the phone.

- Your doctor can fax, call or send your prescription electronically to CVS Caremark Mail Service Pharmacy.

- Tamper-evident, unmarked packaging protects your privacy.

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

Benefit Showcase

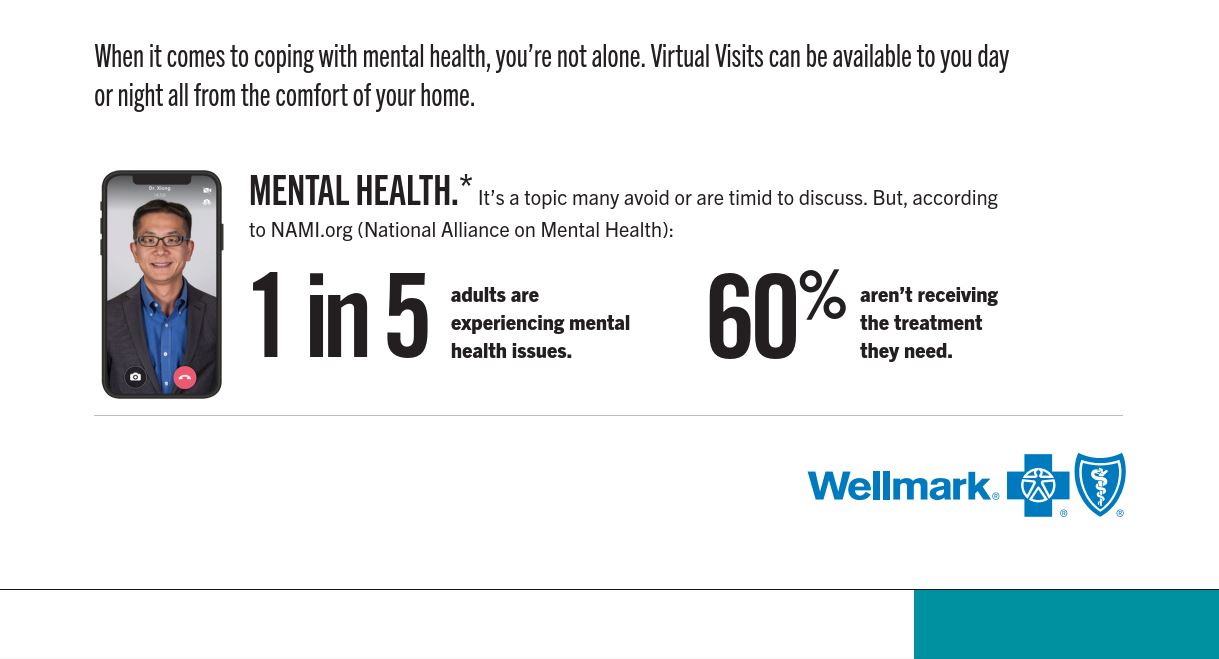

ImpactLife has partnered with Dr on Demand to provide you with 24/7/365 on-demand access to a national network of U.S. board-certified doctors through the convenience of phone, video or mobile app visits. Dr on Demand doctors can diagnose, treat and prescribe medication, when necessary, for a variety of issues. It’s more convenient access to quality healthcare, when and where you need it.

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

Benefit Showcase

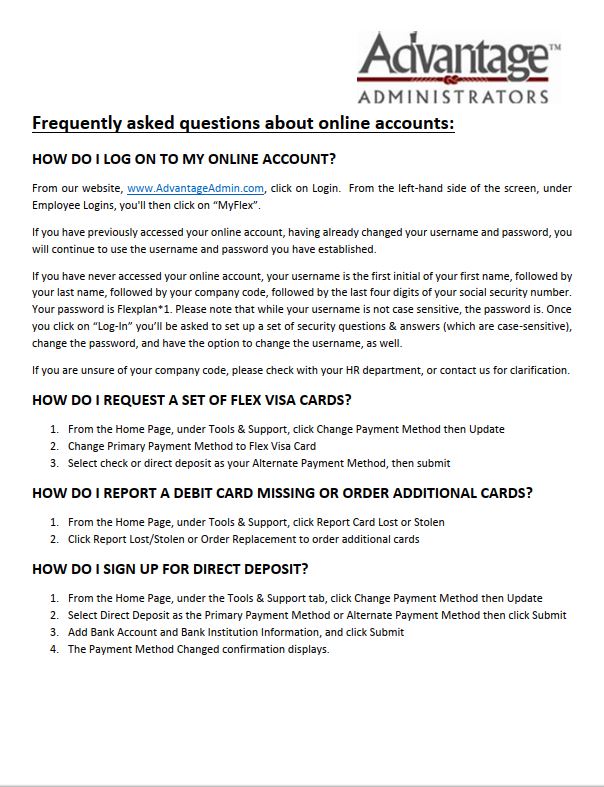

HSA & FSA

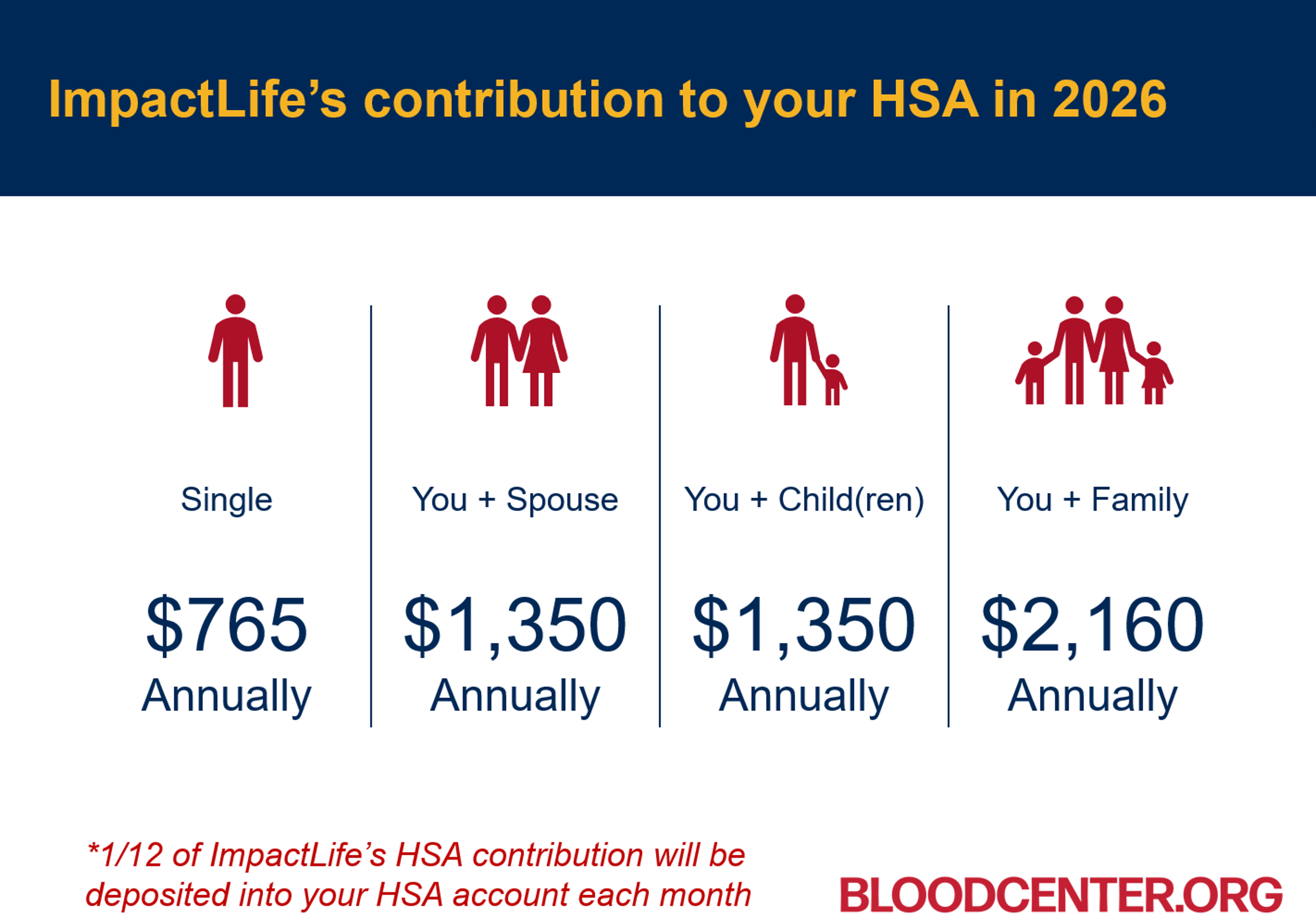

ImpactLife provides both an HSA and FSA to help employees budget and save for qualified medical expenses incurred over the course of the plan year.

Want to learn more about the difference between an HSA & an FSA?

Health Savings Account

A Health Savings Account (HSA) is a personal savings account you can use to pay for qualified out-of-pocket medical expenses with pretax dollars — now or in the future.

Once you’re enrolled in the HSA, you’ll receive a debit card to help manage your HSA reimbursements. Your HSA can also be used for your expenses and those of your spouse and dependents, even if they are not covered by the HDHP Medical plan.

How A Health Savings Account Works

Eligibility: You must be enrolled in the High Deductible Health Plan

Eligible Expenses

You may use your HSA funds to cover medical, dental, vision and prescription drug expenses incurred by you and your eligible family members.

Using Your Account

Use the debit card linked to your HSA to cover eligible expenses or pay for expenses out of your own pocket and save your HSA money for future health care expenses.

Your HSA is always yours — no matter what.

One of the best features of an HSA is that any money left in your HSA account at the end of the year rolls over so you can use it next year or sometime in the future. And if you leave the Company or retire, your HSA goes with you so you can continue to pay for or save for future eligible health care expenses.

2025 HSA Limits:

- Single: $4,300

- Family: $8,550

2026 HSA Limits:

- Single: $4,400

- Family: $8,750

Flexible Savings Account

A Flexible Spending Account (FSA) is a plan that allows you to budget and save pre-tax dollars through payroll deductions to pay for qualified expenses (as defined by the IRS) incurred for the plan year.

Dollars invested in an FSA are tax-free and the entire amount is available on the first day of the plan year (January 1). ImpactLife has elected to participate in the FSA rollover provision, allowing employees to rollover up to $660 from one plan year to the next. You must be enrolled in an HCFSA both plan years. You are still encouraged to consider your expenses carefully before you decide how much to contribute to each Flexible Spending Account. As a reminder, your election will cover the period from January 1 through December 31. You should not contribute more than you are reasonably certain to use.

An FSA covers eligible out-of-pocket health care expenses such as medical copays, coinsurance, prescription drugs, dental and vision costs. It's available to you and any eligible dependents including spouse, children and any other person who is a qualified IRS dependent.

Dependent Care Account

You may use pre-tax dollars from your Dependent Care Account to pay expenses for care when the services enable you and your spouse to work outside of the home. These include expenses for the care of a dependent child, spouse or elderly parent inside your home. Also included are baby-sitters, nursery schools, and day care centers.

Only the portion of expenses that enable you to remain employed are eligible. Educational expenses are not eligible.

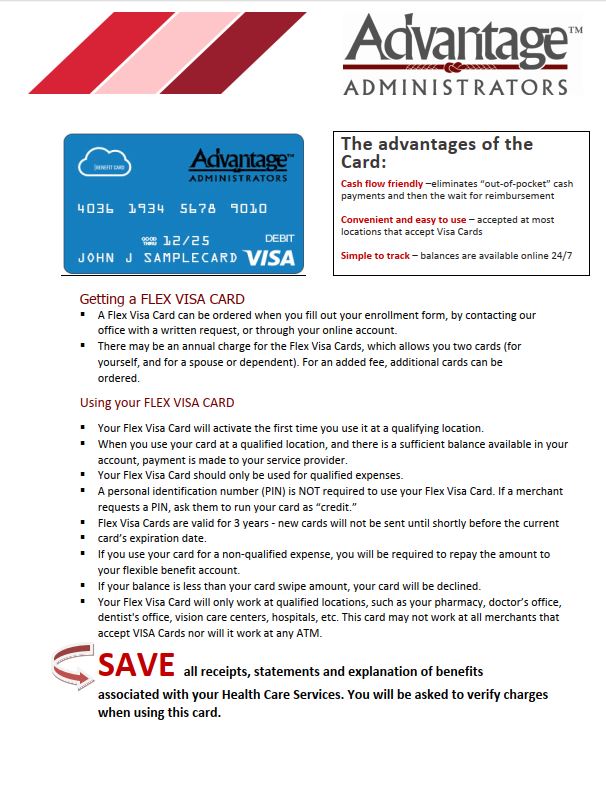

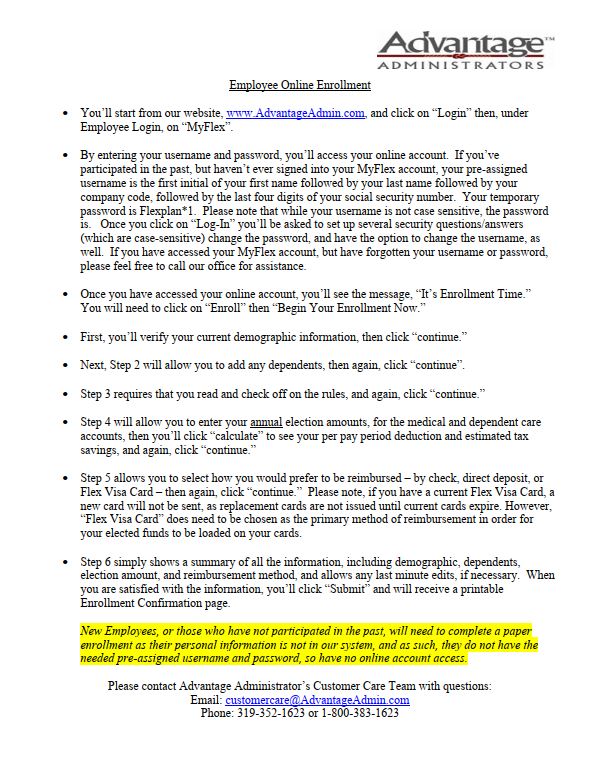

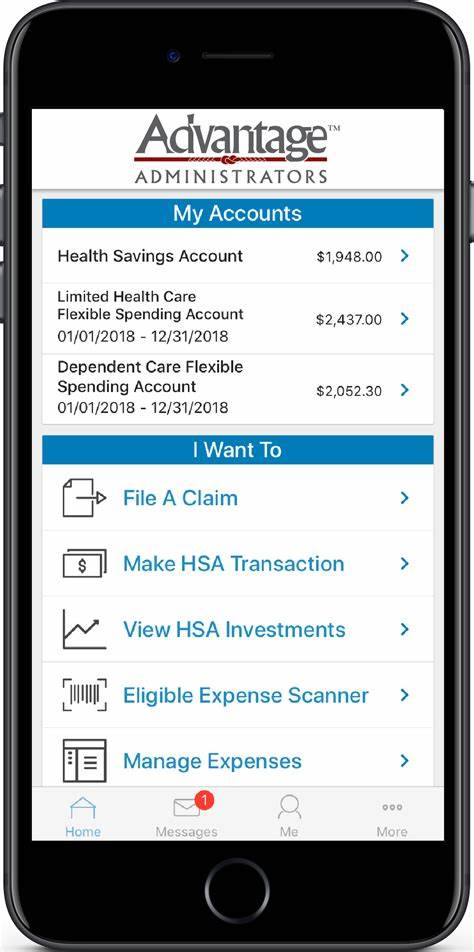

Advantage Administrator’s FSA Mobile App

Get your benefits on the go! Save time and hassles with Advantage Administrator’s FSA Mobile App. The app provides the following features:

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

Benefit Showcase

Dental & Vision

As part of the comprehensive health insurance coverage, ImpactLife offers employees the option to select dental and vision coverage for themselves and their dependents.

Dental Insurance

Maintaining good oral hygiene is paramount to your overall health and wellness. That is why ImpactLife has partnered with Delta Dental of Iowa to provide our employees and their families with excellent dental coverage.

Regular dental care is an important part of caring for your overall health, and keeping your teeth fit may protect you from major expenses in the future. Use dental coverage through Delta Dental to help pay for the cost of routine checkups and just about any other type of dental work you might need, such as crowns or root canals.

If you have an FSA or HSA, you can use these funds to cover eligible dental costs like your deductible or copay.

Vision Insurance

Regular eye examinations can not only determine your need for corrective eyewear, but also may detect general health problems in their earliest stages. It can help identify early signs of diseases that impact your whole body such as high blood pressure, diabetes and high cholesterol.

Whether you have perfect vision or require some type of corrective lenses, preventive eye care is an important part of your overall health. VSP can help you offset the expensive costs of exams, frames, contact lenses, corrective surgery, and more.

If you have an FSA or HSA, you can use these funds to cover eligible vision-related costs like your deductible, glasses or contact lenses.

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

For Internal Use Only

Benefit Showcase

Life & Disability Insurance

While no one likes to think about it, planning for your family’s financial security in the event of sickness, serious injury, or death is one of the greatest gifts you can give your loved ones.

Life Insurance

Life insurance pays a lump-sum benefit to your beneficiary(ies) to help meet expenses in the event of your death.

Accidental Death & Dismemberment (AD&D) insurance pays a benefit if you die or suffer certain serious injuries as the result of a covered accident. In the case of a covered accidental injury (e.g., loss of sight, loss of a limb), the benefit you receive is a percentage of your total AD&D coverage based on the severity of the accidental injury.

ImpactLife employees working 20+ or 30+ hours or more per week are provided with employer paid life insurance and have the opportunity to purchase additional life insurance for yourself as well as your spouse and dependents.

Short Term Disability Insurance

To ensure your income will continue if you are unable to work due to a disability, ImpactLife offers short-term disability (STD). Benefits are payable for a non-occupational injury or illness that keep you from performing the normal duties of your job. If a medical condition is job-related, it is considered Workers’ Compensation rather than STD.

ImpactLife employees working 30+ hours or more per week are provided with Short Term Disability Coverage at no cost. Benefits begin on the 30th day for injury or sickness. It will replace 60% of your basic Weekly Earnings, up to $2,500 per week. Benefits will continue for up to 9 weeks for Injury or Sickness.

Long Term Disability Insurance

Disability insurance can keep you financially stable should you experience a qualifying disability and become unable to work. It can help provide a sense of security, knowing that if the unexpected should happen, you’ll still receive a monthly income.

A qualifying disability is a sickness or injury that causes you to be unable to perform any other work for which you are or could be qualified by education, training or experience.

ImpactLife employees working 30+ hours or more per week are provided with Long Term Disability Coverage at no cost. Benefits begin as soon as 91 days from the date of your disability. You will receive a check for your benefits on a monthly basis. It will replace 60% of your Total Monthly Earnings, up to $11,000 each month.

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

For Internal Use Only

Benefit Showcase

Accident Insurance

Employees can purchase Accident Insurance. When you, your spouse or child has a covered accident, like a fall from a bicycle that requires medical attention, you can receive cash benefits to help cover the unexpected costs.

Accident Insurance can be used however you want, and it pays in addition to any other coverage you may already have. Benefits are payable directly to you.

Critical Illness Insurance

Employees can purchase Critical Illness Insurance. When you, your spouse or child is diagnosed with a covered condition, you can receive a cash

benefit to help pay unexpected costs not covered by your health plan.

While health plans may cover direct costs associated with a critical illness, you can use your benefit to help with related expenses like lost income, child care, travel to and from treatment, deductibles and co-pays.

- The payment you get isn't based on the size of your medical bill.

- There might be a limit on how much this policy will pay each year.

- This policy isn't a substitute for comprehensive health insurance.

- Since this policy isn't health insurance, it doesn't have to include most Federal consumer protections that apply to health insurance.

- Visit HealthCare.gov or call 1-800-318-2596 (TTY: 1-855-889-4325) to find health coverage options.

- To find out if you can get health insurance through your job, or a family member's job, contact the employer.

Hospital Indemnity Coverage

Hospital indemnity insurance is an insurance plan you can purchase in addition to your other benefits. Iff you end up spending time in the hospital, you receive a fixed benefit amount paid directly to you to help cover expenses.

People often use the benefits for deductibles, coinsurance, transportation, medications, rehabilitation or home care costs. You can also use the money to pay for some expenses incurred as you recover, such as groceries and childcare. Hospital indemnity insurance payouts are sent directly to you as the policyholder.

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

Benefit Showcase

Additional Benefits

There are times in life when you might need a little help coping or figuring out what to do. Take advantage of the additional benefits available to you, which includes counseling, health care navigation services, travel assistance and other resources that are available to all employees and their families.

Employee Assistance Program (EAP)

for up to five confidential sessions with a counselor, financial planner or lawyer each calendar year.

- Consultations may be face-to-face or by phone.

- Sessions are per household and may be divided between the

three types of professionals. - Counselors provide an assessment of concerns and refer

participants to appropriate resources and providers. - Financial and legal professionals assist with matters such as tax-filing questions, debt issues, guardianship and power of attorney.

- An additional five sessions are available in the event of a covered disability claim.

Discount Programs

These discount programs allow you to enjoy special pricing on shoes, wireless phone service, computers, travel, entertainment and more.

Members and employees can save on a wide

variety of products and services used every

day. There’s no charge or commitment. Just

pure savings, plain and simple.

Beneficiary Companion Program

- Guidance on how to obtain death certificate copies for final notifications

- Dedicated Beneficiary Assistance Coordinators to manage notifications and close loved one’s accounts, including:

- Social Security Administration

- Credit reporting agencies

- Credit card companies/financial institutions

- Third-party vendors

- Government agencies

- Assistance protecting the loved one’s identity and full resolution services if the deceased’s identity is stolen

Health Care Navigation

- Administrative support for employees on a covered disability leave

- Clinical support for employees

Travel Assistance

We all expect our trips to go off without a hitch and most times they do. However, if you experience an emergency when traveling — no matter how big or how small — you have around-the-clock access to the Travel Assistance Program’s 24-hour, toll-free travel assistance services. Whether you need help with an illness or injury, lost passport, missing luggage or even a prescription refill, you can rest assured you (and your covered dependents) have access to a personal travel emergency companion anytime you’re more than 100 miles away from home.

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

For Internal Use Only

Benefit Showcase

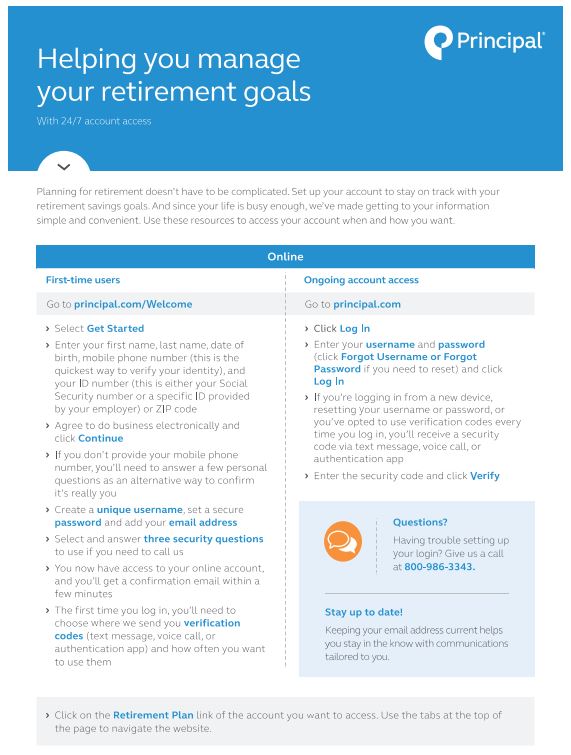

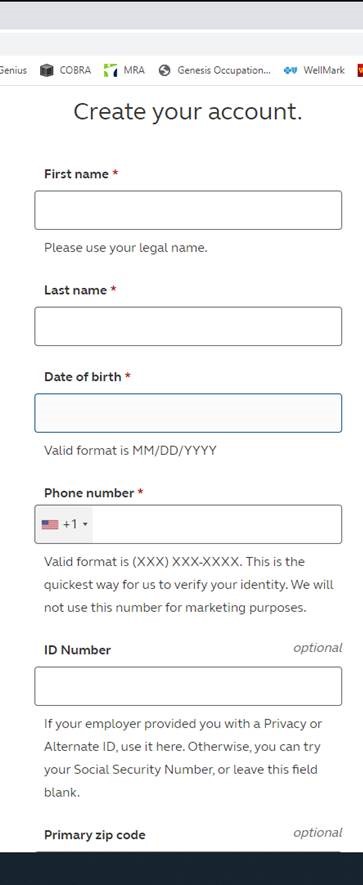

Planning for retirement doesn't have to be complicated. Set up your account to stay on track with your retirement savings goals. And since your life is busy enough, Principal has made getting your information simple and convenient. Use the online resources to access your account when and how you want.

-

You are eligible to start contributing to the 401(k) plan as of the first of the month after 30 days. All new hire employees are automatically enrolled into the retirement plan at 6% of your base wages contributing to the 401(k) Traditional account. If you would like to update the percentage you are contributing or change to contributing to the 401(k) Roth account, please contact Principal.

- For every dollar you put in the plan, pretax or Roth 401(k), ImpactLife will contribute a dollar, up to 4% of your salary. If you are contributing 4% of your salary into the 401(k) then you are maximizing the full company match into the retirement plan.

- You may contribute 1% to 85% of your salary pretax contributions, Roth 401(k) contributions, or a combination of both. Together, both contribution types are subject to annual IRS contribution/plan contribution limits of $23,500 in 2025. Contributions can be made in whole percentage increments only. If you are age 50 or older by the end of the calendar year, you may qualify to make an additional “catch-up” contribution of up to $7,500 in 2025.

We strongly encourage participants to log on to secure your accounts and set up multi-factor authentication which is a key part of the online security guarantee. Upon initial login, participants will be able to review their contribution, investment and beneficiary elections that migrated from Wells Fargo. They will also be able to take a virtual tour of the site. The online “welcome” experience will be available to migrating participants for 90 days via this URL: www.principal.com/welcome and via the mobile app.

Questions?

-

- Tom Melchert

- (563)344-4364 or Thomas.melchert@ms.com

- Amy Phillips

- (563) 344-4384 or Amy.Phillips@morganstanley.com

- Tom Melchert

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882

Benefit Showcase

As an employee of ImpactLife, you and your family members are eligible for Empeople Credit Union membership. Empeople is a full-service financial institution that provides the help you need to empower your financial future – from repairing credit to building net worth. Make the most of your finances with market-leading rates and ongoing financial guidance available for all Empeople members.

- High yield savings & checking accounts

- Tool, auto, and home lending

- 80,000+ fee-free ATMs

- Calls answered 24/7 by a live person

- 1-on-1 ongoing financial guidance

Have benefit questions?

Katy Joyce - Manager, Employee Benefits & Leave Administration

Email: kjoyce@impactlife.org

Phone: (563) 551-8938

Cali Milligan - Benefits Coordinator

Email: cmilligan@impactlife.org

Phone: (563) 551-8882