|

|

Dental |

|

|

|

In-network only |

Out-of-network |

|

Annual Deductible – Individual |

$50 per person |

$50 per person |

|

Annual Deductible – Family |

$150 per family |

$150 per family |

|

Annual Plan Maximum |

$1,500 |

$1,500 |

|

Waiting Period |

None |

None |

|

Diagnostic |

100% |

100% of Reasonable and Customary |

|

Preventive |

100% |

100% of Reasonable and Customary |

|

Basic |

80% |

80% of Reasonable and Customary |

|

Major Services and Orthodontia |

50% |

50% of Reasonable and Customary |

|

Lifetime Orthodontia Plan Maximum |

$1,000 |

$1,000 |

2026 Health Benefits

Your one stop for all benefits information.

Introduction

Welcome to the Cohen-Esrey Benefits Site. This site is designed to help communicate important information about the Cohen-Esrey Benefits Program. The information outlined on this website will assist and educate you in making important benefit decisions for you and your family. Benefit elections will be effective January 1, 2026.

About open enrollment

Each year during Open Enrollment, you have the opportunity to review your benefit needs and adjust your coverage for the upcoming plan year. Open Enrollment provides you with the opportunity to make changes to your benefit elections without having a qualifying life event or family status change.

This means you are allowed to add or drop your coverage or dependent coverage at this time. At any other time during the year, you must experience a family status change (marriage, divorce, birth or adoption, death of a dependent, change in your child’s dependent status, or change in employment status) in order to make these same changes. Elections made during the new hire waiting period go into effect the first of the month following 30 days of employment.

If you experience a family status change or life event, you have 31 days from the date of the event to make necessary changes to your benefits.

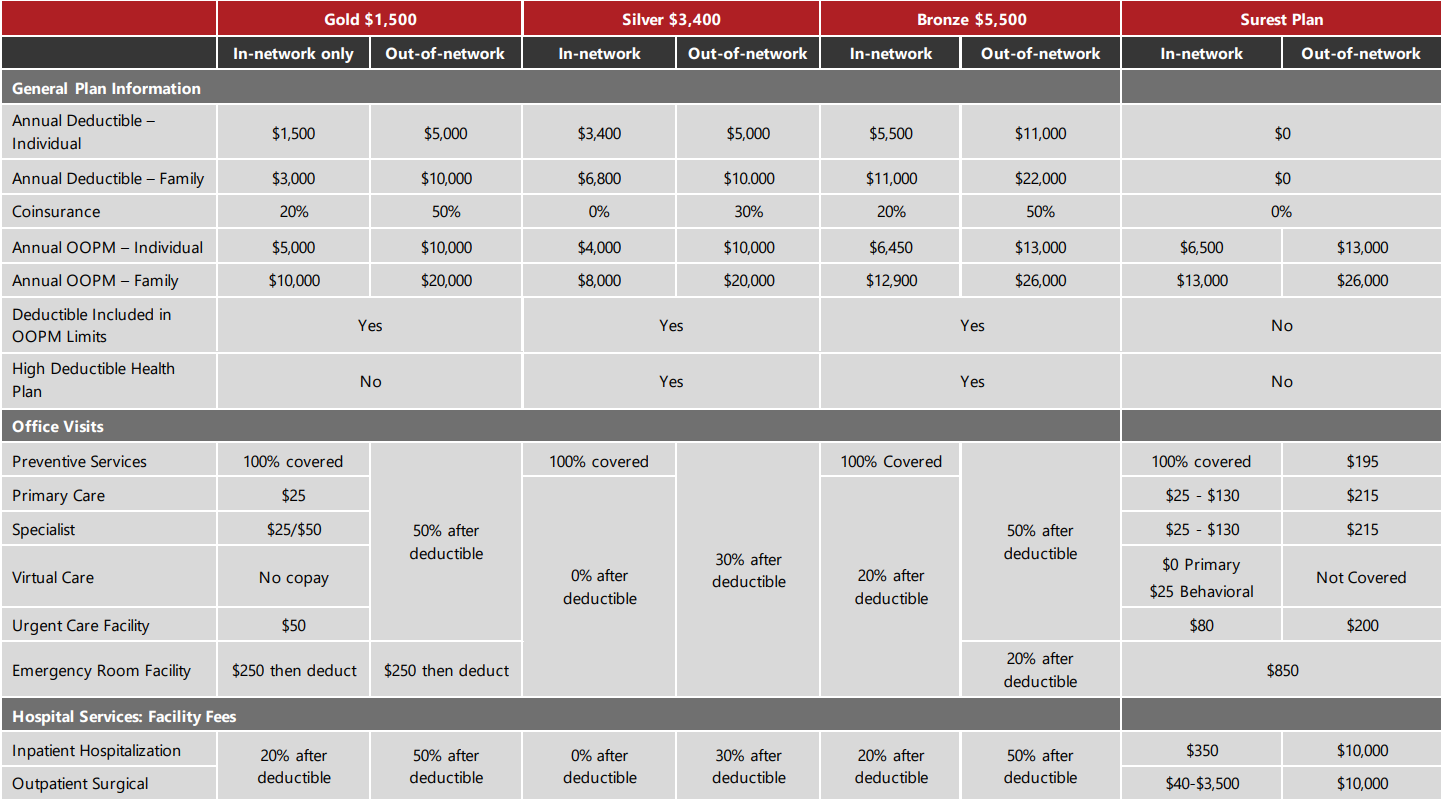

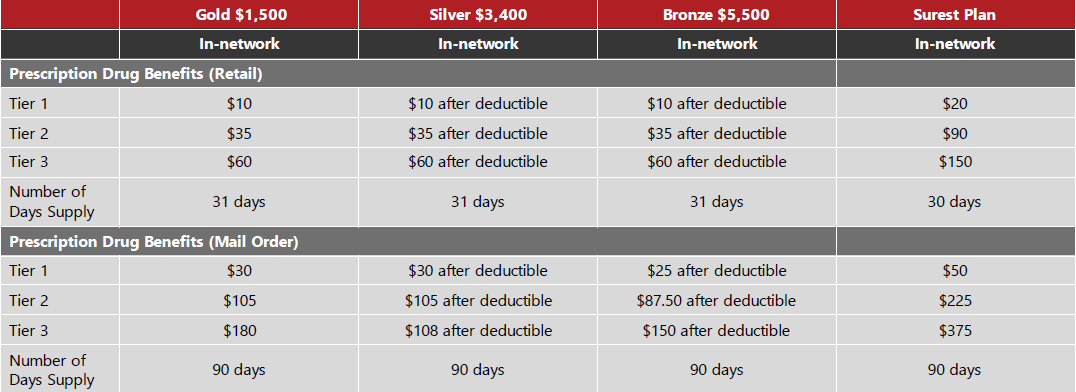

UnitedHealthcare and Surest, a UnitedHealthcare company, will continue to be the medical carrier for Cohen-Esrey. You will have the option of three medical plans with UnitedHealthcare and one medical plan with Surest to find the right plan for you and your dependents.

- Gold Buy-Up Plan: $1,500 individual/$3,000 family deductible traditional PPO.

- Silver Base Plan: $3,400 individual/$6,800 family deductible high-deductible health plan.

- Bronze Plan: $5,500 individual/$11,000 family deductible high-deductible health plan.

- Surest Plan: $0 individual/$0 family deductibles

The Bronze and Silver Base plans allow you the option to pair your medical insurance with a Health Savings Account (HSA). These plans are referred to as Consumer Driven Health Plans or CDHPs (further details on medical tab).

We have a few changes to our plans for 2026, including:

- UHC will be your new dental, vision, accident, critical illness, and hospital indemnity provider.

- LFG will continue to provide voluntary life and disability plans.

Enrollment process

We will be using the Bswift online enrollment system to enroll in the benefit plans available for the 2026 plan year.

Paylocity will be used to complete your enrollment. You will access the Bswift function to make your elections, update family and/or beneficiary information, access benefit materials (e.g., plan summary documents or forms), etc.

You will need to know your login to Paylocity to access this information. Access the Bswift site by clicking the menu on the left and selecting Bswift with heart icon.

Making Your Benefit Elections

From the Bswift homepage, click on "Visit the Enrollment Center" then select "Enroll Now". If you do not see the Start Your Enrollment button, please contact Human Resources.

The enrollment process consists of the following four steps. You will be taken through each step to make changes or confirm your information on file and choose your benefits for the new plan year.

-

Employee (Personal Information)

-

Family (Family Information)

-

Enroll

-

Confirm

Verify Your Personal Information Before Beginning Your Enrollment

Please add all dependents who may be missing from the Family Information section before proceeding to the next section. Click Agree when you have completed your personal and family information.

Making Benefit Elections Medical, Dental, and Vision Plans

To review all available plan options, click the View Options link. If you would like to waive coverage, click the I don’t want this benefit (waive) link. After each election you make, you will see a summary of your election.

Health Savings Account

To elect the Health Savings Account and make a contribution, click View Plan Options to review any necessary information, and then click Select.

Voluntary Benefits

To elect the Voluntary benefits for yourself, spouse, and/or child, select the “View Options” button to view all plans offered. Once you have chosen the plan you wish to enroll in, click “Select” next to the corresponding plan. Select your desired coverage amount where applicable.

Almost Finished!

You will now be on the final review page. Review all of your benefit elections and covered dependents. If you wish to make any changes, simply click on any one of the “Edit Selection” buttons. It will return you to the enrollment page.

Once you have completed your review, check “I agree, and I’m finished with my enrollment” and “Complete Enrollment.”

If you stop at any point before this step, your progress will be saved, but your enrollment is not complete. You can send yourself an email confirmation of your elections or print it for your records. To view a confirmation statement with all of your current benefits, go to My Benefits and select Current Benefits.

Health plan notices

The notice packet we provide is related to the health plan we offer and includes important information that Cohen Esrey is required by the Department of Labor to share with you. Click HERE for the entire English packet. Click HERE for the entire Spanish packet. If you have a child eligible for Medicaid or the Children's Health Insurance Program (CHIP), click HERE for the English flyer that shows you where to go for information in your state, and click HERE for the Spanish flyer.

Certificate of coverage

-

Surest Plan - Certificate of Coverage: Click HERE

-

Bronze Plan - Certificate of Coverage: Click HERE

-

Silver Plan - Certificate of Coverage: Click HERE

-

Gold Plan - Certificate of Coverage: Click HERE

- Vision Coverage - Certificate of Coverage: Click HERE for the Base Plan and click HERE for Buy-up Plan.

- Dental Coverage - Certificate of Coverage: Click HERE

Illinois disclosure notice

Uniformed Services Employment and Reemployment Rights Act (USERRA)

Can't find what you need?

Contact: Human Resources at 913-671-3300

The information contained in this site are for illustrative purposes only. While every effort was made to accurately display your benefits, discrepancies and/or errors are always possible. In the case of a discrepancy between this document and the actual plan documents, the actual plan documents will prevail. If you have any questions, please contact Human Resources.