|

What’s Changing in 2026

|

|

| Medical |

|

| UMR Care |

|

| Life and Disability |

|

| Health Flexible Spending Account (FSA) |

|

| Health Savings Account (HSA) |

|

| Dependent Care Flexible Spending Account |

|

WELCOME

Ryman Hospitality Properties and Opry Entertainment Group are proud to offer a comprehensive benefits package that meets the various needs of our employees and their families. We continually review our programs to ensure that they are cost-effective and high quality benefit options that protect your physical, emotional, financial, and work-life wellbeing.

Because choosing your benefits takes careful thought and planning, we created this virtual total rewards showcase to help you easily navigate and understand our offerings. Please take some time to review the information and return to the site whenever you or your family members have questions or want to review our benefits. You can use the resources below for updated information and benefit details for the 2026 Plan Year.

Take a Look Around!

Use the navigation bar at the top of the page to learn more about each category of benefits. You can watch videos and view documents. If you have questions, we are here! Feel free to submit questions by using the online form below.

Get There Fast!

Click on the links below to take you directly to the tab that holds all the information you need to that benefits category!

Come Back Often!

This site will be available to you on demand all year. Feel free to bookmark this or add it to your favorites, so you and your family members can visit whenever you need additional information!

- Benefits Overview

- Eligibility

- Enrollment

- Benefit Changes

- Termination of Coverage

- Medical Plans

- Dental

- Vision

- Live Well Rewards Wellness Program

- Lantern

- Vanderbilt MyHealth Bundles

- Teladoc

- 401k Savings Plan

- Spending Accounts

- Life Insurance

- Tuition Reimbursement

- Allstate Identity Theft

- PerkSpot

- Leave of Absence

- Disability Insurance

- Paid Parental Leave

- Adoption & Surrogacy Assistance

- Employee Assistance Program (EAP)

- Paid Time Off / Volunteer Days

Still have questions? We have answers.

2026 OPEN ENROLLMENT

2026 Enrollment News

We are committed to empowering you with the information and tools you need to make informed benefit decisions.

This newsletter contains information about what is new and what is available for 2026.

Your 2026 Benefits Guide, Benefit Summaries, Summary Plan Descriptions (SPDs), and Legal Notices are always available on our benefits website.

Annual Enrollment is November 3-21 for all full-time, benefits-eligible employees

Updates for 2026

Like many organizations, we continue to face rising healthcare costs, with many companies seeing double-digit increases and passing those costs directly to their employees. Thanks to our ongoing efforts to manage these costs and negotiate the best possible rates, we were able to limit the increase to a modest 5% for medical premiums. All other benefit premiums will remain unchanged.

Please know that the company continues to absorb most of the medical plan costs and will continue to explore ways to enhance our benefits while balancing affordability for both employees and the company. We are committed to supporting our employees’ health well-being and believe that providing high-quality, comprehensive benefits is a key part of supporting your success.

Commitment to Good Health

Absorbing these costs is a significant financial investment for our company, and we ask that each of you take a pro-active approach to managing your personal health and wellbeing so that we may continue to offer cost-effective, value-added, and competitive benefits and programs in the future.

You can do your part by taking advantage of all plan wellness offerings like annual preventive care visits, routine immunizations, and health screenings. Not feeling well, but don’t have time for an office visit? Teladoc gives you convenient, round-the-clock access to doctors by phone, on-line or using the mobile app. It is part of your medical plan and offered with a $10 copay.

In addition, you can get rewards for taking an active role in your health and wellbeing, if you are enrolled in one of our medical plans. Through the Live Well Reward$ program, you can earn up to $200 in online rewards for well exams, using Teladoc, immunizations and logging your exercise, for example.

These small steps can make a huge difference in your health, and your wallet.

Benefit Selection

Please review you and your family’s needs for the coming year, consider all your options, and select the benefits and coverage levels that best suit those needs. It is important to choose wisely. Once the Open Enrollment period has closed, your next opportunity to enroll or make changes won’t be until the next open enrollment period – the fall of 2026 – unless you experience a qualified family status change.

What’s New and What It Means to You

Detailed information will be available after January 1, 2026, in your Summary Plan Descriptions (SPDs)

The information in the table above is a Summary of Material Modifications (SMM) within the meaning of the Employee Retirement Income Security Act of 1974 (as amended). An SMM describes changes to the information provided in the most recent Summary Plan Description (SPD) for the Plan. An SMM is not the SPD, nor is it the plan document itself; rather, it is a supplemental document to your SPD. Please read this SMM carefully, share it with your family, and keep it, along with your SPD, in a safe place for future reference.

Enrollment Checklist

Place a check in the boxes below as you complete each item

☐ Review the information in this Benefits Guide carefully. Consider any benefit options you may have access to outside of work. See which plans make the most sense for you.

☐ Go to the benefits website for more information on your benefits including Benefit Summaries and Summary Plan Descriptions, etc.

☐ Remember, you must re-enroll each year into an FSA or HSA Plan.

☐ Enroll in your 2026 coverage at ybr.com/ryman or call customer service at 888.438.9271 before the deadline.

☐ Are you adding dependents to the plan? Complete the Dependent Verification process within 60 days (See page 6 of the benefit guide for more information).

☐ Did you purchase additional life insurance and/or accidental death and dismemberment (AD&D) insurance? You may be required to provide evidence of good health for certain increases in life insurance coverage.

☐ Visit Aon PEP website at aonpep.voya.com or call 833.266.9737 to enroll in the 401(k) plan.

☐ Register for FREE employee identify theft and credit monitoring coverage with Allstate at myaip.com.

Benefit Overview

We offer our employees a full spectrum of benefits, as illustrated below. Keep scrolling for more information on eligibility and enrollment!

2026 Full-Time Benefit Offerings

Health & Wellness

Financial Wellbeing

Work-Life / Community

Health Insurance

Who is Eligible?

You are eligible for benefits if you are:

-

An active full-time employee working 30 or more hours per week

Your dependents are eligible if they are:

-

Your legal spouse or domestic partner

-

Your and/or your domestic partner’s child(ren)* up to age 26

-

Your disabled child(ren) up to any age (if disabled prior to age 19)*

* Includes natural, step, legally adopted/or a child placed for adoption, or a child under your legal guardianship

About Domestic Partner Coverage

To enroll your same-sex or opposite-sex domestic partner and his or her dependents for coverage, you will be required to submit a notarized affidavit confirming your domestic partner qualifies as a dependent:

Under federal law, contribution toward the cost of healthcare coverage for your domestic partner and his or her dependents is considered taxable income to you.

Domestic partner premiums will be deducted on a post-tax basis. You may wish to consult with a tax adviser for more information.

Verification of Dependent Eligibility

After enrolling your dependents in coverage, you will need to verify that your covered dependent(s) are eligible to participate in our benefit plans. Dependent verification is required when you add: (1) a new dependent and (2) a dependent who was previously denied coverage through a previous Dependent Verification Service process.

After adding your dependent(s) to coverage, make sure to submit your required verification documents within 60 days. You can submit your documents by:

-

Uploading your documents through the DVS link

-

Fax to: Dependent Verification Center at 1-877-965-9555 (with a cover page)

-

Mail to: Dependent Verification Center, P.O. Box 1401 Lincolnshire, IL 60069-1401

Dependents are covered immediately and remain covered through the verification period. If documents are not submitted or approved during the verification window, coverage will be dropped retroactive to the original coverage effective date.

DEPENDENT VERIFICATION SERVICES (DVS) INSTRUCTIONS:

-

Log into your account at www.ybr.com/ryman

-

Click on Dependent Verification

-

Will take you to Dependent Verification Services

(DVS) portal

-

Click on “Verify” for each eligible dependent to

upload required documentation

-

List of eligibility documents can be found here

Enrollment

When Does Coverage Begin?

Benefits for new hires will become effective on the first of the month following 30 days of employment.

When Can I Enroll in Benefits?

-

Newly hired employees must complete enrollment before their coverage start date, which is the first of the month following 30 days of employment.

-

During the annual Open Enrollment period.

-

During the plan year, if you experience a Qualifying Life Event.

How Do I Enroll in Benefits?

You must actively enroll in all benefits that require employee contributions. You will be automatically enrolled in all Company paid benefits.

To enroll in (or make changes to) your benefits, you must log into Your Benefits Resources (YBR). See Enrollment Instructions in the link below.

Making Benefit Changes During the Plan Year

The benefit elections you make during your initial enrollment period as a new hire, or during open enrollment, will be in effect for the calendar year. You may make changes to certain benefits only if you have what is called a “Qualified Life Event”, and you submit a life change event in Alight and upload supporting documentation within 30 days of the event.

Please take a minute to watch our video to learn more about Qualified Life Events.

Please review our Benefits Guide for additional details on qualifying life events and effective dates. Please contact the Benefits Team with any additional questions or concerns.

Termination of Coverage

If you or a covered dependent no longer meet the eligibility requirements or if your employment ceases, your medical, dental, and vision coverage will end on the last day of the month in which you become ineligible.

You may be eligible to elect COBRA for yourself and your eligible dependents for medical, dental, vision and/or FSA coverage.

All other coverages will end on the day you become ineligible. Your life coverages are convertible. You are responsible for informing The Benefits Team within 30 days if any of your dependents become ineligible for benefits.

Still have questions? We have answers.

HEALTH & WELLNESS

Medical & Prescription Drug Plan Options

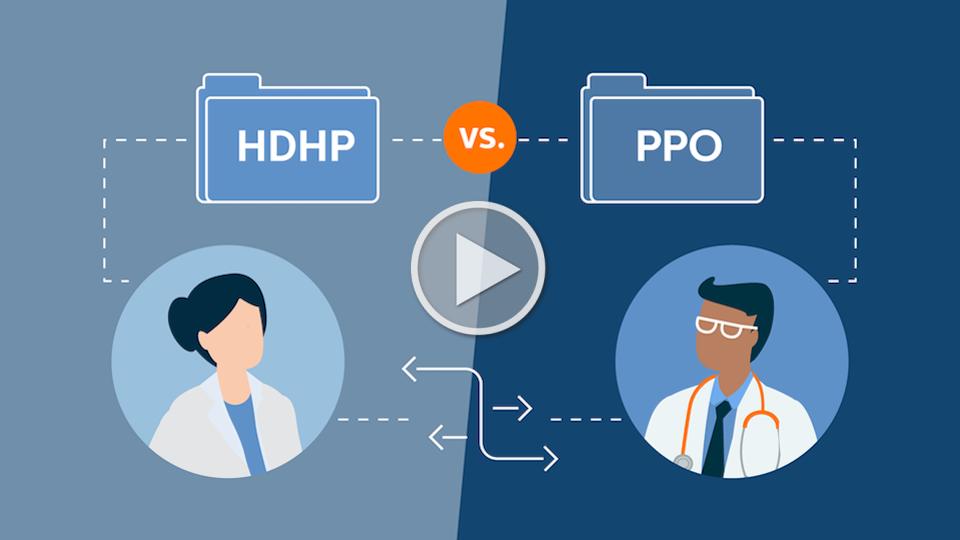

You have the opportunity to choose from three medical plan options administered by UMR for 2026: the Traditional PPO, HDHP with Copay, or the HDHP with HSA. Each of these plans utilizes the nationwide UHC Choice Plus network of providers.

Review the Benefits Guide for more information on plan design and cost.

We are committed to supporting the Transparency in Coverage Rule by making MRFs (machine-readable files) available to you at the following website: https://transparency-in-coverage.uhc.com/

Prescription Drug Coverage is provided through OptumRx

If you are enrolled in one of the Company's medical plans, prescription drug coverage is automatically included. You can use your current medical ID card to fill your prescriptions at the pharmacy or online.

You can use the videos and formulary drug lists here to help better understand your coverage and how to manage your ongoing prescriptions.

Dental

Good oral care enhances overall physical health, appearance and mental well-being. Problems with the teeth and gums are common and easily treated health problems. Keep your teeth healthy and your smile bright with the Ryman Hospitality Properties dental benefit plan. Your dental plan provides several levels of coverage: preventive services, basic routine services, major restorative services and orthodontia coverage.

Basic teeth cleaning and oral exam will be free when you choose a Delta Dental PPO dentist. Please note, if you choose to see a Non-participating provider, you will experience higher out of pocket costs and the dentist can balance bill you (bill you for the difference between what the dentist charges and what the insurance company reimburses).

Questions? Email information@deltadentaltn.com, visit www.deltadentaltn.com or call 800.223.3104.

Vision

Regular eye examinations can not only determine your need for corrective eyewear but also may detect general health problems in their earliest stages. Protection for the eyes should be a major concern to everyone.

Whether you have perfect vision or require some type of corrective lenses, preventive eye care is an important part of your overall health. VSP can help you offset the expensive costs of exams, frames, contact lenses, corrective surgery, and more.

Questions? Visit https://www.vsp.com or call 800.877.7195.

Live Well Reward$ Wellness Program

If you are covered under one of the medical plans, you are eligible to participate in UMR’s Live Well Reward$ Wellness Program. Through the program, you can take a more active role in your personal health and well-being. Use UMR’s helpful resources to find new ways to address your personal health risks and learn healthy strategies you can use in your daily life to help you and your family stay on track. In addition to keeping your health in focus, you also have the opportunity to earn financial incentives when you complete specific action items related to your overall health and well-being. Participation is completely voluntary, and all resources are available at no cost to you.

- Get your preventive care annual wellness checkup ($100; must be completed before 11/1/2026)

- Teladoc registration or updating your health questionnaire ($25)

- Completing a specific Live Well Action Plan ($50 each, up to $100 maximum; multiple to choose from)

- Completing a UMR Wellness Challenge ($50 each, up to $100 maximum; multiple to choose from)

- Completing UMR’s Real Appeal Weight Management Program ($50)

- Logging your exercise 12 times in a month ($20 per completed month)

- Get your preventive care flu-shot ($50)

- Tobacco and Nicotine Cessation Program ($50)

Complete your wellness actions by 2026 to earn your rewards! Log into the Live Well Reward$ portal at UMR.com.

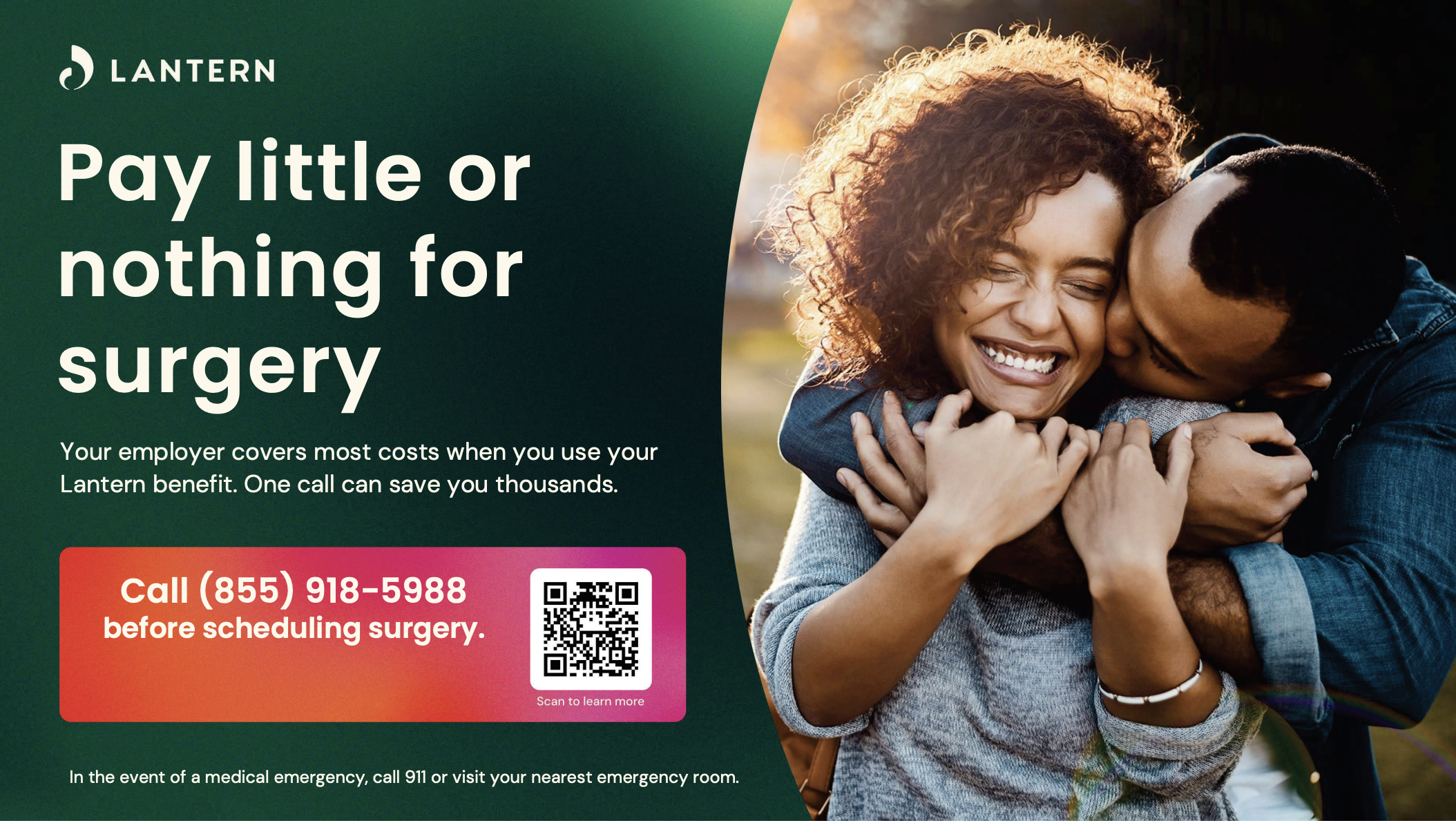

Lantern

Lantern is a resource for members having elective surgical procedures. Lantern Concierges will help members schedule a procedure with a Center of Excellence Provider and all associated pre and post-operation services. Members can receive these procedures at little to no cost including travel if necessary.

Review the Benefits Guide for more information on plan design and cost.

Questions? Email my.lanterncare.com or call 855-200-2099.

Vanderbilt

The Vanderbilt Health MyHealth Bundles program provides you and your dependents a concierge-level health care experience at an affordable cost. A patient navigator guides you through your entire care experience to ease many of the worries commonly associated with health care. With low to no out-of-pocket costs, you can concentrate on what’s most important—your health and well-being.

Learn more about each bundle and how to enroll by clicking below.

Questions? Call 615-936-2635 or schedule time with a Patient Navigator.

Teladoc

SAVE MONEY with Teladoc

When you don’t feel well, or your child is sick, the last thing you want to do is leave the comfort of your home to sit in a waiting room. Now, you don’t have to! A Teladoc visit lets you see and talk to a doctor from your mobile device or computer without an appointment. Most visits take about 10-15 minutes and doctors can write a prescription, if needed, that you can pick up at your local pharmacy.

The best news? In-network Teladoc visits are part of your medical benefits and are offered with a $10 copay under Traditional and HDHP with copay plans. The cost is approximately $54 with HDHP with HSA plan, but once the medical deductible is met there is no copay. Download the Teladoc App.

Questions? Call 800-teladoc (800-835-2362)

Still have questions? We have answers.

FINANCIAL WELLBEING

Investing In Your Retirement 401(k) Savings Plan

Part of solid career planning is considering the life you want when you reach the end of your career. It’s probably safe to say that you’ll want more income than just enough to cover your monthly expenses over the years. How will you pay for the extras that you want and deserve? Your retirement plan is a powerful vehicle to help you get where you want to be. Even small contributions in your retirement investments can grow dramatically by the time you retire. Eligibility: Full-time, part-time and on-call employees age 18 or older with at least one month of employment.

-

Ryman Hospitality Properties matches 100% of your before-tax contributions up to the first 4% you contribute. That’s like free money to help your account grow faster!

-

Employees can contribute up to 70% of their pay to their 401(k) Savings Plan account.

Contribution Options

-

Before tax: You can contribute money before it is taxed, and pay taxes at withdrawal

-

Roth: You can contribute after-tax dollars and receive tax-free withdrawals

-

Choose from a variety of investment options.

-

Make contributions via automatic payroll deductions.

Take action to help make your goals a reality.

Questions? Visit aonpep.voya.com or call 833-266-9737.

Health Savings Account (HSA)

If you're enrolled in a consumer-driven high deductible health plan (HDHP w/ HSA), you're eligible to contribute on a pretax basis to a Health Savings Account (HSA). If you've had a traditional copayment plan, you may be wondering how it is different from a HDHP with an HSA. Traditional copayment plans typically have a lower deductible and higher premiums, so you pay more up front and less when you need care. HDHPs have the opposite – a higher deductible but lower premiums.

If you participate in a HDHP you can open an HSA, which is a personal bank account that you own. Here are some advantages of an HSA:

-

Get triple tax advantages: (1) Contribute pre-tax dollars; (2) Grow your account tax-free; (3) Use your HSA to pay for eligible healthcare expenses tax-free.

-

Use it today or save for tomorrow. Lose the worry of having to spend it all before the end of the year. With the HSA, the balance rolls over year after year so you can let it grow over time.

-

You own the money in the HSA. If you choose to leave the company or switch healthcare plans, you keep the money.

-

It's convenient. Contributions are automatically deducted from your paycheck and deposited into your HSA Bank Account. You can change or stop contributions at any time.

-

Invest your HSA funds. Once your savings reach a certain threshold, you are eligible to invest your HSA dollars and grow your balance.

Employer Contributions:

-

$500 single/$1,000 family

-

Paid quarterly and will be prorated for new hires during the year

-

HSA Annual Max Contribution Limits:

-

Single: $4,400 + $1,000 catchup (for ages 55+)

-

Family: $8.750 + $1,000 catchup (for ages 55+)

-

Note:

-

HSA max contribution limits include employee and employer contributions.

-

In order to contribute to the HSA, you must be enrolled in our HDHP with HSA, not covered under a secondary health insurance plan, not enrolled in Medicare, and not another person’s tax dependent.

Questions? Visit https://ybr.com/ryman/ or call 888.438.9271.

Flexible Spending Account (FSA)

We want to be sure that you have ways to save on the benefits you need to live a healthy life. Don't miss out on the chance to get extra tax savings by participating in flexible spending accounts (FSAs) and save for eligible health care and dependent care expenses through convenient payroll deductions.

Each year, you specify how much of your pay you want to have deducted from your paycheck and deposited into your FSA account to cover eligible expenses. You can contribute any amount from $50 to $3,400 in your Healthcare FSA and up to $7,500 in your Dependent Care account each year. Be sure to use the Spending Account Estimator available at ybr.com/ryman to help calculate your anticipated out-of-pocket expenses to determine if you should participate in a Healthcare and/or Dependent Care FSA.

Healthcare Spending Limit: $3,400 | Dependent Care Spending Limit: $7,500 | Limited Use Spending Limit: $3,300

Ryman Hospitality Properties offers you three types of FSAs:

- Healthcare FSA: This is ONLY available for the Traditional and HDHP with copay plans. Use your Healthcare FSA to reimburse yourself for health care expenses that are not paid for by your medical, dental, or vision plans (including deductibles, copayments, etc.) You can also use your Healthcare FSA to pay for prescription contacts and eyeglasses that are not covered by your vision plan, as well as many over-the-counter medical supplies and diabetic products. You are able to carryover up to $680 of your health care FSA balance remaining at the end of the year.

-

Dependent Care FSA: Use your Dependent Care FSA for eligible dependent care expenses, including before and after-school care, child daycare fees, and daycare fees for an elderly or a disabled dependent. Any unused funds at the end of the year will be forfeited. So plan carefully when making your annual election.

-

Limited Use FSA: Available only for HDHP with HSA participants. A Limited Use account is an FSA that allows you to set aside pre-tax dollars for dental and vision expenses. Eliminates your need to use your HSA funds for dental and vision expenses, leaving you with more money in your HSA to use for regular medical expenses.

Questions? Visit https://ybr.com/ryman/ or call 888.438.9271.

Basic Life Insurance

Life insurance provides financial security for the people who depend on you. Your beneficiaries will receive a lump-sum payment if you die while employed by Ryman Hospitality. The company provides basic life insurance equal to your annual base pay, with a minimum $10,000 benefit at no cost to you.

Accidental Death & Dismemberment (AD&D) Insurance

AD&D insurance provides payment to you or your beneficiaries if you lose a limb or die in an accident. Ryman Hospitality provides AD&D coverage equal to your annual base pay, with a minimum of $10,000 benefit at no cost to you. This coverage is in addition to your company-paid life insurance described above.

Questions? Visit mybenefits.thehartford.com/login or call 888.563.1124.

(This will be effective January 1, 2026)

Voluntary Life Insurance

You may purchase additional life insurance in addition to the company-provided coverage. You may also purchase life and AD&D insurance for your dependents. You are guaranteed coverage; up to the guaranteed issue amount of $500,000 or six times your salary, whichever is less, and up to $50,000 for your spouse without answering medical questions if you enroll when you are first eligible.

Employee— Up to six times your salary with a $1,000,000 maximum amount; $500,000 guaranteed issue amount if you enroll when you are first eligible.

Spouse— Up to $100,000 in increments of $25,000, not to exceed 100% of employee election; $50,000 guaranteed issue amount if you enroll your spouse when you are first eligible.

Children— Live birth to 6 months: $500; Up to $25,000 in increments of $5,000 *up to age 26 if the child is your tax dependent and unmarried

Voluntary Accidental Death and Dismemberment (AD&D) Insurance

Employee— Up to six times your salary with a $1,000,000 maximum amount

Spouse— Up to $100,000 in increments of $25,000

Children— Up to $25,000 in increments of $5,000 *up to age 26 if the child is your tax dependent and unmarried

Be sure to review, and if needed, update or add the beneficiaries for your life insurance. Beneficiaries can be added and updated in YBR at any point during the year.

Questions? Visit mybenefits.thehartford.com/login or call 888.563.1124. (This will be effective January 1, 2026)

Identity, Financial and Privacy Protection - Allstate Identity Protection Pro+ Cyber

Enjoy peace of mind, financial reassurance, and time-saving expertise with your own identity protection plan. Allstate Identity Protection Pro+ Cyber. Ryman Hospitality and Opry Entertainment Group have paid for you to receive a comprehensive identity protection plan. You can add family members to this plan for a low biweekly cost.

The Allstate Identity Protection Pro+ Cyber plan includes the following:

- Identity and Credit Monitoring

- Credit Scores and Reports

- Threshold Monitoring

- Financial Transaction Monitoring

- Social Media Reputation Monitoring

- Dark web breach notifications

- Deceased family member coverage

- IP address monitoring

- Social media account takeover alerts

- Unlimited TransUnion credit reports and scores

- Annual tri-bureau credit report and score

- Wallet Protection

- Digital Exposure Report

- Privacy Advocate Remediation

- $1,000,000 Identity Theft Insurance Policy

- Solicitation Reduction and IdentityMD

- Credit freeze assistance

- In-portal credit lock for adults

- In-portal credit report disputes

- 401(k) and HSA reimbursement

- Stolen funds reimbursement

- Tax fraud refund advance

- Senior family coverage - extended family protection plan for seniors (family members 65+, even if they don't live in your home or aren't dependent on you financially)

Ryman Hospitality provides this coverage to employees at no cost but you must sign up! Activate your account today!

Questions? Visit www.myaip.com or call 800.789.2720.

Perkspot is a free perks and discount program available to all Ryman employees. It's a one-stop shop for all exclusive discounts in more than 25 different categories. Access thousands of discounts including theme parks, event tickets, travel and on the brands you love, available online in one easy-to-access portal, optimized for all devices. to save on the go wherever you are.

Questions? Visit ryman.perkspot.com, email cs@perkspot.com, or call 866.606.6057

Tuition Reimbursement Program

Advance your career with the support of Ryman’s Tuition Reimbursement Program! Ryman is committed to helping you grow professionally. Employees may receive reimbursement of up to $5,250 annually for approved, job-related courses at accredited colleges or universities.

Program Requirements

- Must be a full-time employee who has completed at least one year of employment

- Must have the approval of the department head and Human Resources

- Must achieve a passing grade (equivalent to a C or better) to qualify for reimbursement

- Applications must be submitted and approved before your course begins

Questions? Contact the Ryman Hospitality Total Rewards department at totalrewards@rymanhp.com.

Still have questions? We have answers.

WORK-LIFE / COMMUNITY

Leave of Absence

The Family Medical Leave Act (FMLA) requires covered employers to provide up to 12 weeks of unpaid, job protected leave to “eligible” employees for certain family and medical reasons. Employees are eligible after 12 months of employment and must have worked 1,250 hours during the previous 12 months.

The Hartford will be our new Leave of Absence Administrator in 2026. For all 2026 Leave of Absence requests, please contact the Hartford after January 1, 2026.

For any current Leave of Absence requests (throughout 2025), please continue to contact New York Life by using the information in the documents attached.

Reasons for Taking Leave

-

For the birth and care of the newborn child of the employee;

-

For placement of a son or daughter with the employee for adoption or foster care;

-

To care for an immediate family member (spouse, child or parent) with a serious health condition;

-

For the employee when the employee is unable to work because of a serious health condition;

-

The care of a wounded service member with a serious injury or illness incurred in the line of duty to whom the employee is a spouse, son, daughter, parent, or nearest blood relative (hereinafter referred to as a “service member caregiver on leave”); or

-

Due to a qualifying exigency resulting from the employee’s spouse, son, daughter or parent being on active duty or called to duty status.

In certain cases, this leave may be taken on an intermittent basis rather than all at once, or the employee may work a part-time schedule.

Personal Leave of Absence

In situations where an employee is not eligible for FMLA, an unpaid personal leave of absence may be requested. A personal leave of absence

may be granted for important and urgent personal needs with department and human resources approval. Employees may only apply for a personal leave of absence once per rolling 12-month period and each request will be evaluated on a case-by-case basis. The maximum duration for a personal leave of absence is 30 days (60 days with approval from department leader). Extensions beyond 60 days will not be granted. If you need to request a personal leave of absence, contact your department leader and consult with Human Resources.

Questions? Visit mybenefits.thehartford.com/login or call 888.563.1124.

(This will be effective January 1, 2026)

Disability Insurance

Disability coverage continues a portion of your paycheck if a serious illness, injury, or pregnancy occurs. The goal of the disability plan is to provide you with income replacement should you become disabled and unable to work due to a non-work-related illness or injury. Ryman Hospitality Properties provides eligible full-time employees (after six months of full-time consecutive service) with Short Term Disability (STD) and Long Term Disability (LTD) coverage.

Short-Term Disability (STD) Insurance

- 100% Employer Paid

- Benefits begin on the 8th day of Injury or Illness

- 60% of weekly regular base pay, up to $2,500 per week, will be replaced

- Benefits may continue for up to 25 weeks

Short-Term Disability Buy-up (New in 2026!)

- (Optional) Employee paid

- 70% of weekly regular base pay, up to $3,500 per week, will be replaced

Long-Term Disability (LTD) Insurance

- 100% Employer Paid

- Covers 60% of your regular base pay, up to a $10,000 monthly maximum (after a 180 calendar day waiting period)

- Benefits may continue to normal retirement age

- Subject to Preexisting Condition Exclusion

Family Medical Leave Act (FMLA)

FMLA requires covered employers to provide up to 12 weeks of unpaid, job-protected leave to "eligible" employees for certain family and medical reasons. Employees are eligible after 12 months of employment and must have worked 1,250 hours during the previous 12 months.

Reasons for Taking Leave:

- For the birth and care of the newborn child of the employee;

- For placement of a son or daughter with the employee for adoption or foster care;

- To care for an immediate family member (spouse, child or parent) with a serious health condition;

- For the employee when the employee is unable to work because of a serious health condition;

- The care of a wounded service member with a serious injury or illness incurred in the line of duty to whom the employee is a spouse, son, daughter, parent, or nearest blood relative (hereinafter referred to as a "service member caregiver on leave"); or

- Due to a qualifying exigency resulting from the employee's spouse, son, daughter or parent being on active duty or called to duty status.

In certain cases, this leave may be taken on an intermittent basis rather than all at once, or the employee may work a part-time schedule.

Questions?

The Hartford will be our new Disability carrier in 2026. For all 2026 Leave of Absence requests, please contact the Hartford after January 1, 2026.

For any current Leave of Absence or Disability requests (throughout 2025), please continue to contact New York Life and refer to the documents attached.

Visit mybenefits.thehartford.com/login or call 888.563.1124. (This will be effective January 1, 2026)

Family Planning

Our Total Rewards philosophy is built around offering benefits that support you and your family’s total wellbeing. In addition to our comprehensive health and wellness offerings, we are pleased to provide Paid Parental Leave and Adoption & Surrogacy Assistance to eligible full-time employees looking to expand their family through childbirth, adoption, or surrogacy.

Paid Parental Leave

Ryman Hospitality Properties and Opry Entertainment Group will provide four weeks of company-paid parental leave as a result of childbirth or adoption to eligible full-time employees who have been employed at the company for at least 90 days.

This benefit will apply to birthing and non-birthing parents who welcome a child into their family. Your paid parental leave must be taken in 1 week increments and must be used within 12 months from the date of birth/adoption.

Eligible birth mothers can request to schedule their 4 weeks of paid parental leave to be taken prior to and/or after any short-term disability benefits as long as paid parental leave is taken in a minimum of 1-week increments.

All eligible employees (including eligible non-birth parents) must follow the normal Leave of Absence process and contact The Hartford to file their Paid Parental Leave claim.

Questions?

The Hartford will be our new Disability carrier in 2026. For all 2026 Leave of Absence requests, please contact the Hartford after January 1, 2026.

For any current Leave of Absence or Disability requests (throughout 2025), please continue to contact New York Life and refer to the documents attached.

Visit mybenefits.thehartford.com/login or call 888.563.1124. (This will be effective January 1, 2026)

Adoption & Surrogacy Assistance

Ryman Hospitality Properties and Opry Entertainment Group will provide reimbursement for certain expenses pertaining to adoption & surrogacy, up to $5,000 per qualifying event. This benefit will be available to eligible full-time employees who have been employed at the company for at least 90 days.

The benefit limit is two (2) children per lifetime per Eligible Employee/Family, regardless of any combination of adoption and/or surrogacy. If both parents are Eligible Employees, the maximum benefit and lifetime limit of two (2) children applies to the combined expenses of both parents.

You can submit your reimbursement form and documentation to:

Electronic Delivery (email): totalrewards@rymanhp.com

Physical Delivery (mail):

Ryman Hospitality Properties, Inc.

Attn: Total Rewards Department

One Gaylord Drive

Nashville, Tennessee 37214

For additional questions and information on either of these benefits, please contact the Ryman Hospitality Total Rewards department at totalrewards@rymanhp.com.

Employee Assistance Program (EAP)

Resources for Living is an employer sponsored program available at no cost to you and all members of your household. That includes dependent children up to age 26 whether or not they live at home. Services are confidential and available 24 hours a day, 7 days a week. You can access educational resources on a variety of topics, including:

- Daily Life Assistance

- Emotional Wellbeing Support

- You can access up to 6 counseling sessions per issue each year

- Financial Services

- Call for a free 30-minute consultation

- Legal Services - Free 30 minute consultation with a participating attorney

- Online Resources

- Articles, Assessments, Video Resources, Discount Center, Fitness Discounts, etc.

Questions? Visit www.resourcesforliving.com

User Name: RHP | Password: RHP or call 800.272.7252.

Still have questions? We have answers.

CONTACTS & RESOURCES

CONTACT INFORMATION

If you have specific questions about a benefit plan, please contact the administrator listed below, or your Total Rewards department (totalrewards@rymanhp.com).

| BENEFIT | ADMINISTRATOR | PHONE | WEBSITE/EMAIL |

|

Enrollment/Life Events/

COBRA

|

Your Benefits

Resources (YBR)

|

888.438.9271 | ybr.com/ryman |

|

Medical/Live Well

Rewards

|

UMR | 800.207.3172 | umr.com |

|

Prescription Drug

Coverage

|

OptumRx

|

844.368.0699 | optumrx.com |

| Telemedicine | Teladoc |

800-teladoc

(800-835-2362)

|

|

| Lantern | Lantern | 855.200.2099 | |

|

Vanderbuilt MyHealth

Bundles

|

Vanderbuilt | 615.936.2635 | myhealthbundles.org |

| Dental | Delta Dental of TN | 800.233.3104 | deltadentaltn.com |

| Vision | VSP | 800.877.7195 | vsp.com |

| Life and AD&D Insurance | The Hartford | 888.563.1124 | mybenefits.thehartford.com/login |

|

Spending Accounts (FSA,

Dependent Care, HSA)

|

Smart-Choice

Accounts

|

888.438.9271 |

(click Smart-Choice Account link)

|

|

Short-Term and Long-

Term Disability Coverage

|

The Hartford | 888.563.1124 | mybenefits.thehartford.com/login |

|

Leave of Absence, FMLA,

Parental Leave

|

The Hartford | 888.563.1124 | mybenefits.thehartford.com/login |

| 401(k) Savings Plan | Voya | 833.266.9737 | aonpep.voya.com |

|

Employee Assistance

Program (EAP)

|

Resources for

Living

|

800.272.7252 |

Login:RHP | Password RHP

|

|

Identity, Financial &

Privacy Protection

|

Allstate Identity

Protection

|

800.789.2720 | myaip.com |

| PerkSpot Discount Program |

PerkSpot | 866.606.6057 | ryman.perkspot.com |

| ADP | workforcenow.adp.com (Home Tab) | ||

|

RHP/OEG

Benefits Website

|

https://flimp.live/Ryman-Benefits |

This document is an outline of the coverage provided under your employer's benefit plans based on information provided by your company. It does not include all the terms, coverage, exclusions, limitations, and conditions contained in the official Plan Document, abolicable insurance policies and contracts (collectively, the "Dan documents"). The plan documents themselves must be read for those details. The intent of this document is to provide you with general information about your employer's benefit plans. It does not necessarily address all the specific issues which may be applicable to you. It should not be construed as, nor is it intended to provide, legal advice. To the extent that any of the information contained in this document is inconsistent with the plan documents, the provisions set forth in the plan documents will govern in all cases. If you wish to review the plan documents or you have questions regarding specific issues or plan provisions, you should contact your Human Resources/ Total Rewards Department.

This 2026 Benefit Summary highlights recent plan changes and is intended to fully comply with the requirements under the Employee Retirement Income Security Act (ERISA) as a Summary Material Modification (SMM) and should be kept with your most recent Summary Plan Description (SPD). This document does not guarantee any benefits.

Still have questions? We have answers.