| Medical | Major Medical Plan | Enhanced Major Medical Plan (HSA Qualified) | ||

| In-network | Out-of-network | In-network | Out-of-network | |

| Annual Deductible (Individual/Family) |

$6,750/$13,500 | $13,300/$26,600 | $3,000/$6,000 | $6,000/$12,000 |

| Out-of-Pocket Maximum (Individual/Family) |

$6,750/$13,500 | $26,600/$53,200 | $6,750/$13,500 | $26,600/$53,200 |

| Preventive Care | Plan pays 100% before ded. | 50% after deductible | Plan pays 100% | 50% after deductible |

| Primary Physician Office Visit | Plan pays 100% before ded. | 50% after deductible | 20% coinsurance | 50% after deductible |

| Specialist Office Visit | Plan pays 100% before ded. | 50% after deductible | 20% coinsurance | 50% after deductible |

| Inpatient Hospital Services | 0% after deductible | 50% after deductible | 20% after deductible | 50% after deductible |

| Outpatient Hospital Services (lab, x-ray, diagnostic) |

0% after deductible | 50% after deductible | 20% after deductible | 50% after deductible |

| Urgent Care | 0% after deductible | 50% after deductible | 20% after deductible | 50% after deductible |

| Emergency Room Care | 0% after deductible | 0% after deductible | 20% after deductible | 50% after deductible |

TrueBlue Associate Benefits

TrueBlue is committed to providing our employees with a competitive, comprehensive benefits program that gives you the flexibility to choose the plans that work best for your needs.

U.S. Associates have access to a robust benefits package that allows you to choose the options that are the best fit for your needs. TrueBlue pays the full cost of some benefits, you and TrueBlue share the cost of some benefits, and you pay the full cost of some benefits.

Our benefits website includies important information including our benefits summary, plan documents, provider search directories, health and wellness resources and more.

Guides and Resources:

- Benefit Guide (2026)

- Benefit Guide Spanish (2026)

- Benefit Guide (2025)

- Benefit Guide - Hawaii (2025)

- Benefit Guide - Puerto Rico (2025)

- Benefit Guide - Spanish (2025)

- Separation Guide (2025)

- Separation Guide - Hawaii (2025)

- Associate Carrier Contact Directory

- Benefit Guide (2024)

- Benefit Guide - Hawaii (2024)

- Benefit Guide- Puerto Rico (2024)

Our Purpose

We connect people and work. Ever since our first office opened more than 25 years ago, TrueBlue has been committed to putting people to work and helping change lives. Whether our client is a small business on Main Street or a Fortune 500 company, we work equally hard to find the people to help them be successful.

Our Vision

The way the world works has changed dramatically over the past quarter century. Across the globe, the key challenge is finding the right talent to do the job. That’s why TrueBlue has also changed by broadening our specialized service offerings, reaching more markets, and offering greater technology and innovation that works to the benefit of our clients and workers.

Our Values

Be optimistic

We believe there is a solution to every problem. By being innovative and working together, we can find new ways to get results.

Be passionate

We believe in what we do, are committed to doing good, and will go above and beyond the call of duty for our clients and workers.

Be accountable

We empower our people to take personal responsibility and make an impact.

Be respectful

We listen and learn from each other, embrace diverse views and experiences, and know that finding successful solutions comes from working together.

Be true

We are true to who we are and what our clients need.

Phone: 253-680-8443 | Email: associatebenefits@trueblue.com

Eligibility/Enroll

New Employees

You are eligible to enroll in our benefit plan options, except for the Major Medical plan, which has eligibility requirements. You must enroll within 30 days of receiving your first paycheck. Please wait to enroll until the week after receiving your first paycheck so your eligibility can be process. You can enroll through self-service enroll and log in and select the coverages you desire. If you don’t actively select coverage, you will not have coverage during the plan year, unless you experience a qualifying life event.

To sign up for benefits, visit the link below to self enroll or schedule an appointment with a benefit counselor.

Self Enrollment: www.memberbenefitlogin.com/tbassociates

Benefit Counselor: tbcorp.mybenefitsappointment.com

If you have been rehired, you will have the opportunity to enroll again after a consecutive 13+ week break if all eligibility requirements are met. Please email associatebenefits@trueblue.com for more information.

After four missed premiums, your benefits will be terminated retroactively to the end of the month where payment had been received, unless you are on an approved leave of absence (up to 12 weeks). If you are on an approved leave of absence, you must reach out to the Benefits department to make payment arrangements so that your benefits do not get terminated. For less than four consecutive missed premiums, TrueBlue will take arrears from your paycheck.

Eligibility

Major Medical Plans

Variable Hour Associates

The majority of our associates will be classified as variable hour associates at the time of assignment. To be eligible for the Major Medical Plan, you must meet the ACA full-time eligibility requirements:

-

You must have been employed by TrueBlue for at least 12 months AND have worked 1,560 hours within the last 12 months.

-

When you meet the eligibility requirements, you may qualify for a TrueBlue contribution toward your medical premium payments if you choose to enroll in the Major Medical Plan. A postcard will be mailed to your home address notifying you of your eligibility. The postcard will notify you of the date by which you must enroll in coverage.

-

If you have worked for us for at least 12 months and are unsure of whether you have met the 1,560 hour requirement, you can access this information by reviewing your work history at www.theworknumber.com. You will need to register for this free site. Your user ID will be your Social Security number and your password will be your eight-digit date of birth (MMDDYYYY). Our employer code is 10657 or TrueBlue.

Non-Variable Hour Associates

You are eligible after receiving your first paycheck. If you are a non-variable associate and eligible to enroll in the Major Medical Plan, it will be a plan enrollment option when you go to enroll.

All Other Benefits

Associates are eligible for the Minimum Essential Coverage (MEC) and Fixed Indemnity Medical Plans, as well as the Dental Plan, Vision Plan, the Critical Illness, Accident, Hospital Indemnity, Voluntary Life and Accidental Death and Dismemberment (AD&D) Plans, Short Term Disability (STD) Insurance, Cancer Guardian Coverage, ID Theft Protection Plan, Farmers Auto & Home, MetLife Legal Plan and the LifeMart Associate Discount Program with some exceptions/important notes:

-

Puerto Rico residents are not eligible to enroll in the Minimum Essential Coverage (MEC), Dental, or Vision plans.

-

Hawaii residents are not eligible to enroll in the Fixed Indemnity or Minimum Essential Coverage (MEC) Plans.

-

Minnesota residents enrolled in an indemnity plan are required to also have coverage through the Minimum Essential Coverage (MEC) plan. Any employee enrolled in or electing Indemnity coverage, will automatically be enrolled in the MEC plan.

-

Associates are not permitted to enroll in the Fixed Indemnity plans and the Hospital Indemnity plan simultaneously.

Qualified Life Events (QLE)

Once benefit elections are made, you will not be able to change them until the next open enrollment period, unless you have a qualified life event change of status. Examples of qualified life events (QLEs) are listed below:

-

Marriage

-

Divorce

-

Legal separation

-

Change in employment status (ex. part-time to full-time)

-

Birth or adoption of a child

-

Change in child’s dependent status

-

Death of a spouse, child or other qualifying dependent

-

Change in residence due to an employment transfer for you or your spouse

-

Commencement or termination of adoption proceedings

-

Change in spouse’s benefits or employment status

Additional Notes

-

You cannot be enrolled in both the Major Medical Plan and the MEC Plan at the same time.

-

If you are enrolled in the MEC Plan and elect the Major Medical Plan, your MEC Plan coverage will terminate at the end of the month prior to your Major Medical plan effective date.

-

You are eligible to enroll in additional a la carte insurance for Fixed Indemnity, Dental, Vision, Critical Illness, Accident, Hospital Indemnity, Voluntary Life/AD&D, and STD even if you enroll in the Major Medical Plan.

-

Puerto Rico residents are not eligible to enroll in the Major Medical or Enhanced Major Medical plans.

Documentation for Qualifying Events and Dependents

TrueBlue reserves the right to require documentation of dependent eligibility including but not limited to, birth and marriage certificates, adoption papers and guardianship documents. Associates will be required to reimburse the plan for any benefits paid by the plan for a dependent at a time when the dependent did not satisfy these conditions. It is the Associate’s responsibility to notify TrueBlue if a dependent no longer qualifies so appropriate COBRA notices may be sent.

For more information or questions on your benefits, contact a member of our benefits team.

Phone: 253-680-8443 | Email: associatebenefits@trueblue.com

Major Medical Insurance

Medical Insurance Plans

Telemedicine

Marketplace Insurance

Medicare Benefits

The following Major Medical Plans are available to employees who meet the eligibility criteria detailed on the Eligibility/Enroll Page.

Major Medical Plan

Carrier: United Healthcare

Website: www.myuhc.com

TrueBlue Premember Website: www.whyuhc.com/trueblue

Phone: 833-822-7259

Group: 923468

This plan offers comprehensive medical coverage to associates who meet certain requirements. It provides 100% coverage for preventive services (not subject to the deductible). It also provides 100% coverage for non-preventive services after the deductible is met and has an unlimited lifetime maximum. Covered services include physician office visits, emergency room visits, diagnostic tests, hospital stays, surgical procedures and prescription drugs.

Associates have access to the Choice Plus Network for both physicians and facilities, with over 1,120,000 providers and 5,700 hospitals nationwide. You will pay less for care when you receive services in the Choice Plus Network because these providers discount their fees.

After four missed premiums, your benefits will be terminated retroactively to the end of the month where payment had been received, unless you are on an approved leave of absence (up to 12 weeks). If you are on an approved leave of absence, you must reach out to the Benefits department to make payment arrangements so that your benefits do not get terminated. For less than four consecutive missed premiums, TrueBlue will take arrears from your paycheck.

Puerto Rico residents are not eligible to enroll in the Major Medical plan.

Enhanced Major Medical Plan (HSA-qualified)

Carrier: United Healthcare

Website: www.myuhc.com

TrueBlue Premember Website: www.whyuhc.com/trueblue

Phone: 833-822-7259

Group: 923468

Like the Major Medical Plan, this plan offers comprehensive medical coverage to associates who meet certain requirements, provides 100% coverage for preventive services (not subject to the deductible), has an unlimited lifetime max and accesses the Choice Plus Network. In comparison to the Major Medical Plan, it provides 80% coverage for non-preventive services after the deductible is met. This plan also has lower individual and family deductibles, which reduces your first dollar costs.

If you enroll in this plan, you are eligible to open a Health Savings Account (HSA) at a financial institution of your choice. An HSA is a tax-advantaged account paired with your medical plan allowing you to set aside money on a tax-free basis to pay for medical, dental and vision expenses throughout the year or in the future.

After four missed premiums, your benefits will be terminated retroactively to the end of the month where payment had been received, unless you are on an approved leave of absence (up to 12 weeks). If you are on an approved leave of absence, you must reach out to the Benefits department to make payment arrangements so that your benefits do not get terminated. For less than four consecutive missed premiums, TrueBlue will take arrears from your paycheck.

Puerto Rico residents are not eligible to enroll in the Enhanced Major Medical plan.

| Prescription drugs | Major Medical Plan | Enhanced Major Medical Plan (HSA Qualified) | ||

| In-network | Out-of-network | In-network | Out-of-network | |

| Prescription Drug Deductible | Plan deductible applies | $25 individual, $75 family | ||

| Prescription Drug Out-of-Pocket Maximum | Plan out-of-pocket maximum applies | $1,000 individual, $2,000 family | ||

| Retail (30-Day Supply) (Tier 1/Tier 2/Tier 3/Tier4) |

$12/$35/$60/30% after deductible | N/A | $12/$35/$60/30% | N/A |

| Mail Order (90-Day Supply) (Tier 1/Tier 2/Tier 3/Tier4) |

$24/$70/$120/30% after deductible | N/A | $24/$70/$120/30% | N/A |

This is a summary of coverage, please refer to your summary plan description for the full scope of coverage

Major Medical Plan*

| Rates | Rate Class 1 | Rate Class 2 | Rate Class 3 | Rate Class 4 |

||||

| Weekly | Bi-Weekly | Weekly | Bi-Weekly | Weekly |

Bi-Weekly |

Weekly |

Bi-Weekly |

|

| Employee | $20.01 | $40.02 | $38.60 | $77.21 | $55.08 | $110.16 | $85.86 | $171.72 |

| Employee + dependent | Weekly | Bi-Weekly | ||||||

| Employee + spouse | $323.19 | $646.38 | ||||||

| Employee + child(ren) | $292.41 | $584.82 | ||||||

| Family | $461.71 | $923.41 | ||||||

According to the 2026 ACA affordability guidelines, a plan is considered affordable if you pay no more than 9.96% of your income for associate-only coverage.

Enhanced Major Medical Plan (HSA Qualified)*

| Rates | Rate Class 1 | Rate Class 2 | Rate Class 3 | Rate Class 4 |

||||

| Weekly | Bi-Weekly | Weekly | Bi-Weekly | Weekly |

Bi-Weekly |

Weekly |

Bi-Weekly |

|

| Employee | $35.01 | $70.02 | $48.96 | $97.91 | $69.40 | $138.79 | $104.97 | $209.93 |

| Employee + dependent | Weekly | Bi-Weekly | ||||||

| Employee + spouse | $347.79 | $695.57 | ||||||

| Employee + child(ren) | $313.92 | $627.80 | ||||||

| Family | $500.15 | $1,000.30 | ||||||

VOYA

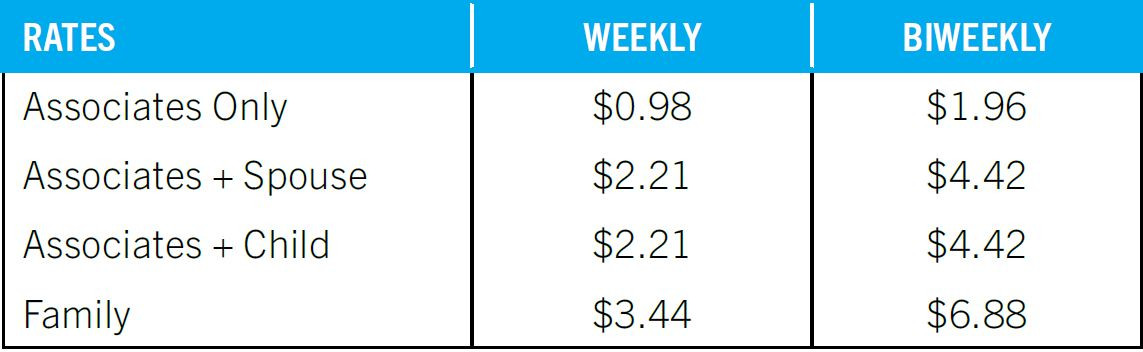

Fixed Indemnity Supplemental Medical Plans*

| Rates | Standard Plan | Preferred Plan | ||

| Weekly | Bi-Weekly | Weekly | Bi-Weekly | |

| Employee | $13.50 | $27.00 | $17.84 | $35.68 |

| Employee + spouse | $27.85 | $55.71 | $38.16 | $76.32 |

| Employee + child(ren) | $22.83 | $45.67 | $30.78 | $61.56 |

| Family | $37.19 | $74.38 | $51.10 | $102.20 |

*Deductions for these benefits will be made pre-tax

Prescription Drug Coverage

Carrier: CapitalRx

Website: CapitalRx.com

Phone: If you have any questions, call the dedicated TrueBlue phone number at 833-202-5951.

If you are enrolled in one of the UHC Major Medical plans, Capital Rx will be the new Pharmacy Benefit Manager (PBM) for 2026. TrueBlue is working closely with Capital Rx to ensure a smooth transition for 2026. At TrueBlue, we are committed to offering a high quality of care and service. In partnership with Capital Rx, we strive to deliver the best service and resources to help you and your family make informed healthcare decisions every day.

Watch the "Welcome to Capital Rx Video" here.

Capital Rx Open Enrollment website here.This site allows you to search for pharmacies and search for your medications on the formulary. If you have any questions, call the dedicated TrueBlue phone number at 833-202-5951.

What is a PBM?

A PBM is a pharmacy benefit manager. PBM’s process prescription drug claims for you and your employer or health plan. Capital Rx collaborates directly with pharmacy providers and drug companies to provide this service. Capital Rx aims to maintain the right balance of drug access and cost savings as part of your plan. If you take one or more medications from the PrudentRx Program Drug List, you’ll receive a welcome letter and a phone call from PrudentRx with details about the program and your medication.

Health Maintenance Organization (HMO) - Hawaii Residents Only

Hawaii residents have access to an HMO plan that provides coverage for in-network providers only. Your care is managed by a Primary Care Physician (PCP) chosen at the time of enrollment. If you require a specialist, outpatient procedure, or hospitalization, your registered PCP must refer you. There are no out-of-network benefits.

Carrier: United Healthcare

Website: www.myuhc.com

Associates, spouses and dependent children have access to medical and behavioral health telemedicine virtual visits. Telehealth provides a convenient and less costly alternative to ER and urgent care visits that helps you contact a medical provider or therapist by app, phone or online 24/7. All medical care is provided by US-licensed professionals including board-certified physicians, physician assistants and nurse practitioners. Talk therapy services with licensed therapists and psychiatrists are available in as little as 24 hours from your initial appointment request.

Carrier: GoHealth

Website: www.gohealth.com/states/

Phone: 855-644-8900

Did you miss the opportunity to enroll in coverage through TrueBlue or are you interested in health insurance plan options outside our standard associate benefit plan offers? We have facilitated access to the marketplaces so you now have the ability to shop for medical, dental, vision and ancillary coverage through GoHealth.

Please note that the GoHealth plan options are not connected with TrueBlue, meaning that all agreements and premium payments will be between you and GoHealth only.

Carrier: GoHealth

Phone: 888-380-0785 (TTY 711)

Are you ready for Medicare? Reach out to our new Medicare partner, GoHealth. GoHealth is a leading Medicare marketplace dedicated to helping cut through the confusion and get you enrolled in a Medicare Advantage, Prescription Drug (Part D), or Medicare Supplement plan with benefits and coverage that meets your needs.

Call today to complete your comprehensive Medicare Benefits Review. The call and the consultation are free, with no obligation to enroll.

- Hours: Monday to Friday 7AM-6PM

- Annual Enrollment Period Hours (10/15- 12/7): Monday to Friday 7AM-7PM & Saturday to Sunday 10AM- 4PM

GoHealth is not endorsed or sponsored by any government entity. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Other Medical Insurance

Medical Insurance Plans

Minimum Essential Coverage (MEC) Plan

UnitedHealthcare FlexWork® Preventative Limited Medical MEC Plan

Carrier: UnitedHealthcare

Website: flexwork.uhc.com (members only)

Phone: 833.822.7259

Group: Group: 7800-137

The FlexWork Limited Medical MEC Plan provides coverage for required Affordable Care Act (ACA) services with access through the nationwide Choice provider network. As a FlexWork member you can access the provider and pharmacy directories through the member portal at flexwork.uhc.com.

The MEC Plan does not satisfy state coverage requirements in Massachusetts. Puerto Rico and Hawaii residents are not eligible to enroll in the Minimum Essential Coverage (MEC) plan.

| Medical | Minimum Essential Coverage (MEC) |

| In-network | |

| Annual Deductible (Individual/Famil |

This MEC is coverage for preventive services only Covers all preventive services required by the Affordable Care Act (ACA) Requires use of a UnitedHealthcare in-network provider for services to be covered |

| Out-of-Pocket Maximum (Individual/Family) | |

| Preventive Care | |

| Primary Physician Office Visit | |

| Specialist Office Visit | |

| Inpatient Hospital Services | |

| Outpatient Hospital Services (lab, x-ray, diagnostic) | |

| Urgent Care | |

| Emergency Room Care | |

| Children's Vision Benefits: Eye Exam, Glasses & Lenses or Contacts |

This is a summary of coverage, please refer to your summary plan description for the full scope of coverage

Minimum Essential Coverage (MEC) Medical Plan*

| Rates | Weekly | Bi-Weekly |

| Employee | $10.50 | $21.00 |

| Employee + spouse | $21.00 | $42.00 |

| Employee + child(ren) | $17.64 | $35.28 |

| Family | $31.15 | $62.30 |

MedCents Consumer Advocacy

MedCents Consumer Advocacy may be able to help with non-covered medical bills with your UnitedHealthcare FlexWork Limited Medical MEC Plan.

What is balance billing?

Balance billing is the difference between the amount your network provider charges and the amount the plan will pay. Some reasons you may receive a balance bill include:

- You have exceeded the annual visit limit allowed by the plan

- You owe more than your FlexWork benefit plan covers for an in patient hospital stay

- You receive care from an out-of-network provider

MedCents Consumer Advocacy is easy to access. Log into the flexwork.uhc.com member portal or call the service number on the back of your ID card.

Fixed Indemnity Medical Plans

Voya Fixed Indemnity Medical Plans provide a fixed daily benefit payment if you have a covered stay in a hospital, critical care unit, or rehabilitation facility. You have the option to elect the Hospital Indemnity Insurance plan that meets your needs, Standard Plan or Preferred Plan. Please note these plans do not satisfy the requirement of minimum essential coverage under the Affordable Care Act.

| Covered Benefits | Standard Plan | Preferred Plan |

| Daily benefit amount $300 | Daily benefit amount $500 | |

| Hospital | ||

| Hospital admission: An admission benefit is payable for the first day of hospital confinement, once per confinement. | $1,500 | $2,500 |

| Hospital confinement: A daily confinement benefit is payable for up to 365 days per confinement, beginning on day 2 of confinement. | $300 (1 times the daily benefit amount) |

$500 (1 times the daily benefit amount) |

| Critical Care Unit | ||

| Critical care unit (CCU) admission: An admission benefit is payable for the first day of CCU confinement, once per confinement. | $3,000 | $5,000 |

| Critical care unit (CCU) confinement: A daily confinement benefit is payable for up to 30 days per confinement, beginning on day 2 of confinement. | $600 (2 times the daily benefit amount) |

$1,000 (2 times the daily benefit amount) |

| Rehabilitation Facility | ||

| Rehabilitation facility confinement: A daily confinement benefit is payable for up to 30 days per confinement, beginning on day 2 of confinement. | $150 (one-half of the daily benefit amount) |

$250 (one-half of the daily benefit amount) |

| Observation unit daily benefit: A benefit is payable up to 1 day per calendar year, for admission to a hospital observation unit for at least 4 consecutive hours other than as an inpatient. | $250 | $350 |

| Non-confinement daily benefits: Benefits may be payable for non-confinement events |

||

| Follow-up doctor visit | $60 | $100 |

| Outpatient surgery visit | $500 | $1,000 |

| Emergency Room visit | $100 | $100 |

Note: Minnesota residents enrolled in an Indemnity plan are required to also have coverage through the Minimum Essential Coverage (MEC) plan. Any employee enrolled in or electing Indemnity coverage, will automatically be enrolled in the MEC plan. Hawaii residents are not eligible to enroll in the Fixed Indemnity plans. Associates are not permitted to enroll in the Fixed Indemnity plans and the Hospital Indemnity plan simultaneously.

VOYA

Fixed Indemnity Supplemental Medical Plans*

| Rates | Standard Plan | Preferred Plan | ||

| Weekly | Bi-Weekly | Weekly | Bi-Weekly | |

| Employee | $13.50 | $27.00 | $17.84 | $35.68 |

| Employee + spouse | $27.85 | $55.71 | $38.16 | $76.32 |

| Employee + child(ren) | $22.83 | $45.67 | $30.78 | $61.56 |

| Family | $37.19 | $74.38 | $51.10 | $102.20 |

*Deductions for these benefits will be made pre-tax

Prescription Drug Coverage

Carrier: Optum Perks Drug Card

Website: perks.optum.com/trueblue

Group: 3672SDF

The Optum Perks Drug Card provides prescription drug savings by helping you identify affordable options. The card is preactivated and can be used right away at your local pharmacy. There are no deductibles, fees or forms to complete and everyone qualifies, including your entire household.

Prescription Cost Transparency Tool

Carrier: GoodRx

Website: www.goodrx.com

GoodRx is a no-cost solution that provides medication cost transparency and helps you save money on your prescriptions. Visit the website and enter in your prescription information and within seconds you will be offered the best prices from various pharmacies near your zip code. You can also use the mobile app to access savings while on the go.

Savings Account

Health Savings Account (HSA) provided by Bank of America

Health Savings Account (HSA)

Carrier: Bank of America

Website: myhealth.bankofamerica.com

HSA customer care: 800.718.6710 (24/7/365)

The 2026 Annual IRS Limits

| Your Maximum Contribution | IRS Annual Maximum** | |

| Employee Only | $3,900 | $4,400 |

| Family | $8,250 | $8,750 |

* Prorated based upon the effective date

** Catch-up Contributions for Associates age 55 and older are an additional $1,000

You May NOT Be Eligible To Receive HSA Contributions If You:

1. Are enrolled in another health plan that is not a CDHP

2. Are enrolled in Medicare

3. Are enrolled in TRICARE

4. Have received medical benefits from VA for any non-service-connected disability at anytime during the previous three months

5. Can be claimed as a dependent on someone else’s tax return

6. You or your spouse is enrolled in a Medical Flexible Spending Account

1 Title 38 of the United States Code, Section 101(17) defines “non-service-connected” as, with respect to disability, that such disability was not incurred or aggravated in the line of duty in the active military, naval or air service.

How Do I Access / Make Contributions to My HSA?

You are eligible if:

- You are enrolled in the HDHP

- You are not covered by a spouse’s plan

- No one else can claim you as a dependent

- You are not enrolled in Medicare, TRICARE, or TRICARE for Life

- You have not received VA benefits in the past 3 months

Once you are enrolled in TrueBlue's Enhanced Major Medical plan, it is up to you to open your Health Savings Account! You can visit myhealth.bankofamerica.com to open an account.

Other HSA Advantages

- You can use the account to pay for qualified healthcare expenses.

- Unspent dollars roll over each year and are yours to keep if you retire or leave the company.

- You can invest your HSA funds, so your available healthcare dollars can grow over time.

- Employees opening an HSA account with Bank of America will have access to their account via online portal, mobile app, and 24/7/365 HSA customer care.

How Much Can Be Deposited into an HSA in 2026?

|

<55* |

Up to $4,400 for individual *Not enrolled in Medicare |

|

55+* |

The maximum contribution increases by $1,000 *Not enrolled in Medicare |

Dental & Vision Insurance

What you'll find on this page:

Preferred Provider Organization, Choice Plan (PPO)

This dental plan allows the flexibility to select any dentist in-network or out-of-network, but if you stay in network, you’ll pay less. Dental coverage focuses on preventive and diagnostic procedures in an effort to avoid more expensive services associated with dental disease and surgery. The type of service or procedure received determines the amount the plan will cover for each visit. Each type of service fits into a class of services according to complexity and cost.

Puerto Rico residents are not eligible to enroll in the Dental plan.

| Dental | In-network | Out-of-network |

| Annual Deductible (Individual/Family) | $25 / $75 | $25 / $75 |

| Annual Maximum Benefit | $500 | $500 |

| Basic | 100% | 100% |

| Major | 50% | 50% |

| Orthodontia |

Not Covered | Not Covered |

| Employee Rates | Weekly Rate | Bi-Weekly Rate |

| Employee | $4.65 | $9.30 |

| Employee + spouse | $11.64 | $23.27 |

| Employee + child(ren) | $8.37 | $16.74 |

| Family | $12.57 | $25.13 |

Vision Insurance

Carrier: United Healthcare

Website: www.myuhcvision.com

Phone: 800-638-3120

Group: 922133

Vision insurance helps offset the cost of routine eye exams and also helps pay for vision correction eye wear like eyeglasses and contacts that may be prescribed by an eye-care provider. You’re eligible for an eye exam and lenses or contact lenses every 12 months. You're eligible for new frames every 24 months. Out-of-network providers will only offer you an allowance towards your vision services.

Puerto Rico residents are not eligible to enroll in the Vision plan.

| Vision | In-network | Out-of-network |

| Examination (once every 12 months) | $10 copay | Up to $40 |

| Lenses (once every 12 months) | ||

| Single | $25 copay | Up to $40 |

| Bifocal | $25 copay | Up to $60 |

| Trifocal | $25 copay | Up to $80 |

| Frames (once every 24 months) |

||

| New frames |

$25 copay; $120 allowance, 30% off balance over $120 | Up to $45 |

| Contact lenses (once every 12 months | ||

| Contacts (in lieu of lenses) |

$25 copay; $120 allowance | Up to $ 120 |

| LASIK |

LASIK with QualSight LASIK 35% off retail price or 5% off promotional price |

|

| Hearing Aid Discount |

Savings on custom-programmed hearing aids when you buy them from UnitedHealthcare Hearing. Visit www.UHCHearing.com and use promo code MYVISION when placing your order to get the special price discount. |

|

| Employee Rates | Weekly Rate | Bi-Weekly Rate |

| Employee | $2.03 | $4.06 |

| Employee + spouse | $4.02 | $8.05 |

| Employee + child(ren) | $3.75 | $7.50 |

| Family | $5.73 | $11.47 |

Life & Disability Insurance

Voluntary Life and Accidental Death & Dismemberment (AD&D) Insurance

Carrier: Aflac

Website: www.aflacgroupinsurance.com

Phone: 800-433-3036

Group: 26154

Life and accidental death and dismemberment (AD&D) insurance helps ease your loved ones’ financial burden. Your designated beneficiary will receive a financial benefit if you pass away from a covered accident or illness or become dismembered due to a specifically covered accident.

TrueBlue offers two plan options with varying benefit levels for Associates, spouses and children.

- Associate - $20,000

- Spouse - $2,500

- Child(ren) - $1,250

- Associate - $30,000

- Spouse - $2,500

- Child(ren) - $1,250

| Employee Rates | Life and AD&D Low Plan | Life and AD&D High Plan | ||

| Weekly | Bi-Weekly | Weekly | Bi-Weekly | |

| Employee | $2.63 | $5.26 | $3.95 | $7.90 |

| Employee + spouse |

$2.99 | $5.98 | $4.31 | $8.62 |

| Employee + child(ren) |

$2.99 | $5.98 | $4.31 | $8.62 |

| Family |

$2.99 | $5.98 | $4.31 | $8.62 |

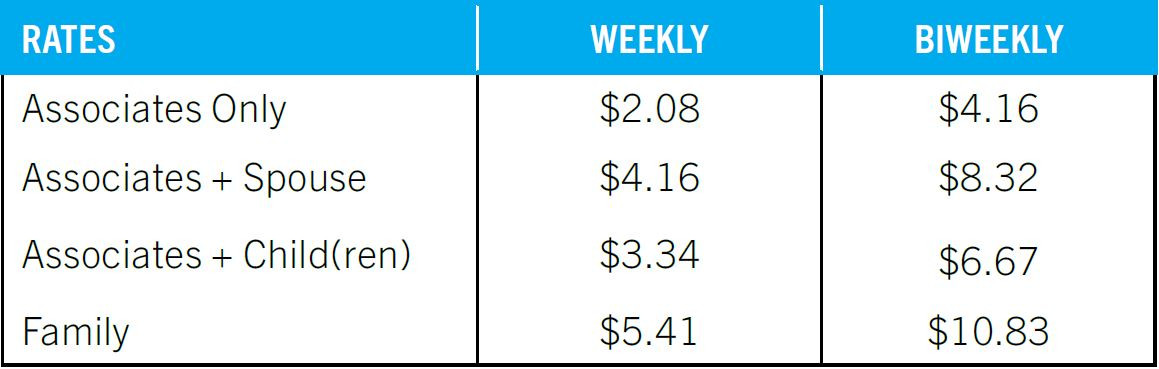

Short-Term Disability Insurance: High Plan

Carrier: Voya

Website: www.voya.com

Phone: 877-236-7564

Group: 717690

If you become ill or suffer an injury that prevents you from working, short-term disability insurance replaces a portion of your income for a defined time. Starting on the 8th day of continuous illness or injury, you will receive a $400 weekly lump sum for up to 26 weeks. Coverage includes disability due to pregnancy and childbirth.

| High Plan | |

| Maximum Weekly Benefit | $400 |

| Elimination Period | 7 days for accident, 7 days for illness |

| Maximum Benefit Period | 26 weeks |

Short-Term Disability Insurance: Low Plan

Carrier: Voya

Website: www.voya.com

Phone: 877-236-7564

Group: 717690

If you become ill or suffer an injury that prevents you from working, short-term disability insurance replaces a portion of your income for a defined time. Starting on the 8th day of continuous illness or injury, you will receive a $200 weekly lump sum for up to 26 weeks. Coverage includes disability due to pregnancy and childbirth.

| Low Plan | |

| Maximum Weekly Benefit | $200 |

| Elimination Period | 7 days for accident, 7 days for illness |

| Maximum Benefit Period | 26 weeks |

| Employee Rates | High Plan |

Low Plan | ||

| Weekly | Bi-Weekly | Weekly | Bi-Weekly | |

| Employee | $11.72 | $23.45 | $6.36 | $12.72 |

Leave of Absence Process

If you are going out on leave for a serious health condition for yourself or a family member, email leaveadmin@trueblue.com or leave a voicemail at (253) 573-5484.

Additional Benefits

Accident Insurance

Carrier: Voya

Website: www.voya.com

Phone: 877-236-7564

Group: 717690

Accident insurance pays cash to help with out-of-pocket expenses when an accident occurs. You or your designated beneficiary will receive a benefit to help ease the financial burden if you suffer an accident or pass away from a covered accident or illness. Covered expenses include emergency room treatments, stitches, crutches, injury-related surgeries and more. Any benefits you are eligible to receive are payable without regard to your medical coverage. When you submit a claim, the approved benefit will be paid directly to you and can be used however you want.

TrueBlue offers two accident insurance plans that cover associates, spouses and children - a Low Plan and a High Plan.

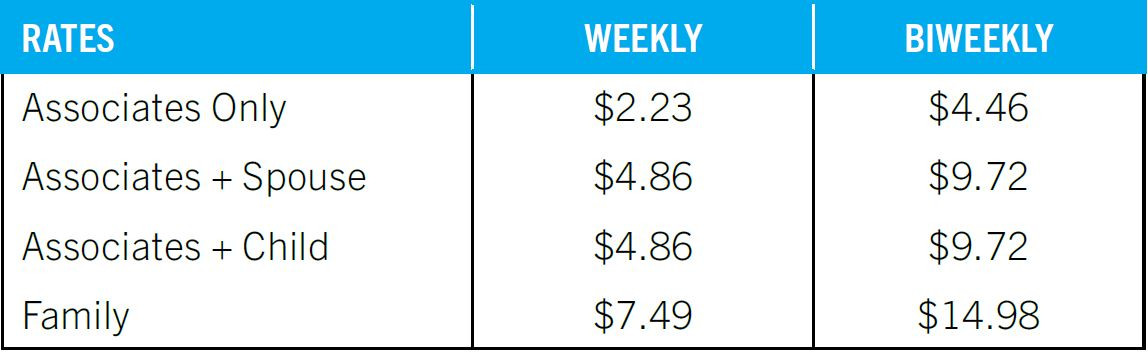

Low Plan Rates

High Plan Rates

Critical Illness Insurance

Carrier: Voya

Website: www.voya.com

Phone: 877-236-7564

Group: 717690

If you are diagnosed with a serious illness, you will have many concerns including how you will manage the cost of your care. Even if you have a comprehensive health insurance plan, there are some expenses that won’t be covered. Critical illness insurance provides a lump-sum payment upon diagnosis of certain covered illnesses or conditions to use any way you want to help cover the extra cost of treatment, child care, mortgage, car payments and other expenses that may arise from a critical illness.

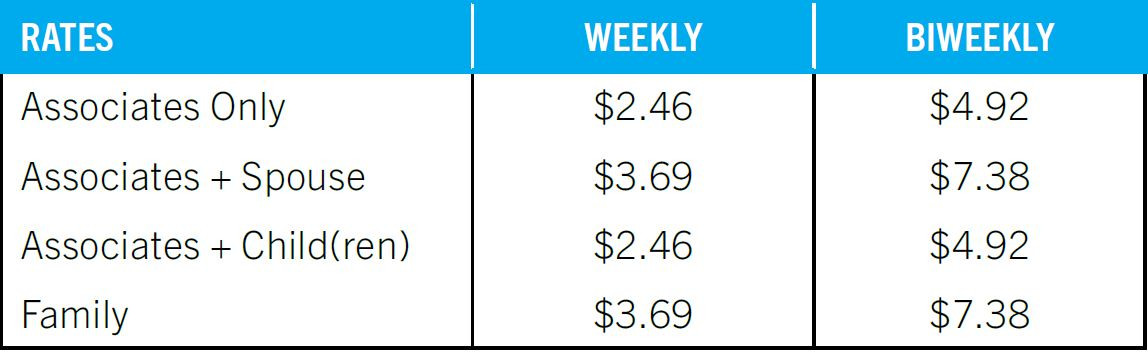

TrueBlue offers two critical illness insurance plans that cover associates, spouses and children - a Low Plan and a High Plan.

Low Plan Rates

High Plan Rates

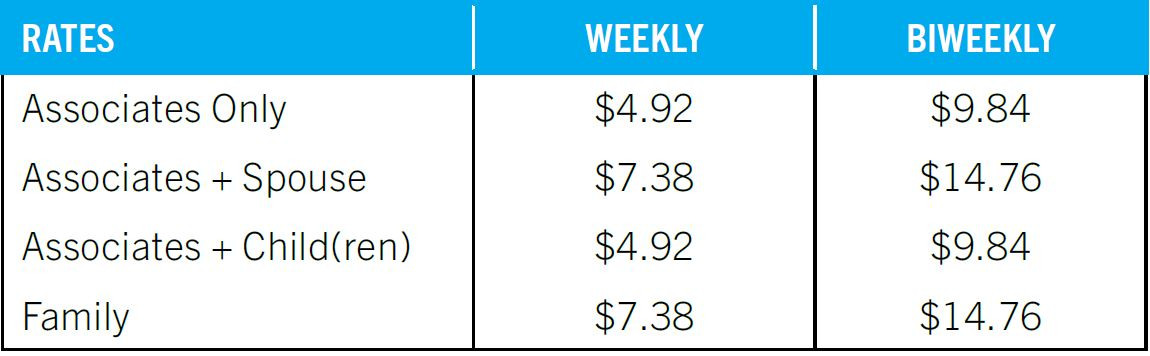

Hospital Indemnity Insurance

Carrier: Voya

Website: www.voya.com

Phone: 877-236-7564

Group: 717690

Hospital indemnity insurance can complement your medical coverage by helping to ease the financial impact of a covered stay at an eligible hospital, critical care unit or rehabilitation facility. Typically, a flat amount is paid for admission and a per daily amount is paid for each day of a covered stay, starting from the very first day. As with accident insurance, any benefits you are eligible to receive are payable without regard to your medical coverage. When you submit a claim, the approved benefit will be paid directly to you and can be used however you want.

Associates are not permitted to enroll in the Fixed Indemnity plans and the Hospital Indemnity plan simultaneously.

Cancer Detection

Carrier: Genomic Life (formerly Cancer Guardian)

Website: www.genomiclife.com

Phone: 844-694-3666

Group: TRAS-CGx-2021-0814

Cancer detection coverage is an innovative approach that gives you and your family members peace of mind for the future. Genomic Life identifies your genetic risk in advance and addresses the challenges presented when dealing with cancer and other diseases. Should you or your family member face a cancer diagnosis, our cancer services team will provide personalized support throughout the course of treatment including nurse advocacy, comprehensive genomic profiling, peer-to-peer physician consults, expert pathology reviews and more.

Identity Protection

Carrier: Aura

Website: www.aura.com

Phone: 833-552-2123

Protect yourself and loved ones with advanced identity monitoring through identity protection insurance. In today’s digital era, data is our most valuable resource and at times, falls into the wrong hands. Plan features include identity monitoring, credit monitoring, suspicious activity alerts, 24/7 customer support and more.

Auto & Home Insurance

Carrier: Farmers

Website: www.myautohome.farmers.com

Phone: 800-438-6381

This program helps you save money on auto and home insurance with group discounts and convenient payment options.

You can save an average of $586 on auto insurance by enrolling. Farmers offers auto, recreational vehicle (RV), boat, personal excess liability protection and home insurance to protect your most valuable assets. Farmers offers a range of insurance solutions to balance costs with employees needs.

To get a quote, call and use the code ECD or visit the website and use the code Trueblue Associates.

Legal Plan

Carrier: MetLife

Website: www.legalplans.com

Phone: 800-821-6400

This benefit provides you with convenient, professional legal counsel. It covers some of the most frequently needed personal legal matters such as general phone advice and office consultations, wills and estate planning, document review and preparation, home and real estate matters, debt and identity theft matters, family law and eldercare.

Enroll today for only $25 per month.

Associate Discount Programs

Carrier: LifeMart

Website: discountmember.lifecare.com

Registration Code: trueblue

Carrier: MyLife Savings Marketplace (formerly Tickets-At-Work)

Website: trueblue.savings.workingadvantage.com

Your work-life balance and general well-being are as important to us as the work you contribute. That is why we are excited to offer you these savings marketplaces.

Access national and local discounts on the brands you know and love. Browse deals for child and senior care services; gyms and nutrition plans; automotive services and care rentals; travel and hotels; computers and cell phones; theme parks or movie tickets and restaurants-even grocery coupons!

Plan Documents/Notices

Associates can access current compliance notices below. This library will be updated as new notices become available.

Illinois Consumer Coverage Disclosure Act - Per the requirements of the Illinois Consumer Coverage Disclosure Act, it is our obligation to inform you of our medical plan offerings in comparison to the state of Illinois’ list of essential health insurance benefits. This allows you to make informed decisions about whether coverage through your employer or in the individual market will best meet your needs. Each medical plan that is available in Illinois is disclosed on the following pages. For more information on Illinois’ essential health benefits, you may click here.

Important information regarding 1095-C forms – for U.S. Employees and Associates

You should receive a 1095-C if you:

- Worked full-time (an average of 30 hours or more per week) in the calendar year, even if you did not enroll in employer-offered qualifying health coverage.

- Were enrolled in employer-offered coverage, even if you did not work full-time hours.

Not everyone will receive a 1095-C

- If you did not work full-time and did not enroll in coverage, you will not receive a 1095-C from us.

- If you did not reside in the U.S. during the calendar year.

- If you were enrolled in coverage through the Health Insurance Marketplace (i.e. such as through Healthcare.gov, not through your employer), you will receive a 1095-A form from the marketplace.

FAQs

When and how will I get my form?

- If you elected to receive a paper form, 1095-C forms are mailed at the end of January from St. Louis, MO.

- If you elected the paperless option, you can access and download your 1095-C form by logging onto mytaxform.com.

If it has been more than 90 days since you have accessed the site, you may need to reset your password. Do this by clicking "Forgot Password".

For new users: you must opt in by January 15th. The company code is 10657.

Can I access my form in Oracle?

- No, unfortunately we are not able to load them into Oracle at this time.

Why is there a dollar amount in line 15?

- The is the employee contribution amount of the lowest cost coverage offered to you. This does not represent any actual costs or charges to you, as you may have elected a differentplan, or did not enroll at all. The IRS uses this in determining whether the coverage offered to you was considered affordable per IRS guidelines. Benefit deductions appear on your pay stubs. If you were not enrolled in health coverage during the year and want to be sure that you were not charged, you can do so by reviewing your pay stubs or contacting Payroll.

Do I need my 1095-C to file my federal income tax return?

- Please refer to the Instructions for Recipients page included with your 1095-C form for descriptions of the different codes.

What do the different codes mean?

- No. You do not need to wait till you have your form to file your federal tax return. Beginning in 2019, the federal individual mandate no longer applies, which means there is no penalty to employees for not having qualifying health coverage.

NOTE: California, New Jersey, Rhode Island, Massachusetts, and Washington, D.C. have their own individual health insurance mandates requiring qualifying health coverage. If you resided in any of these states or district during the year, please check your state or district's requirements.

What if I still have questions?

- Request a Copy of Your 1095-C: Call Equifax at 1-800-827-9159.

- Additional 1095 Help: Email 1095Questions@trueblue.com.

- W-2 Help: Search the many knowledge articles in My Service Center, create a ticket under Payroll Tax, or call 1-800-722-5840.